0% Mortgages for Fiscally Responsible Governments

News

|

Posted 26/06/2025

|

1123

Switzerland made headlines on Tuesday last week when it dropped its official interest rate to 0%. Over the last 20 years, a 0% emergency rate has usually rung alarm bells, but as people in Australia continue to struggle to pay their mortgages, that now seems like a dream come true. So, as Australia’s interest rates remain above much of the developed world with the stubborn RBA (and Federal Reserve in the US) holding firm, the question needs to be asked: why?

But as we know, the “why” is an easy answer — out-of-control government spending.

In the 1990s, Switzerland was facing fiscal challenges from rising public debt and growing deficits, so it implemented the ‘debt-brake’ rule. The rule aims to maintain a balanced budget over time while allowing for temporary overspending during downturns. Like the rest of the world, Switzerland overspent during COVID-19, but while others couldn’t pull themselves off the debt addiction, Switzerland ran a budget surplus within a year, swiftly reversing the excessive spending from the pandemic.

By implementing this rule and framework, Switzerland has — over the past 20 years — managed to avoid excessive debt regardless of which political party was in power. Successive left, right, or centrist-led governments have had to operate within this spending constraint, limiting election pork-barrelling and vote-buying. Maybe it’s time Australia and the rest of the Western world looked at something similar.

Government Expenditure: The Road to Ruin

With the “Big Beautiful Bill” in America and Australia’s unprecedented spending lifting the size of government to 21.3% of the economy, compared to the 16.1% average across 133 countries, both nations appear to be locking in higher deficits for longer. A solution will undoubtedly be needed in the very near term.

As economies and technology grow, the size of government should ideally shrink or at least remain stable for a nation to prosper. Since the GFC, that principle has been ignored, and post-COVID, the rapid proliferation of deficits and government size is setting the Western world on a path toward economic ruin.

So, what are the world’s best-case options? Look no further than Switzerland, where deflation has led to 0% mortgages. This deflation has been driven by the stability of the economy and, in turn, its currency which has appreciated against others like the yen, USD, and AUD. As the Swiss franc strengthens, Swiss citizens pay comparatively less for goods, particularly as other countries inflate their currencies through excessive spending.

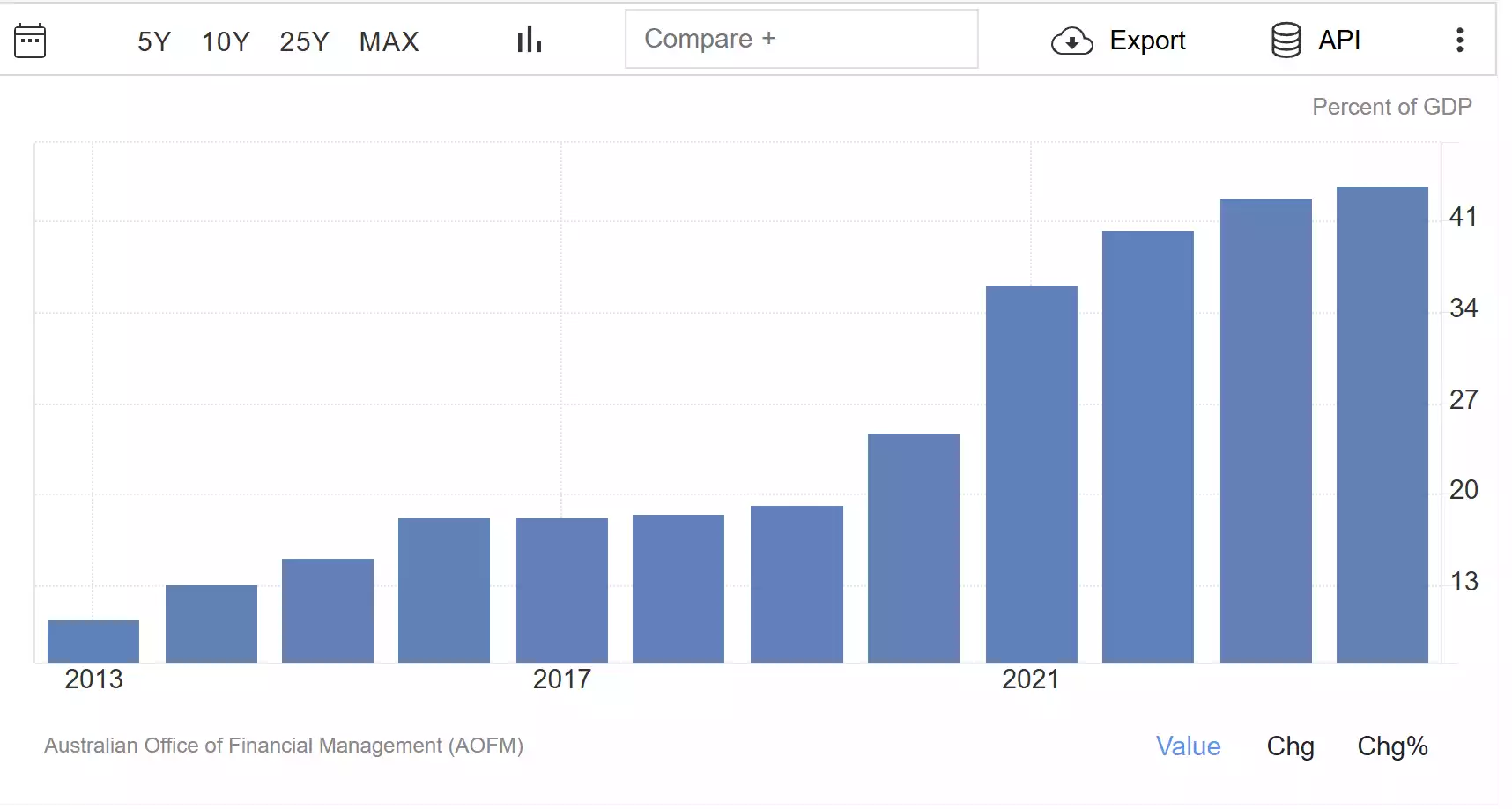

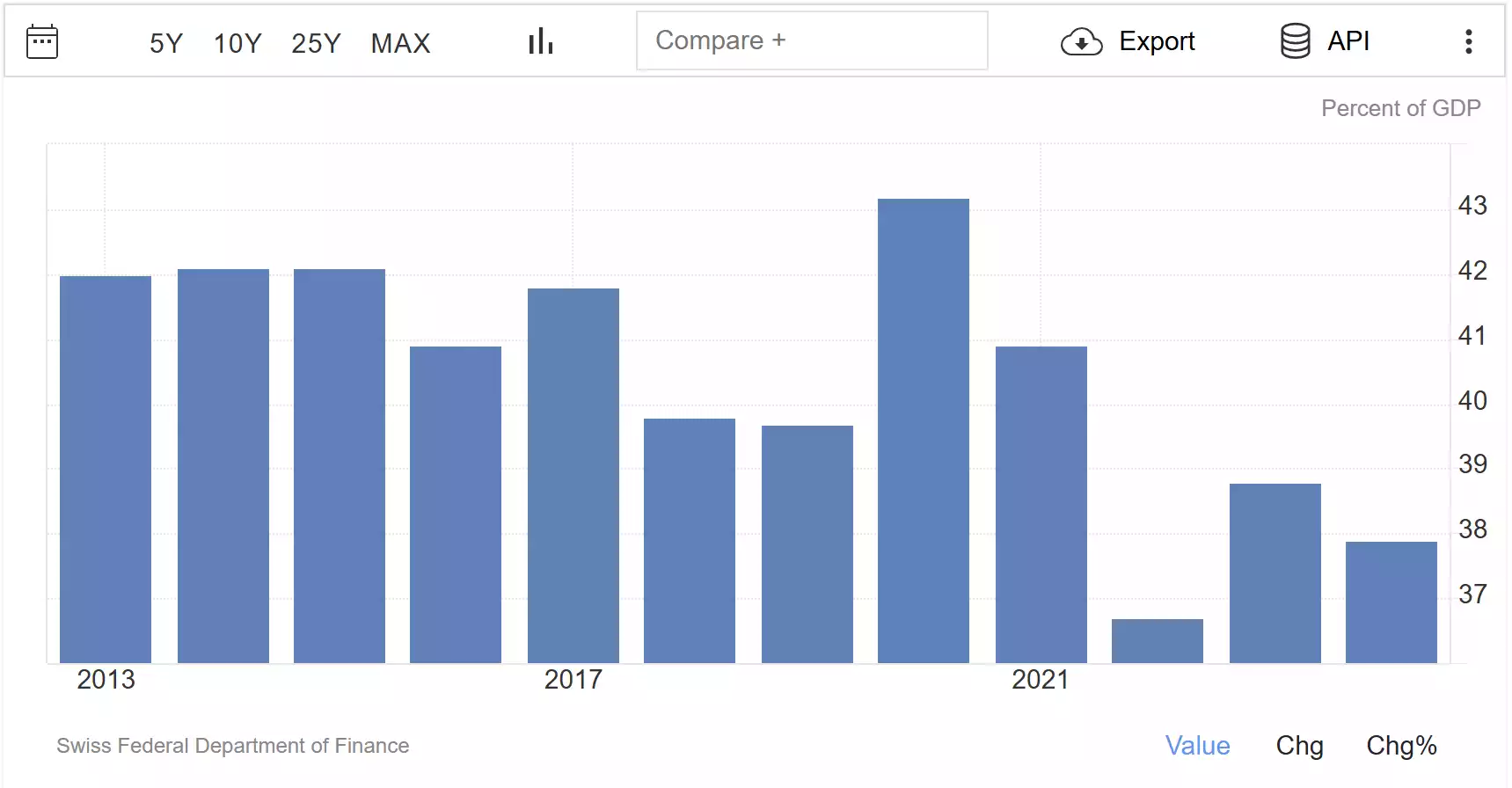

Since 2013, Australia’s debt-to-GDP has grown more than fourfold, from around 10% to 43%. Meanwhile, Switzerland’s debt has shrunk from 42% to 37%, even across the COVID-19 years.

Australia debt to GDP per year

Switzerland debt to GDP per year

What has driven Switzerland’s government conservatism is a rule introduced in 2003 to counter exactly what we’re currently seeing across the Western world known as the debt-brake rule. It has reined in government spending across various political parties by mandating balanced budgets.

Switzerland’s Debt Brake Rule

The debt-brake was implemented in 2003. Its architect was former Councillor Kaspar Villiger, twice President of the Swiss Confederation (1995 and 2002). With a background in mechanical engineering and experience running the family tobacco business, Villiger brought strong commercial sensibilities to government. He later made major contributions to economics, including donating 100 million Swiss francs to the University of Zurich’s Department of Economics and serving as President of the Chamber of Commerce of Central Switzerland.

In the 1990s, Switzerland experienced a sharp rise in deficits, exacerbated by federal pension funding. In 2001, a constitutional referendum was held, and the debt-brake passed with 84.7% support. Between 2003 and 2019, federal debt was reduced by CHF 27 billion.

Many of the initial concerns surrounding the debt-brake such as fears it would stall investment or limit crisis response have proven unfounded. Switzerland has enjoyed an era of prosperity since its implementation. Compared to its eurozone neighbours, whose average debt stands at 97% of GDP, Switzerland sits at just 37%.

In an increasingly centralised and debt-driven world, assets like gold and silver which are eternal, reliable, and decentralised — offer a rare safeguard against political overreach, currency debasement, and systemic fragility. They sit outside the grasp of governments and central banks, anchoring us instead to something real.

Watch the insights video inspired by this article here: https://www.youtube.com/watch?v=GCdtp-IlqZA