Powell's Speech Could Shatter False Hope: Where to Watch

News

|

Posted 24/08/2023

|

1750

The Jackson Hole Symposium is about to kickoff, but it seems that certain investors are happy enough to assume what will happen and double-down on their trades. We have been conditioned for the last week by an army of analysts that "higher for longer" is what's coming and that it will be effectively carried out, only to see bulls nibble away at Powell's vague but stated strategy.

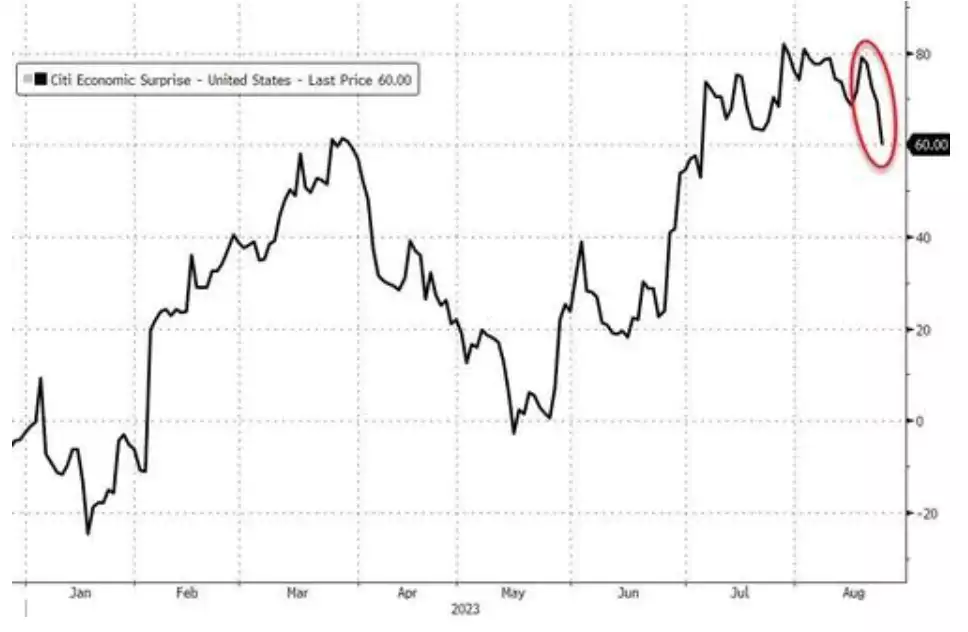

US Services PMI data just came out worse than expected and the reaction by most markets has been overwhelmingly positive. The S&P500 has popped up roughly 1%, signalling that there is still a view that the Fed is more talk than walk, and that more economic pain simply means a higher chance that the Fed will come to the rescue. Gold also rallied 1% and silver surged up 3% whilst bonds reversed their treacherous march. And so we have the return of ‘bad news is good news’ as the market gags for the Fed to ease up. Indeed this week has seen the biggest string of bad economic news since April (courtesy of the Citi Economic Surprise Index)…

‘Hence’ the following reversal to the upside in US equities… (makes sense right?....)

The only real "positive" news recently is potentially that Non-farm Payroll revisions slashed 306K jobs rather than the 500K rumoured in recent news headlines. This is still negative news and is also deleterious to Powell's fear of a wage/price spiral: When rising wages give people the confidence and the means to spend more, which drives up prices further, which leads to a push for higher wages.

So far, Powell has followed through with his aggressive hiking cycle and has even mentioned that pain may be required to fix the economy in the longer term. Evidence has been increasingly mounting that the path he is taking is the same taken in the late seventies/early eighties which caused a double-dip recession and gave the economy the recalibration it needed. One of the key themes then and now has been hiking and then holding until something cracks. That crack did come in the past after not only holding rates higher, but adding another surprise rate hike. Let's see if this is the playbook the current Fed is following, which could mean a rude awakening for risk markets.

Jerome Powell's much anticipated speech will be taking place on Saturday at 12:05AM (AEST) and is expected to be live streamed on the Kansas Fed's YouTube channel: https://www.youtube.com/kansascityfed