Overcapacity or Overcompetitive – The New China trade War

News

|

Posted 05/06/2024

|

2001

The new hyped ‘Green economy’ has become the next battle ground for a U.S./China trade war, that drags the rest of the world into the war and seemingly leaves China and U.S. less wounded, with the rest of the world bearing the brunt of the war. Is it any surprise that China has built capacity in the ‘Green economy’ as that is all the West has spoken about for the last 5 years (with a small COVID-19 distraction on the side). Now the U.S. is claiming China has overcapacity and is dumping EVs and lithium batteries due to ‘unfair trade practices’. China alternatively states that it’s not overcapacity, but rather over-competitive manufacturing, rather than relying on international supply chains China’s world leading manufacturing have complete industry chains allowing them to be more competitive in a free trade environment. Over the past 40 years the U.S. led free-trade wonder has hollowed out these chains in the rest of the West.

Follow U.S. down the Tariff Rabbit hole

As the property market in China began to collapse and the West started talking about ‘Green technology’ China pivoted into EVs, batteries, and solar panels to help utilise its manufacturing supply chains. But they pivoted in a big way, currently their EV market is running at 65% capacity, stoking fears of dumping excess capacity in international markets all whilst being subsidised by the Chinese government. To protect these manufacturing markets Biden has recently announced increasing tariffs from China on a range of goods, increasing EVs from 25% to 100%, steel from 7.5% to 25%, and solar panels from 25% to 50% to name a few. With Biden’s comment ‘They’re flooding the market and ‘It’s not competing it’s cheating’ as the rationale for these increases. With the upcoming election and both parties now pro-China tariff a continued trade war will be costly to the world and stoke worldwide inflation.

Following the U.S.’ lead, the Europe Union is scheduled to announce the results of the anti-subsidy investigation into Chinas ‘dumping’ of Electric Vehicles in Europe. Unlike Australia, Europe sees the advantage of keeping automobile manufacturing onshore and as such is looking to follow the U.S. lead by raising tariffs from 10% to 20-30%. China has warned that if this tariff is imposed China is likely to retaliate. China has signalled that they will put a 25% import duty on large-engine European companies, a move that will particularly affect Germany’s ailing manufacturing market, still in contraction after the Russian gas energy own-goal. The major export market for German luxury vehicles in China currently generates $30billion per year in income. Other potential targets include pork, dairy, wine, and luxury goods.

The last time a trade war erupted between the U.S. and China, when Trump was President, the damage was done to U.S. partners more than the U.S. Who would forget when the Trump worshipping Scott Morrison jumped on the Trump China tariff, following his hero to war, to leave Australia in its own trade war with China – but much less ammunition to fire. Australia’s exports were targeted by China with tariffs on Barley, wine and lobsters to name a few. Last month tariffs on wine were lifted seeing a surge in imports for the month back to around 10% from 1.45% in March. In 2019 Australia’s share of the Chinese wine market was 37%, the trade war proved costly to the Australian wine industry.

Tariffs and Inflation – Ask Argentina

As inflation slows but continues to defy the final drop to put Central Banks around the world at ease, a potential trade war has the potential to reignite inflation. This form of protectionism adds to inflation firstly directly through tariffs increasing the cost of goods, and secondly by producing the goods at a higher rate as industries become lazy and don’t innovate to stay ahead as they already know they are ahead. Look no further than the tariffs applied in Argentina in the 1960s all the way to last year when Milei abolished all tariffs opening the Argentinian economy. During this period tariffs went as high as 16% and up until last year were sitting at 6.5% on average. When Milei took power, he abolished all tariffs, inflation was running at around 25% per month, currently it has fallen to 8% per month. Astronomically high by any standard but falling more rapidly than anywhere in the world currently.

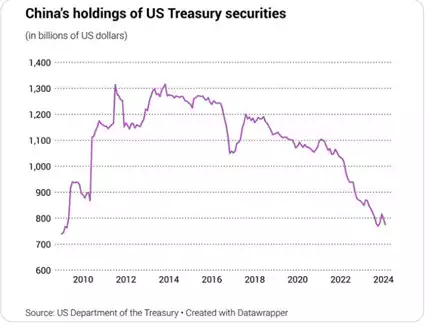

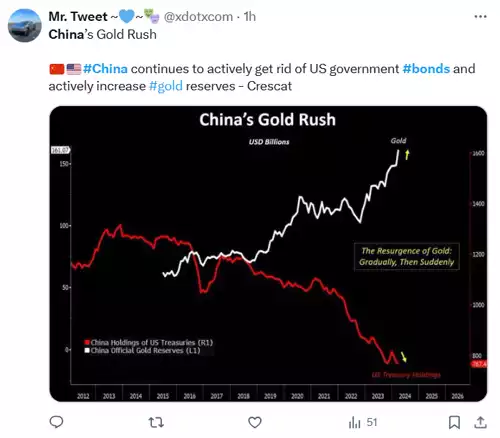

China Bond Sale

In what can only be seen as an initial response, China has recently increased its sell-down of U.S. Treasuries at a record pace. In the first quarter of 2024, China sold a record number of treasuries, reducing assets to $767.4billion. We wrote to this more thoroughly yesterday.

All whilst they increased their gold reserves at a similar record rate, seemingly preparing for an all-out trade war, this will stoke inflation, something the U.S. cannot afford with record deficits leading to higher interest rates and therefore higher interest costs.

So as China retaliates with bonds sales driving up the long tail of the Treasury markets, tariffs increase prices, and as China looks to retaliate against the West’s protectionism, all this spells increased inflation, a more hostile world, and higher gold prices.