Market Wrap Up: More Fed Panic Sees Global Stocks Beginning to Sink

News

|

Posted 27/09/2023

|

1788

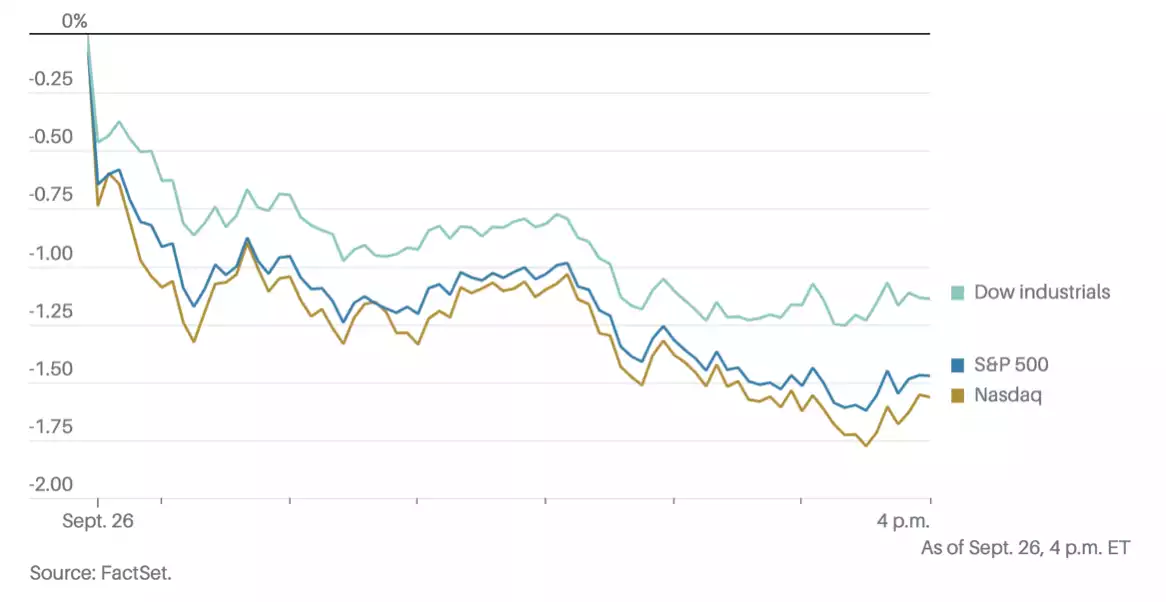

Stock markets saw a severe decline this morning as investors prepared for a period of extended high interest rates. This shift in market sentiment led to a notable strengthening of the US dollar and a considerable sell-off in Treasury bonds.

Two major indices, the S&P 500 and the Nasdaq Composite, experienced sharp declines, reaching their lowest levels since early June. This decline in stock prices was primarily driven by a growing consensus among investors that the Federal Reserve would maintain elevated interest rates for a more extended period.

While there remains uncertainty regarding whether the central bank will enact an additional quarter-point interest rate increase in the current policy tightening cycle, the anticipation of rate cuts in the near future has diminished.

This change in investor expectations comes on the heels of the Federal Reserve's release of its "dot plot," which outlines its projections for future interest rates. The data revealed that Fed officials anticipate a slower rate of interest rate reduction in 2024 than previously anticipated.

Just a few weeks ago, traders were betting on US interest rates reaching 4.2 percent by the close of 2024, suggesting the possibility of up to five rate cuts. However, the current sentiment in the futures market points to rates being at 4.7 percent by the end of 2024, implying that there may only be three or four rate cuts.

Investors now believe that the first rate cut by the Fed will occur in June, following the central bank's communication that it intends to reduce the number of rate cuts in 2024 and 2025.

As these expectations have evolved, there has been a significant rise in government bond yields both in the US and Europe.

The yield on the benchmark 10-year US Treasury, a crucial indicator, remained relatively stable at 4.55 percent, close to its highest level since 2007. Meanwhile, the yield on the 30-year note reached a post-2011 high of 4.7 percent.

We discussed a lot more about the bond market in yesterday's episode of insights here.

The moves in equities and bonds were explained by “cuts are being priced out”, said Jack Ablin, chief investment officer at Cresset Capital. “Rates are not going to drop as much as we thought a few months ago.”

The reaction of course was not just limited to US markets.

The impact was not confined to US markets alone. European equities faced losses for the fourth consecutive trading session. The Stoxx Europe 600 dropped by 0.6 percent, and Germany's Dax index fell by 1 percent, reaching its lowest point since March.

The yield on 10-year German Bunds, a key European benchmark, edged up by 0.01 percent to 2.8 percent on Tuesday, remaining near its highest level since 2011.

The US dollar, which typically appreciates when investors anticipate tighter monetary policy, gained 0.2 percent against a basket of six major currencies, reaching its highest level since late 2022.

“We have long thought that the equity market has been too aggressive in pricing in rate cuts and strong economic growth,” said Mark Haefele, chief investment officer at UBS Global Wealth Management.

“But an imminent end to rate hikes and the prospect of weaker growth as rates are kept higher for longer support our preference for fixed income.”