The Pivot is (has to be?) closer than we think

News

|

Posted 26/09/2023

|

2072

Short squeeze in Bond market imminent

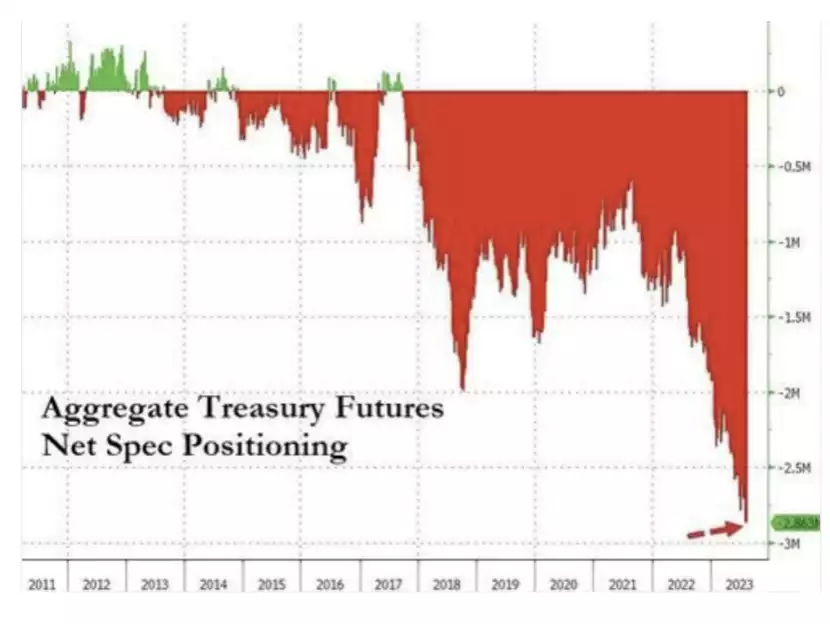

A short squeeze has been touted in the bond and treasury market for the last 5 months since 1.2 million was reached on the US 10 Year, with hedge funds continuing their bearish bets. The positioning has in fact grown to a record short position. Short positions on the US 10Y US treasuries recently hit 2.863 million. If there is an unexpected event or news that causes yields to drop and therefore prices to go up, this could lead to an enormous short squeeze, which in turn would lower interest rates.

Short term Treasuries outperforming the S&P

With yields on 2Y bonds now well above 5%, investors are moving funds away from the stockmarket and into high yielding short term bonds. ‘The absolute yield on short-term Treasuries is extremely attractive. Currently 2-year Treasuries are yielding over 5%, a level that has not been present in almost 20 years’ said Adam Cooms portfolio manager at Winthrop Capital Management. ‘Additionally, the 2-year note is out yielding the S&P 500 by over 3.5%, which is also the highest difference in 20 years’.

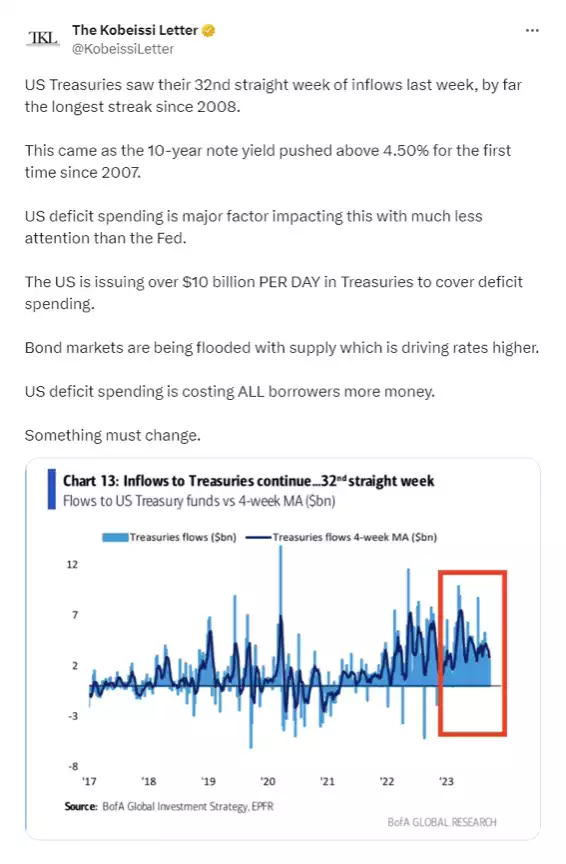

US Treasury Flood

US Treasury yields continue to rise on the back of unprecedented US deficit spending, now amounting to $10 billion per day. As the spending continues, new treasury bonds are issued to cover the shortfall. Additionally, as bonds come to maturity they are required to be reissued. This has now occurred over 32 weeks, which according to the Kobeissi Letter is the longest streak since 2008. As new bonds are issued money moves from the stockmarket or bank deposits into this market at the same time as the massive issuance lifts interest rates on these treasuries as demand eventually begins to peter off.

Moody Downgrading

In an even greater blow to treasury yields and therefore treasury prices, Moody announced yesterday that due to the US government funding standoff (as opposed to the debt ceiling) they are reviewing the US credit rating. Both Fitch and S&P have previously lowered ratings, most recently Fitch lowering on August 1st 2023. If the rating is lowered this may cause a spike in US yields, lifting interest rates without Federal Reserve intervention.

The Federal Reserve will have a choice to make soon

With runaway spending in the US, and inflation looking more and more sticky, with oil prices close to $100 per barrel and an impending government shutdown, the Federal Reserve will be forced into a corner. With inflation staying higher, the Federal Reserve will need to look to further tightening to hold back inflation. This will drain liquidity from the stock market, with investors looking for the greatest yield, which is currently in 5% plus Treasuries and Bonds. If the credit agencies continue to downgrade the US economy, with Moodys as the last standing AAA credit agency is proposing to do, this will put further upward yield pressure on bonds, and further investor interest especially in short term treasuries and bonds. If the increasing yields have the potential to crash the stock market, the Federal Reserve may in fact be forced to ignore these inflationary pressures; pivot and drop interest rates just to maintain current treasury rates.

And then we enter true Stagflation…