Jobs Report Shock: The Catalyst for Rate Cuts and Global Liquidity Surge

News

|

Posted 18/07/2024

|

1366

In yesterday’s article, we emphasised the Fed's hints at imminent rate cuts and the accompanying surge in global liquidity. Today, the latest data supports this outlook, pointing to slowing economic activity and a softening labour market in the U.S., which aligns with the Federal Reserve's focus on labour demand as a key indicator for policy adjustments.

U.S. Firms Indicate Slowing Activity and Softer Labour Market, Ainslie Research Reveals

Recent data from the U.S. Federal Reserve shows that economic activity in the United States expanded at a slight to modest pace from late May through early July. Firms are predicting slower growth ahead, and there are signs of a softening job market, reflecting the Federal Reserve's heightened focus on labour demand to avoid delaying interest rate cuts.

The latest survey, which collected insights from business contacts across the Federal Reserve's 12 districts up to July 8, also indicated a modest rise in inflation pressures, with input costs beginning to stabilise in most areas.

"Economic activity maintained a slight to modest pace of growth in a majority of districts this reporting cycle," the Fed reported. Seven districts saw some growth, while five reported flat or declining activity, an increase from two in the previous period. Businesses expect slower growth over the next six months due to uncertainties around the upcoming election, domestic policy, geopolitical conflicts, and inflation.

This analysis comes as Fed Chair Jerome Powell and his colleagues emphasise that the risks associated with inflation and the job market are now balanced.

Following unexpectedly high inflation earlier this year, recent data from April, May, and June have been more encouraging. Inflation, as measured by the Fed's preferred gauge, stands at 2.6%, with the next update due on July 26.

With disinflation resuming, the Fed is focusing more on labour market conditions as a reason to consider policy rate cuts. Several districts reported softer labour market conditions, with some employers raising hiring standards and pausing hires despite numerous job openings.

The Fed aims for a "soft landing" where economic growth slows gradually, unemployment remains low, and inflation returns to the 2% target. The unemployment rate reached a 2.5-year high of 4.1% in May, with wages growing at the slowest pace in three years amid an expanding labour pool.

The unemployment rate hit a 2-1/2-year high of 4.1% in May and annual wages increased at the slowest pace in three years amid an expanding labour pool, the latest government data showed.

Wage gains were described as modest to moderate, with some areas reporting a slowdown in wage growth. Despite signs of easing inflation, multiple reports indicated that high costs continue to strain households, impacting spending. Elevated costs, particularly for rent, are pushing families to move in together and individuals to seek roommates.

The Fed's benchmark overnight lending rate has been held between 5.25% and 5.50% for the past year. While a rate cut at the upcoming July 30-31 meeting seems unlikely, investors expect the Fed to lower borrowing costs in September, November, and December this year.

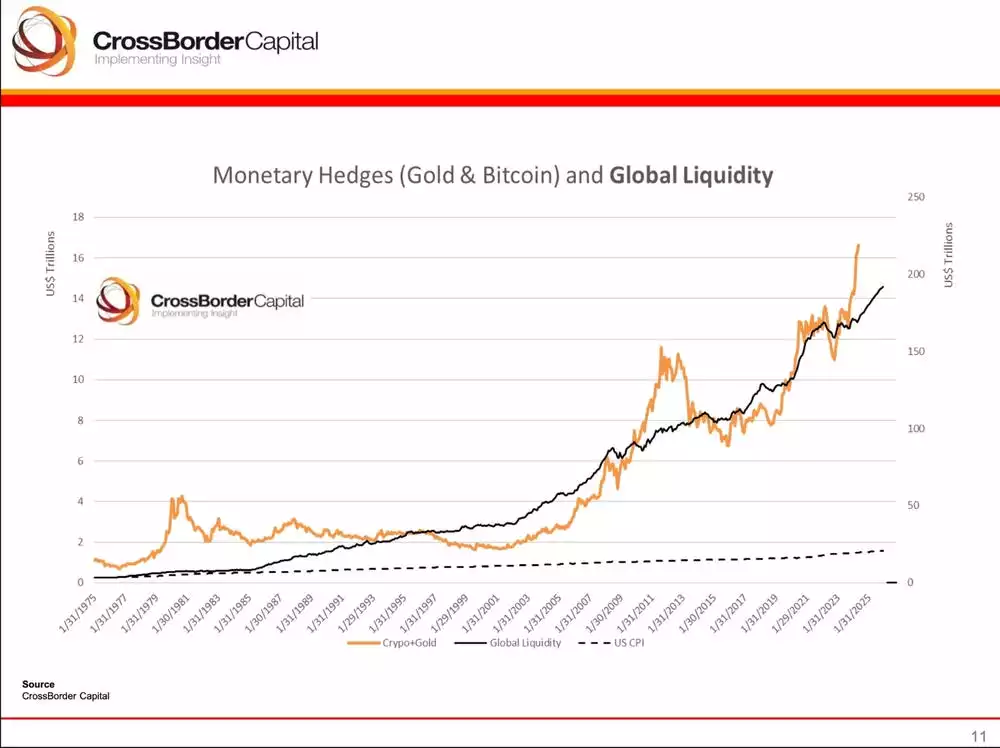

Global Liquidity: When Bad News is Good News

In the context of global liquidity, the adage "bad news is good news" holds true. The slowing labour market is a critical factor driving the Federal Reserve to consider lowering rates and injecting liquidity into the economy. Employment trends, especially in an election cycle, have a significant impact on policy decisions. As the job market softens, the Fed is more likely to act to stimulate growth, which in turn boosts liquidity and asset prices.