More US Banks Downgraded: Is Another Banking Collapse on the Horizon?

News

|

Posted 23/08/2023

|

2197

Two weeks after Moody's lowered the ratings of a large suite of US regional banks, S&P Global Ratings has now followed suit with its own round of concerning downgrades.

In a recent Bloomberg report, S&P Global delivered a pessimistic outlook for more lenders as a result of higher interest rates and the withdrawal of deposits.

In the research note, S&P clarified that challenging conditions in lending have led them to lower the ratings of five banks by a single level each: KeyCorp, Comerica Inc., Valley National Bancorp, UMB Financial Corp., and Associated Banc-Corp. Additionally, they've assigned negative outlooks to River City Bank and S&T Bank.

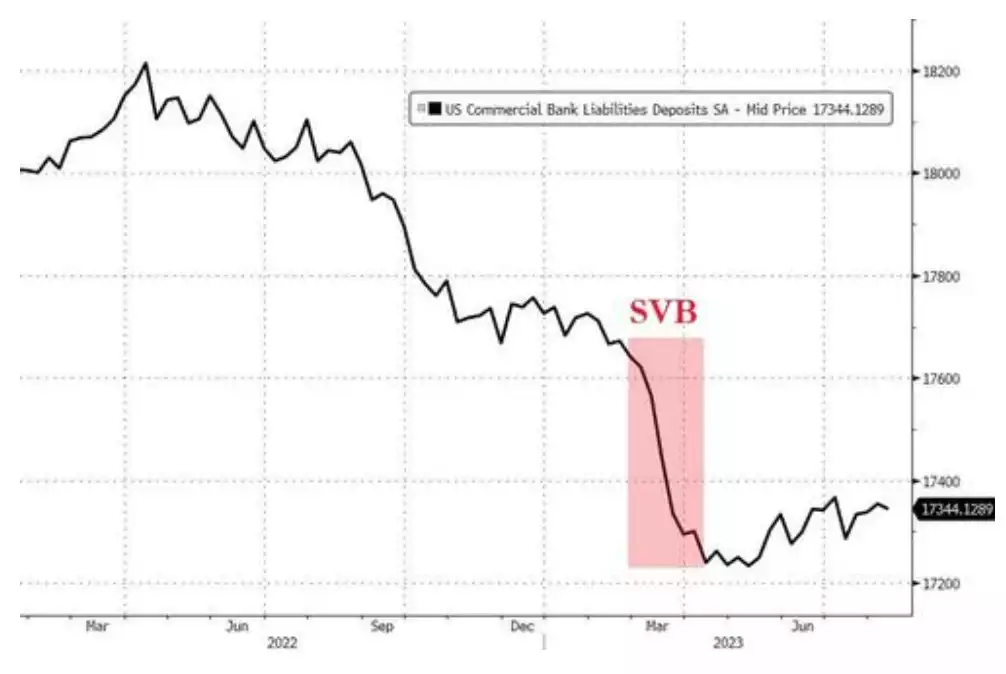

More specifically, that depositors have "shifted their funds into higher-interest-bearing accounts, increasing banks' funding costs," S&P said, adding, "The decline in deposits has squeezed liquidity for many banks while the value of their securities - which make up a large part of their liquidity - has fallen."

In Moody’s report two weeks ago, they attributed their series of bank downgrades to three main pillars, rising funding expenses, potential vulnerabilities in regulatory capital, and growing risks tied to loans connected with commercial real estate.

"US banks continue to contend with interest rate and asset-liability management risks with implications for liquidity and capital, as the wind-down of unconventional monetary policy drains system-wide deposits and higher interest rates depress the value of fixed-rate assets," Moody's analysts Jill Cetina and Ana Arsov said in the accompanying research note.

The Moody analysts went on to forecast a rather dire prediction for 2024.

"We continue to expect a mild recession in early 2024, and given the funding strains on the US banking sector, there will likely be a tightening of credit conditions and rising loan losses for US banks."

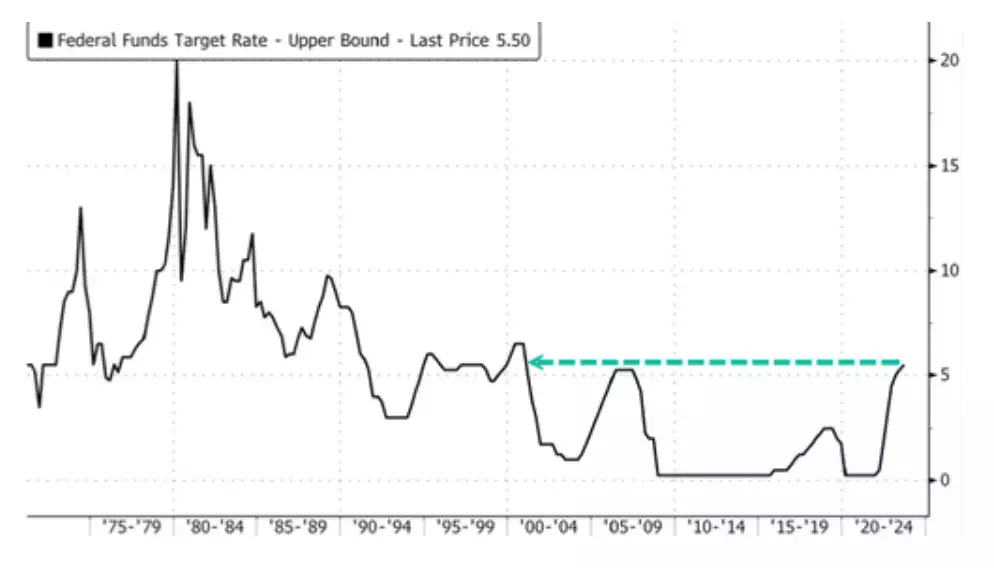

These challenges in the banking sector align with the Federal Reserve's series of substantial interest rate hikes, reaching levels not seen in over two decades. While the full ramifications of this tightening cycle might not have fully materialized, S&P has cautioned that elevated rates are placing stress on borrowers.

This scenario mirrors Fitch Ratings' recent decision to downgrade the highest credit rating of the U.S. government. Fitch analyst Chris Wolfe even suggested the potential for another round of upheaval in the banking industry, with the prospect of widespread rating downgrades, even affecting major players such as JPMorgan Chase.

Now that would be a disaster of epic proportions.

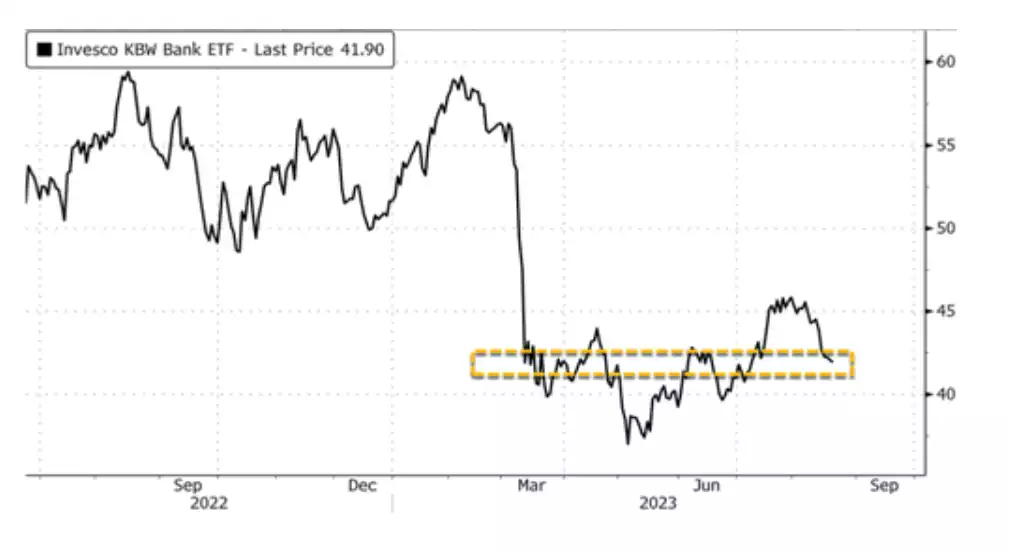

Amidst all these developments, the KBW Bank Index, which tracks major U.S. banks, remains at levels similarly observed in March—a time when several regional banks encountered significant difficulties.

Clearly, the US banking system has been unstable for some time, as bank credit ratings are not merely downgraded overnight. However, the fact that traditional credit agencies have now at this point chosen to conform their ratings to the reality of the US banking sector, could mean there is a lot more damage to come, as the evidence for further banking collapses has become too great for these establishment agencies to ignore.