ING Bank Optimistic on Gold’s End To 2024 (And We Agree)

News

|

Posted 13/08/2024

|

2352

At the start of last week, gold joined the global sell-off in equities stemming from the de-risking of Yen carry-trade fiasco and rising worries of a looming recession in the US. Although gold is seen as a safe harbour during times of uncertainty, it’s likely that investors needed to sell gold in order to cover margin calls on other investments, so it was spared in this event. In a recent report, ING expects a strong end to the year for gold for a number of reasons, many of which we have written about recently.

The Fed

The report predicts a 50-basis point cut to interest rates in September with several smaller cutes of 25 points to follow through next year. Should this occur, we might see rates fall to 3.5% by the middle of next year and that would provide a strong tailwind for gold, which tends to perform well when borrowing costs are lower.

Central banks buy and holding

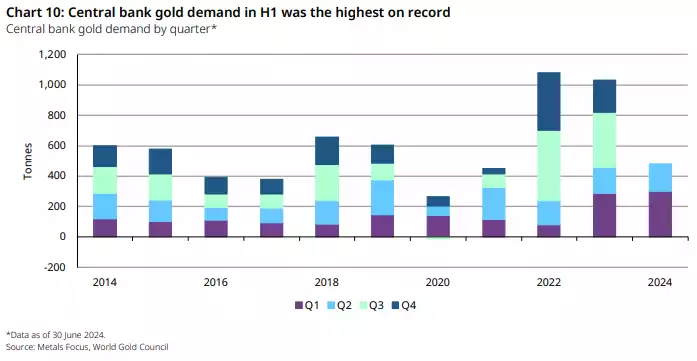

As we wrote about in a recent article, central banks continued to purchase gold in June, with net buying of 12 tonnes, according to data from the World Gold Council (WGC). Emerging market central banks led the way, with Uzbekistan and India each adding 9 tonnes to their reserves.

Notably, China's gold buying has slowed in recent times, with the People's Bank of China (PBoC) not adding to its gold reserves for the third straight month in July. This is a major pause after an 18-month buying spree that helped to drive gold prices to record high prices. Perhaps these high prices are discouraging further purchases, for now. As of the end of last month, the PBoC's are happy holders with their total gold holdings remaining steady at 72.8 million troy ounces.

Despite these fluctuations, the reports expect central bank demand to remain robust, especially given the current economic climate and geopolitical tensions, coupled with a retreat from record-high prices.

ETF Inflows on the Rise

Gold ETFs have seen two consecutive months of inflows, thanks to higher buying from Europe and Asia managed which offset outflows from North America. Generally, when gold prices rise, investor holdings in gold ETFs increase as well, and the opposite happens when prices fall. However, throughout much of 2024, gold ETF holdings have been in decline, even as spot gold prices have reached new highs.

Geopolitical Tensions

War and conflict have only heightened in the recent past and it’s hard to see how that won’t be resolved any time soon. The Israel-Hamas war has entered its tenth month and the risk of all-out war between Israel and Iran’s proxies looms. The war in Ukraine churns on and now Ukraine has is occupying territory in the Kursk region of Russia – the first time Russia has been occupied for a foreign force since 1944. The conflicts continue to place enormous pressure on the United States and debt continues to rise as a result.

Looking Forward

Despite the chaos in equities, gold has recovered quite well and is still up almost 25% against the Aussie dollar from the start of the year. The authors of the report expect gold to continue its upward trend after a period of consolidation and reach a peak of US$2,450 ($3,719 AUD) by the end of the year. Morgan Stanley, though, is more optimistic with a prediction of $2,650 US ($4,022 AUD) over the same time.