How the 0.1% Richest Stay Rich

News

|

Posted 26/03/2024

|

2769

Looking through all the short term noise, it is becoming clear the world is on course for a monetary expansion period for the records and one likely to coincide with higher inflation, making it a stagflationary nightmare if you don’t own the right assets. Today we look at where we are at, where we are going and who will benefit.

First for context, in a U.S. Fed fixated world, look beyond the Fed… From respected economist and fund manager Daniel Lacalle:

“Thirty central banks easing and seventy national governments increasing spending in an election year means more fuel for the inflation fire in a year in which money supply growth has bounced significantly from its 2023 lows.”

And yet we are fixated on whether the Fed will do 3 cuts or 4 or 5 this year without looking past this. The U.S. may be holding rates but last week they eased bank lending rules to release more money into the system, the U.S. Senate passed a bill to increase spending by another $1.2 trillion, the Swiss National Bank last week cut rates, the ECB held but flagged cuts to come, NZ is now in both a technical and per capita recession and likely to drop next meeting, and even though the Bank of Japan raised rates they raised them to… zero!

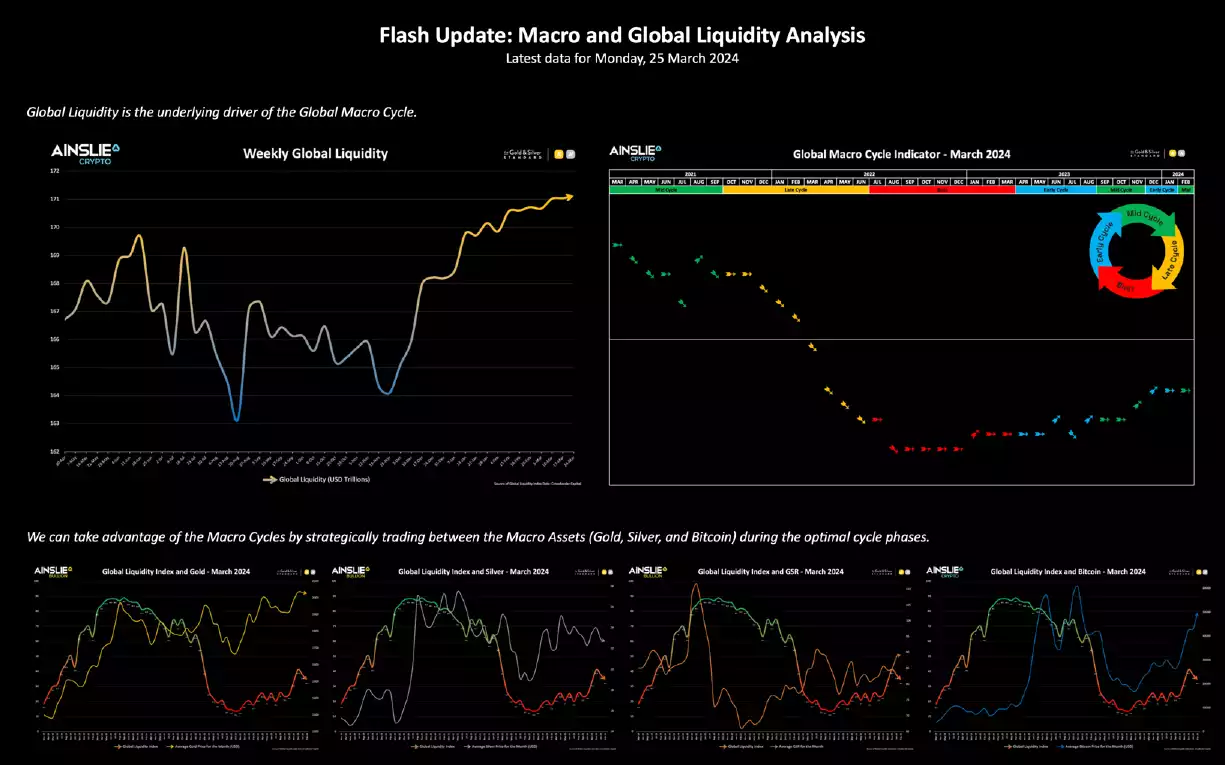

Regular readers will know we watch the Global Liquidity cycle very closely given its incredible correlation with precious metals and bitcoin. In the flash update yesterday you can indeed see a slowing of the global liquidity and even dip in the index. BUT it still hit a new all-time high of $171.12 trillion! The main culprits are the Fed (stopping the emergency bank bailout fund BTFP and before the effects of looser bank lending changes) and China’s PBoC temporarily tightening to ease the pressures on the Yuan whilst still trying to manage a falling economy. i.e. both appear temporary.

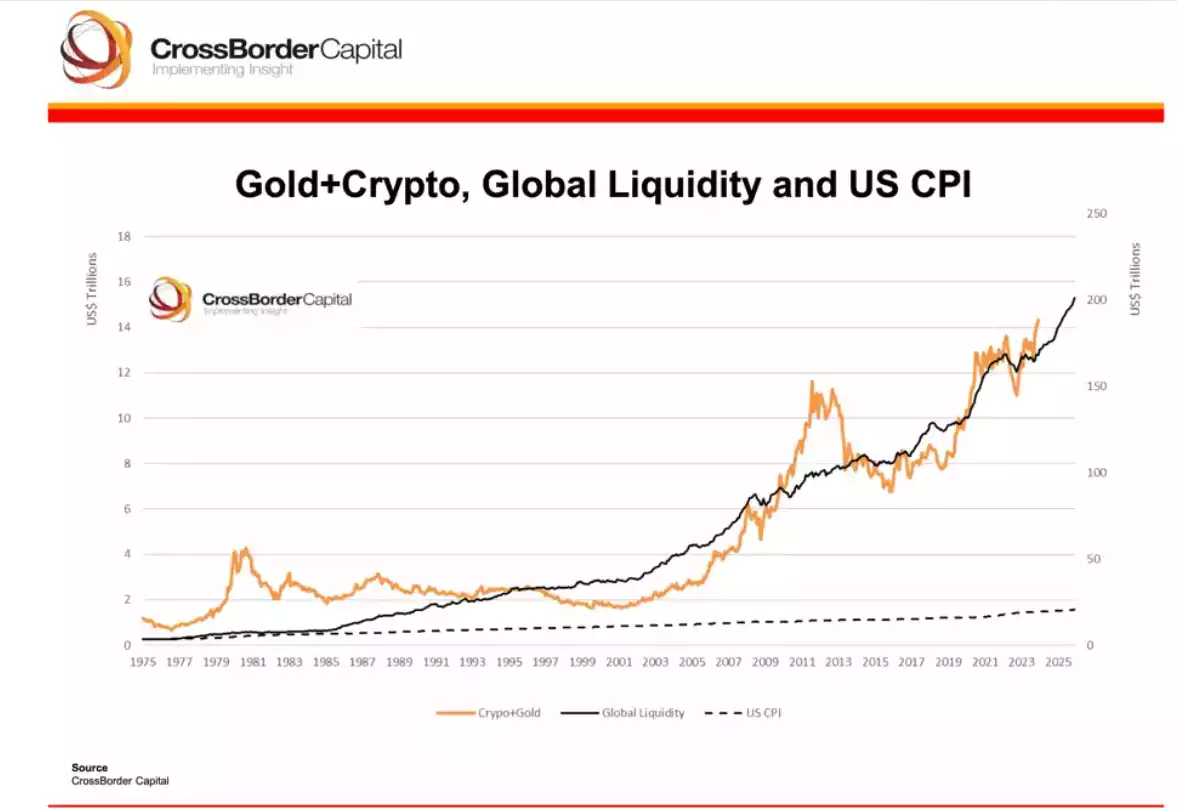

On any metric we appear still to be in the early stages of the liquidity expansion phase of early to mid cycle. They key thing to remember here is that in our Fiat currency world, all liquidity expansion comes from monetary inflation or debasement. More debt creating more currency. We often speak to the following chart that shows how gold and bitcoin keep up with that monetary inflation whilst consumer inflation (CPI), what your wage is loosely linked to is well below.

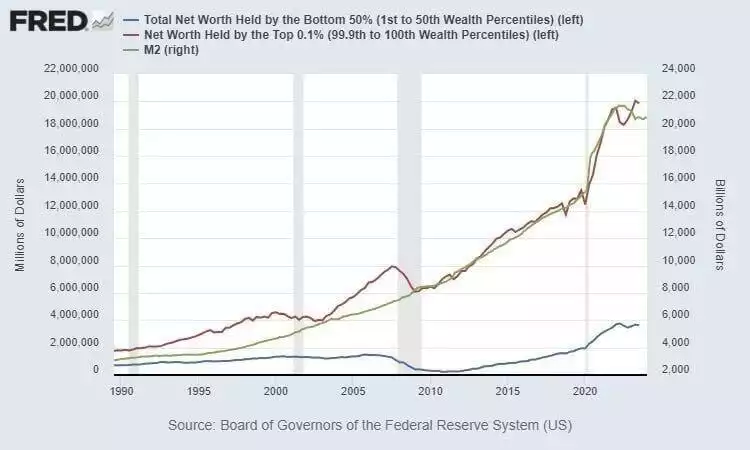

That inevitably sees those who hold the real monetary assets of gold, silver and more recently bitcoin become richer whilst the rest are left behind. The following chart from the very perpetrators of this social destruction, the U.S. Fed, put this in very very clear terms in the context of the U.S., but absolutely also the blue print for the world as a whole. For the hard of seeing or colour blind… The top 2 lines are the net worth of the richest 0.1% (red) and the M2 (U.S. monetary supply in green). Way down the bottom is the total net worth of the bottom 50%. You can see the direct comparison with the above chart. Don’t hold these assets and your wages AND cost of living go up by the same so you go nowhere. In Australia your wages haven’t even kept up with inflation!

Understand that those in the 0.1% are very very incentivised to keep this going and generally hold the power until a social ‘revolt’ of sorts occurs or the whole house of cards falls.

Governments have no means of paying off the debt. The U.S. alone is increasing theirs by around $1 trillion every 100 days! Add elections and add the cost of servicing that existing debt and you are assured that more money will be created and that they MUST cut rates before they get inflation under control and so we get the dreaded stagflation of high inflation and low growth.

Lacalle summarises insightfully:

“You may think all the above problems are policy mistakes, but they are not. This is a slow process of nationalizing resources. Inflation and artificial money creation through deficits and monetization are a gradual transfer of wealth from real salaries and deposit savings to the government. You are basically becoming poorer to sustain an ever-increasing government size. The next time you read that massive deficits and monetary easing are good policies for the middle class, ask yourself why you find it harder each year to pay for goods and services. The mistakes made in 2020–2024 will cost the middle class many more taxes, even if the government promises it will only be “taxes on the rich,” the oldest gimmick to raise your taxes.

More taxes, persistent inflation, the hidden tax, and the loss of value of your wages. That is “easing” for you. A private sector recession with headline economic figures bloated by government debt. The recipe for stagflation.”

The sooner you start accumulating your own precious metals and bitcoin, the sooner you put yourself on that top line trajectory.

Remember Ainslie Crypto allows you to buy bitcoin and other cryptocurrencies with the ease and assurance of dealing with a human, offering secure cold storage, and SMSF friendly, high value capacity. And of course, Ainslie Bullion offers the legendary customer service and trust that comes with 50 years of helping people get on that top line.