Happy Easter – Hot Cross Stagflation

News

|

Posted 27/03/2024

|

1525

Happy Easter – Hot Cross Stagflation

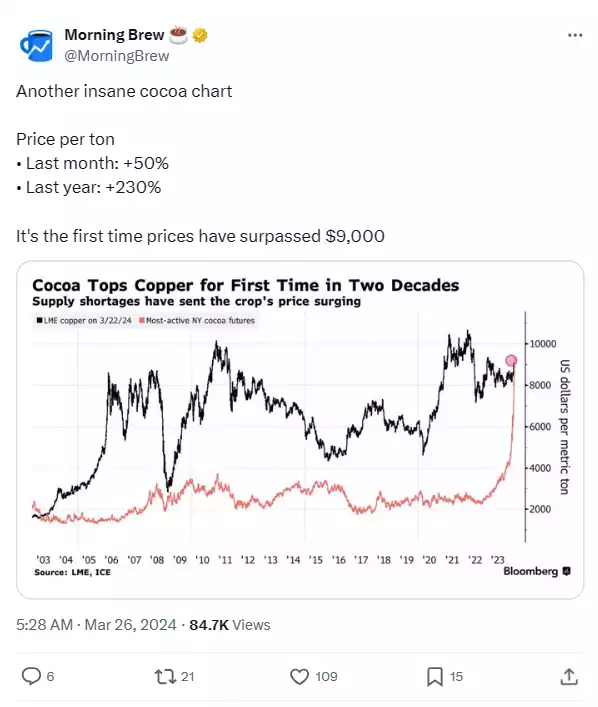

Cocoa prices appear to be in a melt up – with prices recently reaching over $10,000 per tonne – more than copper… With Easter this weekend – the price of chocolate in the supermarket is noticeably higher, with shrinkflation taking a few eggs out of each bag and bunny prices up. Prices for cocoa surpassed copper for the first time since 2003 with shortages being driven by low yielding crops and demand growing (especially over easter). Adding to this government regulation and a short squeeze in the commodity appear to have seen prices behave more like a Meme stock and far surpassing even Bitcoin’s run this year.

Production Issues

Around 85% of cocoa is grown in West Africa, with Ghana and Ivory Coast contributing 60%. Cocoa trees grow in a narrow band around the equator, at 20 degrees latitude. With a recent heatwave and elevated humidity due partly from the current El Nino climate, cocoa yields are significantly down. In Ghana, nearly 500,000 hectares of cocoa harvest has been lost due to swollen shoot virus disease (associated with El Nino). The age and virus of the cocoa tree affects yield and traditionally the cocoa farms are abandoned and new fresh forests started. These forests are becoming increasingly difficult to find and plant leading to older and lower yielding farms. New government regulation will also change the farming habits, increasing costs further into the future. With cocoa demand increasing 4% per annum output will likely be down into the future. Some cocoa production facilities in West Africa have begun to shutdown

Government Issues adding to woes

As always inflation is added to the market through regulation and government demands. To maintain cocoa production, deforestation has been common in West Africa, adding to the price of cocoa is new regulations;

"Adding complexity is the EU's upcoming deforestation regulation that could limit output if farms don't comply," writes SA analyst Weather Wealth,

Chocolatiers will be required to source cocoa beans that are sourced under this regulation adding to both potential commodity cost as well as additional compliance costs within the businesses.

And Finally a Short Squeeze

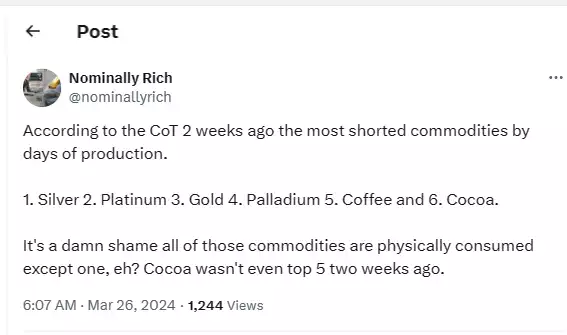

2 weeks ago cocoa was the 6th most shorted commodity (behind all the precious metals and coffee). At the time the price was sitting at around $7500, part of the price change may have been caused by a short squeeze for chocolate coming into Easter….

How will Central Banks manage these commodity surges?

Interestingly, the last time there was price to trough increase in cocoa like this was in the 1970s (period of stagflation) with a 10x climb. Currently cocoa is only at 5x so potentially still has even further to go. Could this be another indicator that stagflation is on its way?

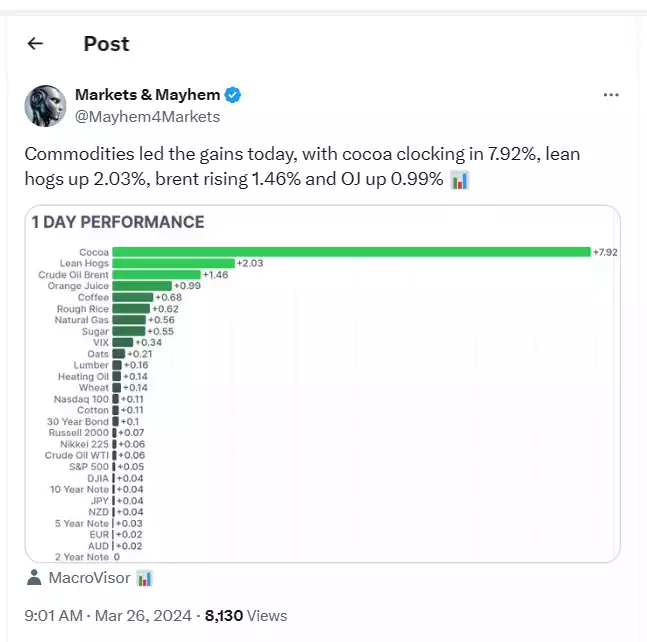

On the 26th of March Cocoa’s price skyrocketed by nearly 8% in a single day, with several other commodities lifting nearly 1% on the day including Oil, Orange juice and Sugar.

Interestingly the last time Cocoa behaved like this was in 1976 - With gains like these on commodities, the Federal Reserve (and other nations) are going to have a difficult time dropping interest rates to stave off the pending recessions that are becoming more and more likely…