Goldman Sachs Raises Gold Forecast

News

|

Posted 01/10/2024

|

4446

Goldman Sachs analysts have raised their forecast for gold from US$2,700/oz to US$2,900/oz for early 2025. This comes after an already considerable 29% increase this year and 45% since 2023 against the U.S. dollar.

There are two main reasons for the lifting of Goldman’s forecast:

- Their economists anticipate faster declines in short-term interest rates in China and the West will cause a gradual rise in ETF flows.

- Data is showing that emerging market central bank purchases on the London OTC market continue to drive the rally, as it has done since 2022, and they believe this structural tailing to continue.

Secret buying

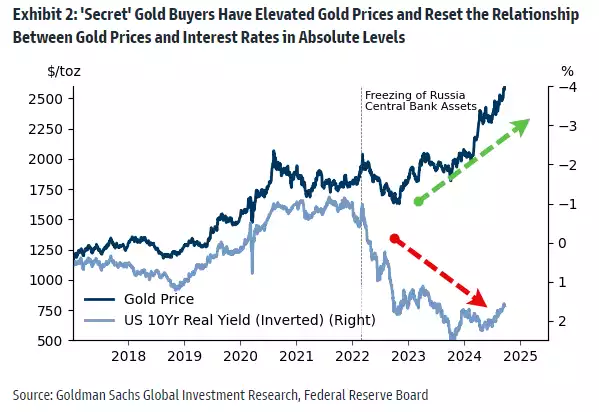

Last week, we explored the apparent secret gold purchases by Saudi Arabia since 2022. The below chart by Goldman Sachs demonstrates how the gold prices relate to changes in interest rates, but, since 2022, a buyer (who prefers to keep quiet) has reset the relationship in terms of absolute levels.

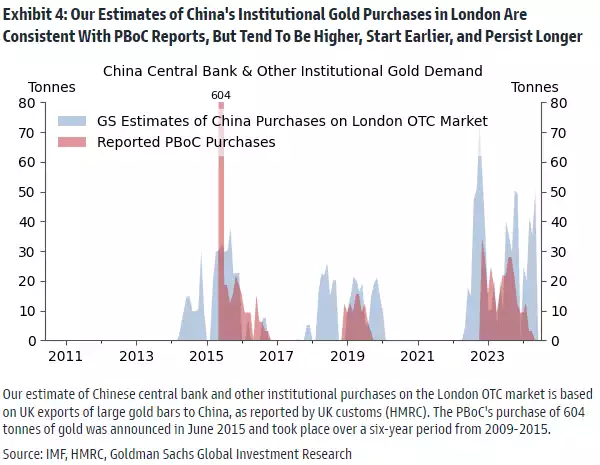

With its reported streak of 18 consecutive months of purchases since November 2022, The People’s Bank of China has been a focus for gold investors. Goldman Sachs’ estimates of their institutional gold purchases in the London OTC market align with the PBoC reports but tend to be higher and longer lasting.

In the end, regardless of which large financial institution is providing their view on the future price of gold, we reiterate what we’re currently seeing affect the markets:

- Structurally higher central bank demand

- The boost from lower global interest rates

- Hedging benefits against geopolitical shocks, debt fears, and recessionary risks.

While we live in a dynamic and ever-shifting world, the above second and third reasons, in particular, are factors that appear to be moving in only one direction right now. Markets cooled on the last day following Fed Chair Jerome Powell’s comments that signalled future rate cuts would be (only) 25bp, but they’re still coming down going forward. Oh, and the risk of regional war in the Middle East is getting particularly hot.