Gold and Silver Forecasts – Short, Medium and Long Term

News

|

Posted 15/10/2025

|

13330

After a record run to AU$6,400 for gold and AU$82 for silver, many are now asking where this bull run is headed—short, medium, and long term.

While no market rises in a straight line, a hallmark of a healthy uptrend is a period of consolidation that allows previous gains to be absorbed. Ideally, we could now see gold and silver stabilise over the coming months before the next leg higher.

From a cyclical perspective, the current eight-year gold cycle began in late 2022, placing the next major half-cycle low around 2026. History suggests we should expect a strong parabolic move leading into this period, followed by consolidation, and then a renewed rally out of it.

We forecasted such a parabolic move for precious metals earlier this year, and it has now materialised. In the short term, this move is best digested by the market through a period of calm—setting the stage for the next major phase as we approach the half-cycle mark.

Looking to the medium term, Bank of America recently raised its 2026 forecasts to AU$7,700 for gold and AU$100 for silver. Over the longer term, it’s we likely haven’t seen the full story yet.

With US government debt now around US$37 trillion—and projected to keep rising exponentially—US dollar debasement is essentially locked in as the only way to keep servicing that debt.

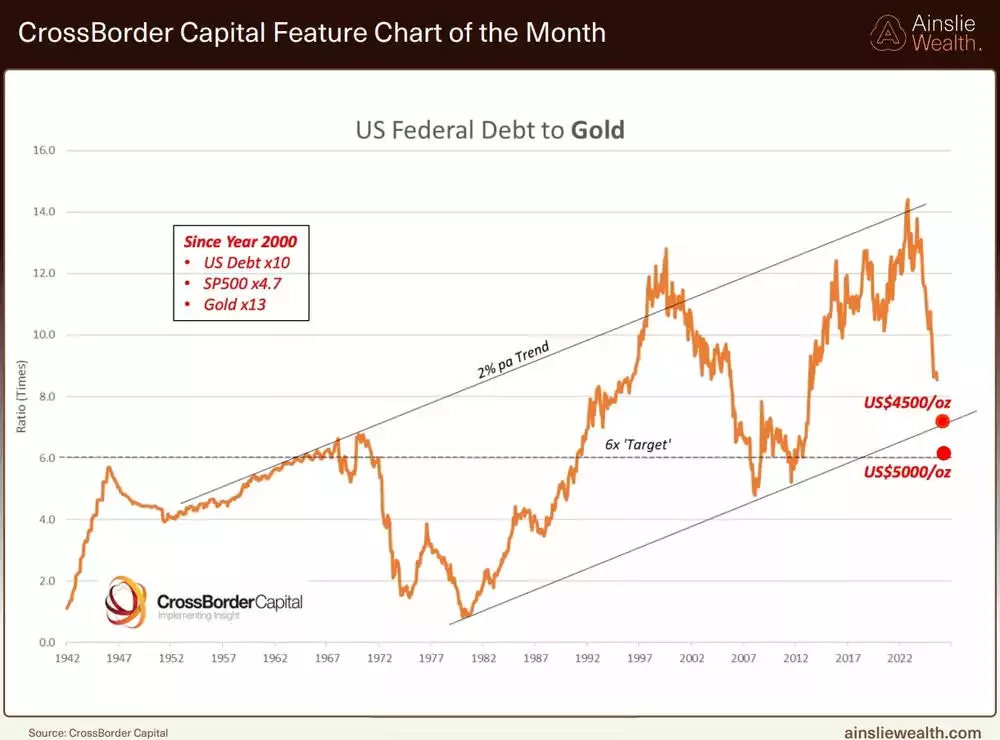

The chart below points to a plausible near-term target of US$4,500/oz for gold (around AU$6,800/oz). But if we extend the trajectory of US debt out 15 years, the implied gold price could reach US$25,000/oz (roughly AU$37,000/oz).

Gold has increasingly acted as a barometer for US government debt. As debt levels climb, the US dollar tends to weaken, pushing gold higher. This inverse correlation stems from the need to expand the money supply to service the debt—while gold, priced globally in US dollars, rises accordingly.

With the next major gold cycle beginning in 2030, the coming decade looks especially strong for the metal.

So where does that leave silver?

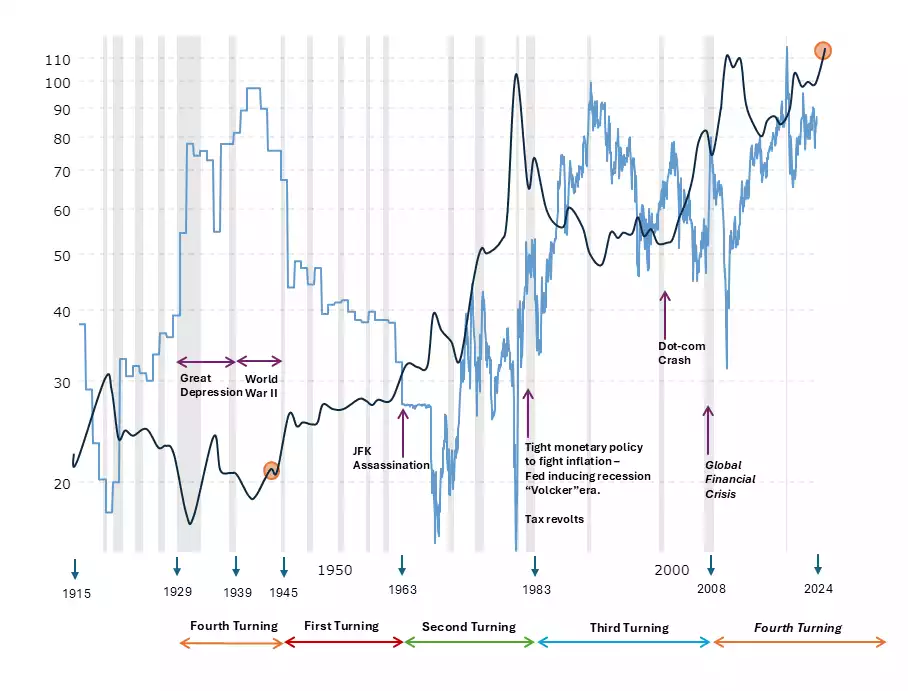

The gold-to-silver ratio (GSR) offers a key clue. As we move from the current 80-year socio-economic cycle to the next—often described as the “Fourth Turning”—it’s worth revisiting how the GSR behaved during the last such transition.

Following the previous 80-year reset, the GSR fell from the 60–90 range to the 20–40 range over two decades and remained there for the following 20 years. If we assume a similar average ratio of 30 in the years ahead, and a long-term gold target of AU$37,000, this implies a silver price of around AU$1,200 within 15 years.

While short-term moves often capture attention, the broader picture shows both gold and silver may have a long runway ahead.

As we navigate the coming decades of economic transition—from one human-made system to another—individuals, institutions, and central banks alike will need to rely on a consistent, enduring store of value to protect their wealth. Gold and silver remain exactly that.

Watch the Insights video inspired by this article here - https://www.youtube.com/watch?v=kp02gizIqyE