Potential Big Move Incoming for Precious Metals

News

|

Posted 03/09/2025

|

3063

With gold having consolidated over the past three months following a strong bullish run, the broader macro uptrend remains firmly intact. While a seasonal dip in global liquidity is expected through Q3, a positive outlook for Q4 strengthens the case for a renewed move higher in both gold and silver.

Silver is already leading the way, with the Gold-to-Silver Ratio trending lower — a promising setup for silver as the next leg unfolds.

We can add further depth to this view by examining inter-market dynamics, sentiment, and seasonality currently at play.

Inter Market Dynamics

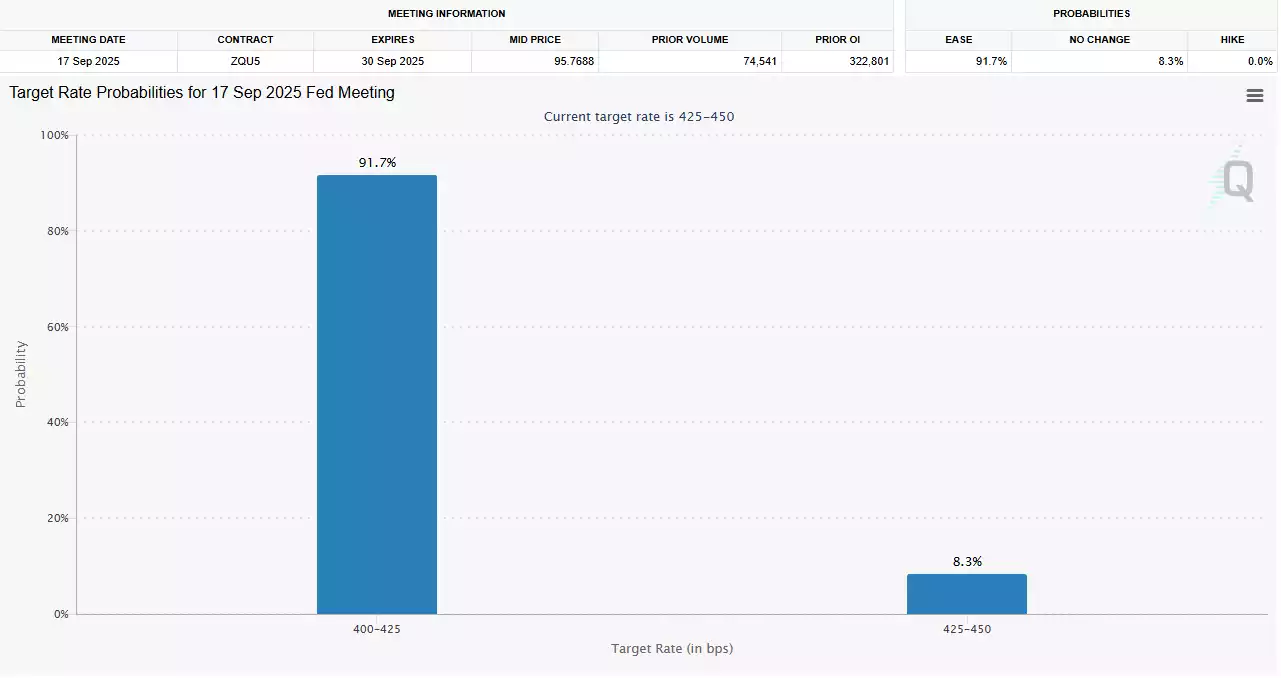

The US Dollar Index (DXY) remains in a macro downtrend. With a 91.7% probability of rate cuts expected from the US Federal Reserve this month, the DXY faces continued downward pressure — providing a tailwind for global liquidity and US dollar-priced hard assets like precious metals.

The US bond market has also been supportive. Yields are trending lower (white), driving up collateral values and reinforcing a downtrend in volatility (blue). This backdrop strengthens the foundation for improved global liquidity.

Notably, gold and silver mining stocks have surged recently, even as gold has remained in consolidation. This divergence may be an early signal — with larger players positioning ahead of a move higher in the metals themselves.

Sentiment

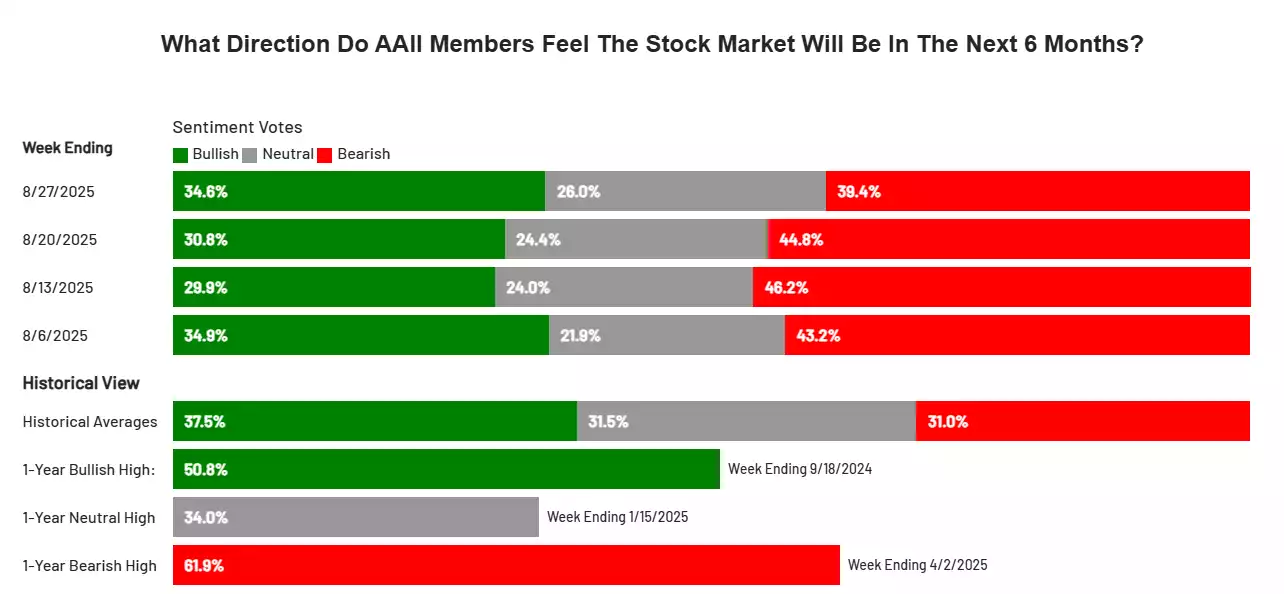

Investor sentiment in the US stock market is showing clear signs of uncertainty. According to the latest AAII survey, only 34.6% of respondents are bullish, with 39.4% bearish and 26% neutral.

Historically, the AAII is a reliable contrarian indicator, with retail investors often positioned on the wrong side of the market. With fear still elevated and complacency absent, this ‘wall of worry’ is typically a constructive setup for asset price gains — particularly in gold and silver.

Seasonality

In post-election years, Q3 often sees choppy liquidity conditions, followed by a clearer uptrend into Q4. This year appears to be following that playbook, with an anticipated August air pocket now playing out. Looking ahead, historical seasonality supports a bullish outlook for hard assets through the final quarter of the year.

Gold cycle

Gold’s long-term 8-year cycle (2022–2030) is expected to reach its mid-point in late 2026. A consolidation phase leading into that period would be consistent with prior cycles. After three months of consolidation, gold now appears well-positioned to begin its next leg higher.

Q4 2025 presents an ideal window for this move to gain momentum — supported by falling interest rates, a weakening DXY, rising global liquidity, and cautious investor sentiment.