Gold Surprise Spike. Bullish Pattern. U.S. interest Costs exceed Defence

News

|

Posted 21/06/2024

|

1998

Gold this morning has seen a surprise spike and has formed a potentially bullish chart pattern. The chart below shows it popping up AU$37 in only two hours, and the next several candles hint at another potential breakout.

The Nasdaq has finally broken its 7-day winning streak and has had its worst drop in roughly a month. Tech companies’ gains have become increasingly consolidated into a handful of companies, namely Nvidia, which has also finally had a dip. This year’s rapid and aggressive increase in stock market indices may be one of the factors weighing on gold’s success, gold being a potential exit strategy.

So far Gold, priced in Australian Dollars, is already up over 17% from the beginning of the year - a tremendous rise in only half a year. This rise came despite longstanding historical pressure of high interest rates. Looking at the image below, one can see a higher low potentially forming on the current daily candle. Closing at a higher low could be the first hint at the next continuous run up in price.

Recent economic indicators, including softened labour market conditions and sluggish retail sales figures, suggest subdued economic activity in the second quarter. The Federal Reserve is closely monitoring these developments, seeking confirmation of easing inflationary pressures as it cautiously considers potential rate cuts later this year.

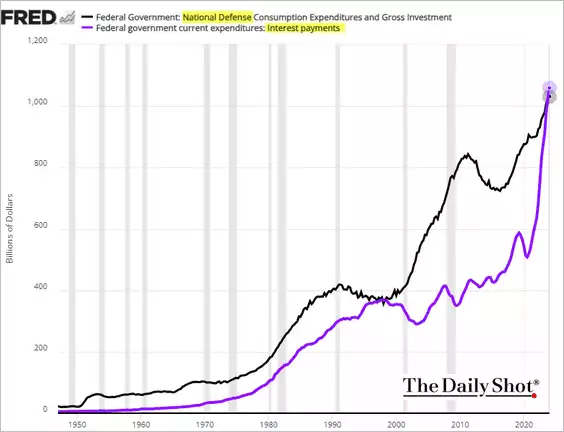

Lower interest rates diminish the opportunity cost of holding gold, which does not yield interest like other investments. However, this year has been notable in gold ignoring the high interest rates. Why? Potentially as smarter buyers (particularly central banks) can see that in the current era of record high debt levels, higher rates and that debt make for unprecedented interest payment costs and what that does to the stability of the USD and economic system. As we’ve shared previously and you can see below, that interest cost of US$1.1trillion per year now exceeds U.S. defence spending, spending of epic proportions to maintain the world’s biggest defence force. But just check out the trajectory of those interest payments. The Fed simply HAS to cut rates, its just waiting for the right narrative whilst inflation is so high.

In addition to economic factors, gold has benefited from safe-haven demand amidst ongoing geopolitical tensions and uncertainties surrounding political landscapes, such as France's upcoming elections and its economic challenges.

Short-term market attention will be focused on upcoming U.S. weekly jobless claims data and flash purchasing managers' indices, which could further influence gold's price.

ANZ analysts recently provided a positive gold outlook, projecting a target price of US$2,500 per ounce by the end of 2024.