The Gold Rush Continues: Central Bank Buying Spree Will Not Stop in 2024

News

|

Posted 20/06/2024

|

3006

In a newly released survey, central banks worldwide are openly signalling a strong desire to buy even more gold, despite two successive years of record purchases and gold prices reaching new all-time highs.

In 2023, central banks added 1,037 tonnes of gold, the second-highest annual purchase in history, following a record 1,082 tonnes in 2022. The Central Bank’s Gold Reserve Survey (CBGR) released yesterday, which gathered data from 70 central banks, reveals that nearly 30% plan to add to their gold reserves within the next year.

Shaokai Fan, global head of central banks and head of Asia-Pacific at the World Gold Council (WGC), notes, "Extraordinary market pressure, unprecedented economic uncertainty, and political upheavals around the world have kept gold front of mind for central banks. Many institutions have become more aware of the asset’s value as a way to manage risks and diversify their portfolios."

The survey found that while 71% of respondents still consider gold's legacy a reason to hold it, other factors have gained prominence. Key reasons now include gold’s long-term value (88%), performance during a crisis (82%), and its effectiveness as a portfolio diversifier (76%), the latter two of which appear to be more important than ever given the current geopolitical instability, as well as the upcoming U.S. elections.

Central banks in emerging markets and developing economies (EMDEs) maintain a positive outlook on gold’s role in their reserves. This year, advanced economy central banks are also viewing gold more favourably, with over half (57%) expecting gold to account for a higher proportion of their reserves in five years, a significant increase from 38% in 2023.

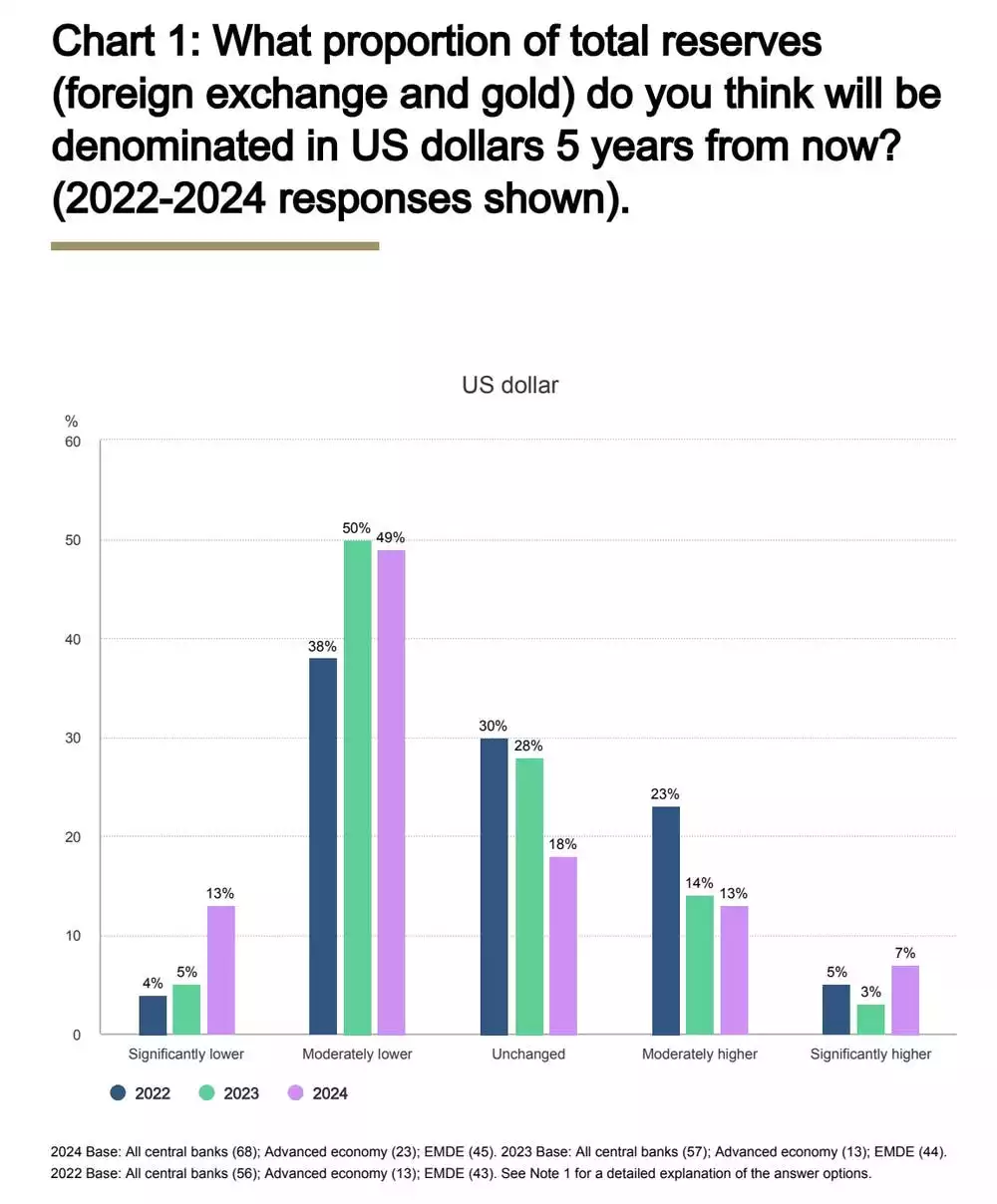

Moreover, advanced economy central banks have grown more pessimistic about the U.S. dollar's future share of global reserves, a sentiment historically more prevalent among EMDEs. Over half (56%) of advanced economy respondents believe the U.S. dollar's share will decline, up 10 percentage points from last year, while 64% of EMDE respondents share this view.

"Despite record demand from the official sector in the past two years and climbing gold prices, many reserve managers still maintain their enthusiasm for gold," Fan added. "While price fluctuations may temporarily slow down purchases, the broader trend remains as managers recognize gold's role as a strategic asset in the face of ongoing uncertainty."

Year to date, gold prices have risen approximately 13.5%, reaching a record high of US$2,427 per ounce in mid-May before pulling back slightly. Holdings increased to 3,088 tonnes last month, supported by European and Asian flows, while physically backed gold ETFs experienced their first monthly inflow since May last year.

The WGC also highlighted that the bullish narrative for the U.S. dollar might be weakening, suggesting that a peak in the dollar has historically benefited gold. In various economic scenarios, the U.S. dollar is expected to face challenges, potentially enhancing gold's appeal as a safe-haven asset.

Overall, it’s clear that this trend of central bank purchasing was not just a strong reaction to economic instability post COVID-19, but a strong consistent force that will remain a key underlying component of the gold market for the foreseeable future, particularly given the diversification and stability benefits gold holds in the current political landscape. And that is not us or anyone else saying that, that’s the central banks themselves.