Gold Soars to New Heights Amid Global Uncertainty

News

|

Posted 28/04/2025

|

1742

Gold prices continue to surge in April, driven by escalating geopolitical tensions and economic uncertainties. On April 22, spot gold hit a record high of US$3,500 per ounce, a 26% increase since the start of the year, fuelled by fears of a US-China trade war and a weakening dollar. Despite a brief dip to US$3,318.71 on April 23 as trade tensions eased, analysts remain bullish, with Goldman Sachs forecasting prices could reach US$3,700 by the end of 2025, and US$4,000 by mid-2026.

Silver and Platinum Face Mixed Fortunes

While gold basks in the spotlight, silver and platinum are navigating choppier waters. Silver prices, currently at US$33 per ounce, are expected to face short-term headwinds due to uncertain industrial demand, though JP Morgan predicts a rise to US$39 by the end of 2025. Platinum, trading at US$959, has struggled to break above the US$960-$965 resistance level, with prices dipping 0.5% recently. While both metals have been overshadowed by gold’s rally, their industrial applications, particularly silver's pivotal role in solar energy, electric vehicles, and electronics, are expected to drive future gains as global manufacturing rebounds and silver positions itself for a historic bullish breakout.

Central Banks and Investors Fuel Demand

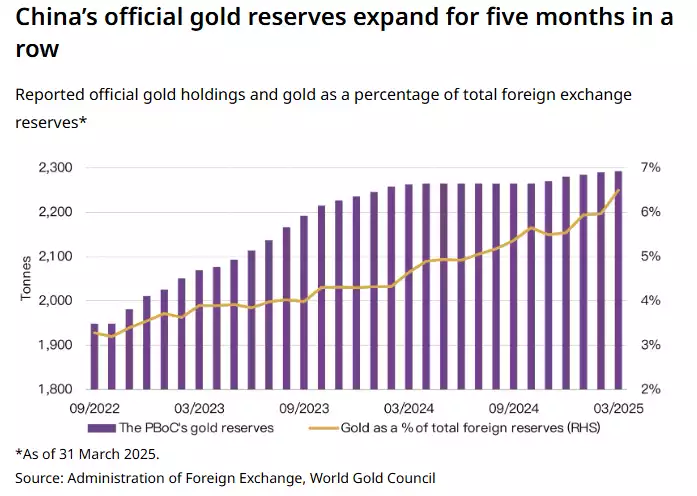

The gold rally is underpinned by robust demand from central banks and investors alike. Central banks, particularly in BRICS nations, are stockpiling gold at a record pace, with China adding 12.8 tons to its reserves in Q1 2025. This strategic accumulation, coupled with retail and institutional investors seeking stability amid tariff wars and a 120% US debt-to-GDP ratio, has tightened supply. With mine production lagging, UBS strategists note that the market still has room for more investors, potentially pushing prices higher.

What’s Next for Precious Metals?

Gold’s safe-haven status is likely to keep it in demand as long as trade tensions and inflation persist. Silver and platinum, however, may need stronger industrial demand to catch up. With analysts like Ed Yardeni predicting gold could hit US$4,000 by year-end, investors are watching closely.