A Historic Bullish Setup for Silver

News

|

Posted 13/03/2025

|

6277

Yesterday, we discussed how precious metals are not yet in a bull market. Today, we're diving deeper, and exploring additional indicators that suggest precious metals could be on the verge of a "once-in-a-century" bullish setup.

Supply squeeze with physical silver

China has been purchasing silver directly from miners, unrefined, as silver concentrates at a fixed price. This is an "impact avoidance strategy" used by nation-states to stockpile without drawing unnecessary attention or causing prices to increase too much. While this doesn't have a direct impact on spot price, it has a significant influence on the supply shortage. Additionally, India recently imported 2,600 tonnes of silver from the UAE, a significant portion of global supply.

With a shortage of over a billion ounces of silver from the past five years of excess silver demand outweighing supply, a supply squeeze is looking increasingly likely, pointing to a scenario where physical silver may become unobtainable as an investment asset.

With an eye-watering 1:400 physical-to-paper ratio the strain of this shortage on the futures markets could easily result in a scramble for physical delivery and a spike in the spot price of physical silver. We are already seeing a glimpse of this in the futures markets today, as they enter backwardation.

Silver futures markets

Seeing backwardation on silver markets where the price of physical silver today is higher than future prices (i.e. a negative cost to carry) indicates soaring immediate demand for the physical metal. Industrial demand, particularly from countries like China, seems to be driving this trend. The backwardation in silver suggests a potential squeeze, where demand outstrips available supply, leading to price volatility.

Gold to Silver Ratio (GSR)

The Gold to Silver Ratio which tells us how many ounces of silver give us 1 ounce of gold is currently at 88 with the long-term average at 50. We usually see this spend multiple decades in a row well above and well below the average.

As we are simultaneously coming up to the end of an 18.6-year land cycle (the last one was the 2008 Global Financial Crisis) and an 80-year socio-economic cycle (the last one was the great depression), we can see how the GSR behaved moving from one cycle to the next for each of these.

GSR over the 18.6-year land cycle

In the 2008 Global Financial Crisis, as we transitioned from the previous 18.6-year cycle to the next, we saw the GSR rise, leading into the collapse phase. During this time, silver continued to become undervalued, as priced in gold. This is where we are today, on the lookout for the final phase of the uptrend.

After the crash, however, during the recovery phase, we notice the GSR fall off a cliff, as the silver price skyrockets. This is because, as most other markets struggle to recover, precious metals continue putting in steady capital growth and as a result speculation enters the precious metals space.

Silver, with its smaller market cap, tends to react strongly to this speculation with greater percentage increases in value.

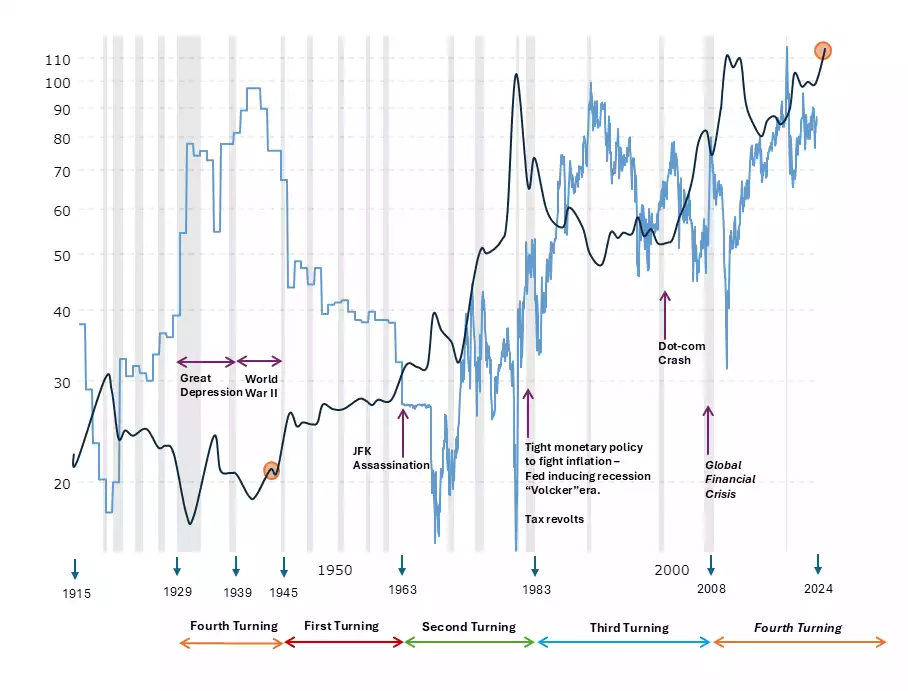

GSR over the 80-year socio-economic cycle – The Four Turnings

While the GSR falls off, as we transition from one 18.6-year cycle to the next, we can see a once-in-a-century fall off of the GSR as we move from an 80-year socio-economic cycle to the next – called the four turnings.

The "Four Turnings" is a thesis formulated by historians Neil Howe and William Strauss, suggesting that society moves in 80-year macrocycles, made up of 4 sub-cycles called "turnings", with each turning lasting about 20 years - and having its own generational archetype, specific role to play, and predictable result.

During the fourth tuning, society is expected to address a range of major crises, head-on and create a new system by the end of it, leading into the first turning of the next 80-year cycle.

As we are currently in the fourth turning, which is due to transition into the first turning of the next 80-year cycle, we can note how the GSR behaved previously, during this phase.

The previous fourth turning was marked by the end of WWII, where the GSR fell from around 90 to below 20 (light blue), and silver went on a 35-year-long bull run (dark blue).

As we find ourselves at a similar cyclical phase today (marked in orange), we're on the lookout for a generational bull run in silver, while the GSR spends multiple decades below the long-term average of 50, in the next phase.

Technical cup and handle pattern

The Silver USD chart shows one of the largest cup and handle patterns ever recorded. This is a bullish pattern with a first target of US$71/oz for silver.

Having held above the 0.5 level of this pattern (US$20.9) is the early sign of the bullish pattern playing out, being confirmed.

Considering our position in the 18.6-year and 80-year cycles, along with the physical supply shortage, nations stockpiling, backwardation in futures markets, a physical paper ratio of 1:400, and a bullish cup and handle pattern; all signs point to a historic bullish setup for silver! All of this, while most are not paying attention to the silver market.

Watch the Ainslie Insights video discussion of this article here: https://www.youtube.com/watch?v=h7J_tuzqZBA