Gold Price Continuing to Surge on the back of FOMC and Powell

News

|

Posted 21/03/2024

|

2524

Gold investors woke up to more good news this morning, gold hitting another all-time high, with the market experiencing a resurgence in buying activity due to the Federal Reserve indicating its commitment to lowering interest rates three times this year.

On Wednesday, the Federal Reserve made a highly anticipated announcement, opting to keep its Fed Funds rate unchanged within a range of 5.25% to 5.50%. However, the focus of the markets was more on the central bank's forward guidance regarding future interest rates.

The Fed's updated interest rate projections reveal that the committee anticipates the Fed Funds rate to remain at 4.6% by the end of the year, consistent with the December forecast.

Prior to the announcement, the gold market was trading with relative low volatility the past few days but saw a positive shift in response to the news. Spot gold prices were last recorded at $2,203 per ounce, marking a 0.7% increase for the day.

The gold market has gained momentum as expectations of a rate cut in June solidify. According to the CME FedWatch Tool, there is now over a 60% likelihood of a rate cut in June, up from a 50/50 chance before the announcement.

U.S. equity markets also reacted strongly, with the S&P 500 climbing 0.9% to a record level of 5,225, marking its second consecutive day of hitting all-time highs. The Dow Jones Industrial Average rose 1% to 39,512, while the Nasdaq composite gained 1.3% to reach 16,369, both also achieving record highs.

Despite the Fed signalling potential rate cuts, it remains hesitant about specifying the timing. Overall however, the central bank conveyed a generally optimistic outlook on the economy's health.

"Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated."

While inflation has moderated, the Fed indicated it is not yet ready to decrease rates significantly.

"The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent."

Although rate cuts are still expected this year, the easing cycle might be less aggressive than what markets anticipate.

The updated projections indicate that the Fed foresees interest rates reaching 3.9% by the end of 2025, slightly higher than the 3.6% forecasted in December. Additionally, interest rates are expected to settle at around 3.1% by 2026, up from the previous estimate of 2.9%.

In addition to more modest interest rate cuts, the Federal Reserve is increasingly optimistic about the U.S. economy's outlook. The latest economic projections show the Fed expects the economy to grow by 2.1% this year, a notable increase from the 1.4% estimate in December. Growth forecasts for the following years have also been revised upward, with expectations of 2.0% growth in 2025 and 2026, compared to earlier projections of 1.8% and 1.9%, respectively.

The Fed's outlook on the labour market is similarly positive, anticipating a lower unemployment rate of 4.0% this year, down from the previous estimate of 4.1%. The unemployment rate is then expected to stabilise at 4.1% next year before dropping back to 4.0% in 2026, unchanged from prior estimates.

Regarding inflation, the Fed doesn't anticipate core inflation reaching the 2% target until 2026. Core inflation is projected to increase by 2.4% this year, the same as December's forecast, and rise to 2.2% next year, up from the previous estimate of 2.1%.

The upshot? Whilst the so called ‘dot-plot’ was more hawkish (tightening bias), the Fed Chair came out extremely dovish and the markets has read the tea leaves and believes liquidity will surge again, just as we have repeatedly stated. From Bloomberg, Hirtle Callaghan & Co’s CIO Brad Conger:

“The FOMC was on the horns of a dilemma. January and February’s inflation readings showed that progress towards the Fed’s 2% target is stagnating at best and inflecting back up at worst.

The facts called for a hawkish adjustment to reflect the slackening progress. Instead, we got a dovish adrenaline shot -- reaffirming the November pivot. The boost to financial conditions is working counter to the Fed’s price mandate. So much for Jay Powell’s presumed admiration for Paul Volcker.”

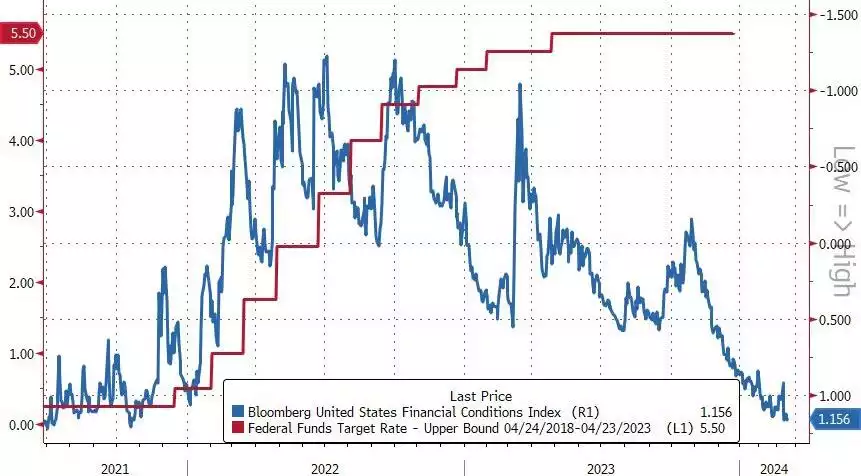

We wrote last week about the Fed Funds Rate v Treasury yield ‘alligator jaws’. In the context of last night just check out the ‘alligator jaws’ of where the Fed Funds Rate is versus Bloomberg’s Financial Conditions Index. Yep, back where we pre COVID… So if you think rates can stay where they are in these conditions and with $34.5 trillion of debt to service and a pre election $2 trillion deficit spending spree to be soon added then there are many bridges looking good to buy right now too…. Gold may be at an all time high, but the party is only about to start.