Gold Now Beating Stock Market in 2023

News

|

Posted 27/10/2023

|

2319

Service Sector Falling Apart

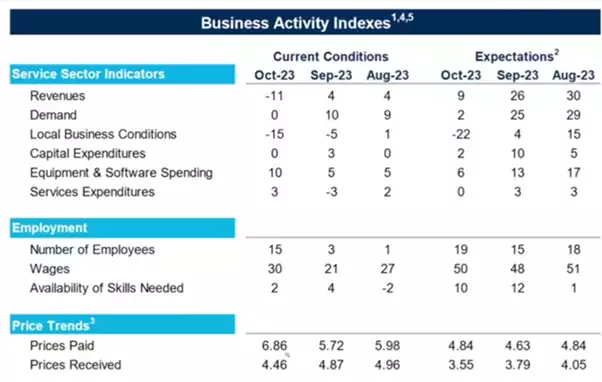

According to a survey by the Richmond Fed, October saw the revenues index drop by -11 and the demand index fall similarly from 10 to 0. The indices for future revenue expectations in the service sector also suffered. The local business conditions index fell from -5 last month to -15 for October, and expected local business conditions dropped from 4 to -22.

This means US consumers do not have extra money anymore. They have student loan responsibilities hitting them again and their credit cards are not helping. We wrote to this here.

Layoffs, or Hire More People and Give Raises?

We see a major disconnect when it comes to the Richmond Fed's employment index, which showed a rise from 3 in September all the way to 15 in October. Firms have been reporting raises, wage hikes and no problem hiring the talent they need. Most firms surveyed anticipate continued wage hikes. This disconnect is further highlighted by the fact that growth in prices paid has increased, while growth in prices received has decreased. This means companies have been willing to actively hunt for new talent and offer higher wages, despite lowered business activity and income.

Double-Dip Incoming?

If you are wondering how the stock market in the US is still afloat, you are not alone. The last time that government bond yields climbed similarly, we saw "double-dip" recessions.

The 10-year Treasury yield has risen 4% in the last 3 years. This week it reached 5% - something it hasn't done since 2007. In terms of the increase, it has been the biggest since the early 80s when Fed Chair Volcker was trying to fight inflation and ended up helping cause a double-dip recession.

How is Gold Responding?

Gold (priced in USD) has responded by closing above a major resistance level. From a technical point of view, this could potentially mean it has further to rise.

Gold Outperforming Stocks

As of today, gold is officially outperforming the S&P 500 in 2023. As of Thursday’s close, the S&P was up 7.8% since Jan. 1st, and gold was up 9.2% in the same period. This could be attributed to the bond news covered above, but it is also apparently weighted heavily by the Hamas attack and resulting war. In Aussie dollar terms, gold is up an incredible 17.2% this year whilst the ASX200 is down 2%, a 19% outperformance in gold over Aussie shares.

So, is the worst over for the economy and the war, or is it yet to come?