Evergrande Collapse – China now vs U.S. GFC

News

|

Posted 31/01/2024

|

3475

The will-they won’t-they speculation of Evergrande is over, with a Hong Kong Court finally ordering the group to liquidate as creditors were unable to reach a restructuring deal. With $300 billion dollars in debt, the equivalent of nearly 2% of the Chinese economy it was expected (maybe hoped) the Chinese Government would jump in and save the group, but on Monday these hopes were dashed with the court ruling. For background you can read our last update here.

China’s real estate growth has been the largest contributor to Chinese growth over the last 2 decades, at its peak contributing between an estimated 22-31%, the latter estimate when including infrastructure to support the real estate development. In comparison U.S. construction makes up only 4% of its GDP.

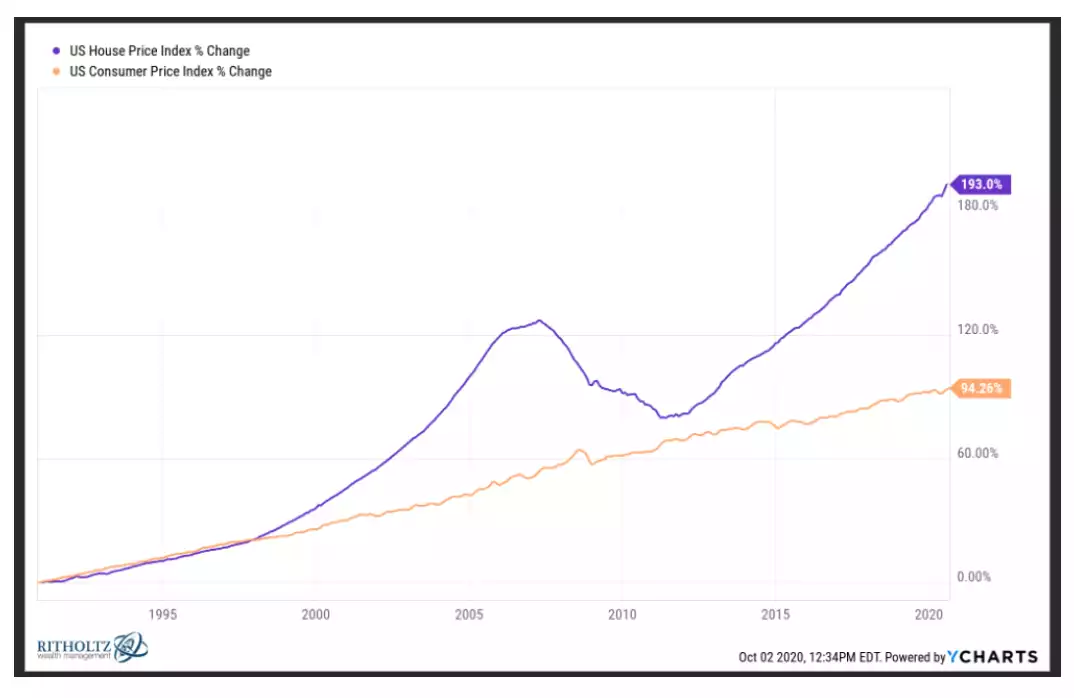

Additionally, unlike the U.S., 70% of Chinese wealth is in real estate. Every 5% decline in home prices wipes out an approximate $2.7 trillion in housing wealth. Compared to the U.S. where it’s housing market is similar in size to the S&P500 at $43.5 trillion and $41.3 trillion, which excludes other investments such as private businesses, which is then much bigger than the S&P market cap. Therefore housing investment would fall under 30% in the U.S.

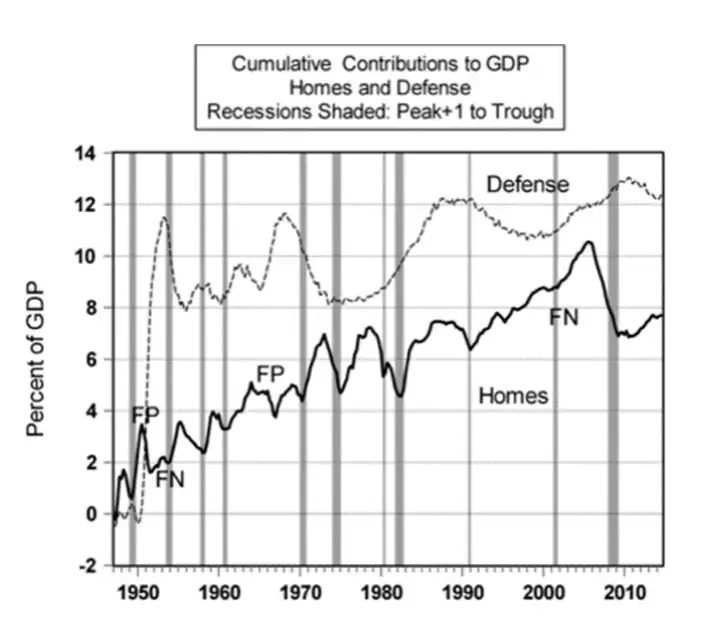

2007 Global Financial Crisis – When America Overbuilt

The catalyst for the Global Financial Crisis was driven by over speculation in real estate and lax financial lending practices, which created a real estate bubble, which began to deflate in late 2005, to mid 2006. With favourable ‘walk away’ terms in the U.S., anyone that had negative equity (around 12% by 2008) were able to walk away from their home and leave the banker holding the losses. The bubble ultimately was driven by an ‘Irrational Exuberance’ driven by speculative fever. Additionally, there was consolidation and growth in home builders which saw already committed projects in the pipeline, before the price decline began, needing to be completed. This saw the GDP contribution of housing grow from around 4% in 1980 to 10% in 2007.

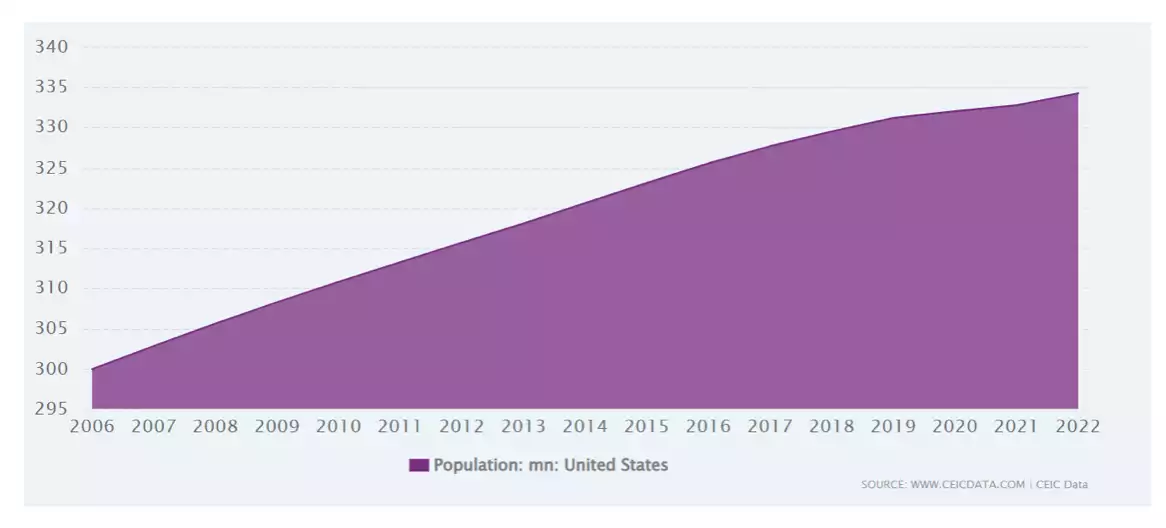

This speculation and overdevelopment saw an oversupply of 3.5 million housing units. With a population of around 300 million, and the average household 2.6 people, the housing requirement was around 115.5 million units, the 3.5 million represented an excess of 3%, which with population growth meant by 2010 this excess stock would have been absorbed (ignoring demand geographics)

It’s no surprise then that the recent U.S. house price growth cycle bottomed just after 2010 and began to grow from 2011.

China Overbuilt in numbers

China does not have the financial system in place that exacerbated the fall in house prices in the U.S. The similarities are the oversupply led by consolidated builders such as Evergrande who’s pipelines (in Evergrande’s case 1200 projects) continued to oversupply the market and the other similarity is the ‘over exuberance’ or over investment which are both far greater than the U.S. saw in the GFC.

The oversupply of housing in China is estimated at 65 million housing units. With a household size of 2.98 and a population of 1410 million people, the oversupply represents an excess of 13.7%. Now also unlike the U.S., the Chinese population is not growing, in fact with the 1 child policy of the 1980s coming home to roost their population is in fact dropping. In order to absorb the oversupply of housing the population needs to grow by nearly 200 million people or household sizes need to shrink to the same size as the U.S. of 2.6. These are pretty extraordinary numbers.

Unsurprisingly this is not an easy fix. Either demographics (household size/population size) need to structurally change or households need to be encouraged to own multiple households (wealth distribution/growth) or foreigners need to be encouraged to invest in Chinese property. The U.S. took 2 years to undo a 3% hole, how long will China take to get out of a 13% hole without the same growth to achieve that? What is clear is the immigration policies of the West that have encouraged rapid population growth with limited housing supply are facing a polar opposite dilemma to China right now, it will be interesting to see how the world equilibrium changes over the next decade.

Balance your wealth in an unbalanced world…