Not so Happily Evergrande After… China on the Brink

News

|

Posted 29/08/2023

|

12436

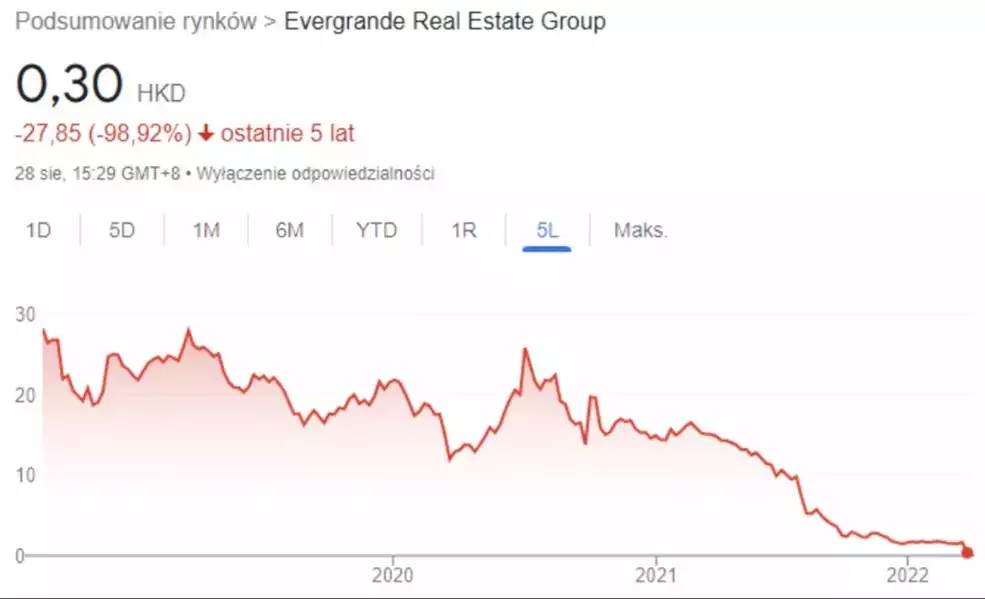

After 17 months in a trading halt – Evergrande opened yesterday on the Hong Kong Stock market, to see its stock fall 90%, but after a previous 95% fall, this now leaves Evergrande at 99% off its previous high of close of 30HKD – now at 0.30HKD. So how did this fairy tale begin and why is the darling of the Chinese property market, now turning into a nightmare for the Chinese economy?

Who is Evergrande?

Evergrande was founded by Xi Jiayin in Guangzhou in 1996, during a period of mass urbanisation in China. Evergrande is the second biggest property developer in China, owning more than 1300 projects across 280 Chinese Cities.

In October 2009 the company raised US$722 million in an initial IPO on the Hong Kong Stock Exchange. During the decade of 2010 Evergrande diversified into farming, healthcare, water, finance and entertainment, with several of these investments more recently being divested in losses.

Due to mounting losses and the inability to sell apartments in order to pay rising debt costs (rising interest rate crisis), Evergrande filed for Chapter 15 bankruptcy, with an estimated US$328 billion in current liabilities which at this point will likely see 0 return.

Chinese Property Market

In 2021 it was estimated China was building around 15 million new homes a year, causing construction and homewares taking up 25% of GDP. With 2nd tier cities seeing 10% plus returns on housing, it was boom times in Chinese property market, but around 2020 this seemed to hit a roadblock, with reported returns dropping to around 6%.

It was during these years, that the likes of Wanda, Evergrande and Country Garden Holdings, the 3 biggest property companies in China started taking huge amounts of debt, with an estimated 1/10 in outstanding loans to non-financial clients worldwide tied to the Chinese Property market in 2021.

So as rates increased, and residential returns dropped, these Chinese Property Companies began to default and attempt to restructure their debts, so far unsuccessfully. Since 2021 40% of the Chinese development market have defaulted on their debts, the most recent Country Garden Holdings, with an estimated $194 billion in debt, missing a $22.5 million payment on the 5th of August.

China Contagion

This last month has seen China begin to enact some emergency measures per the timeline below:

- 15/8 China announces it will stop reporting youth unemployment (over 20%!)

- 15/8 China lowers 1-year interest rate in ‘surprise’ interest cut to 2.5%

- 25/8 China announces eased mortgage rules reducing down payments requirements

- 25/8 China asks mutual funds in the nation to stop net equity sales

- 27/8 the CRC announced it would slow the rate of IPOs

- 28/8 China reduces stamp duty on stock trading by 50%

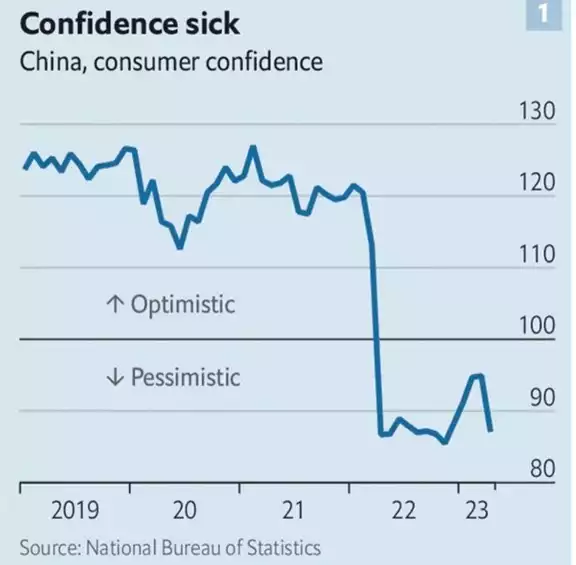

With consumer confidence now dropping to lowest levels ever recorded, it appears these emergency measures are failing. After all these emergency measures, yesterday Chinese mainland stock market opened 5.5% higher only to fizzle back to 1.2% for the day.

So what does China need to do to lift consumer confidence enough to reinflate the Chinese property market, lift the stockmarket (currently sitting at the lowest US market comparison since 2001) and lift consumer confidence? If they can’t do this, will this be the Chinese Lehman moment - Big Trouble in “Evergrande” China | Ainslie Bullion.

What does this mean for the Chinese and world economy

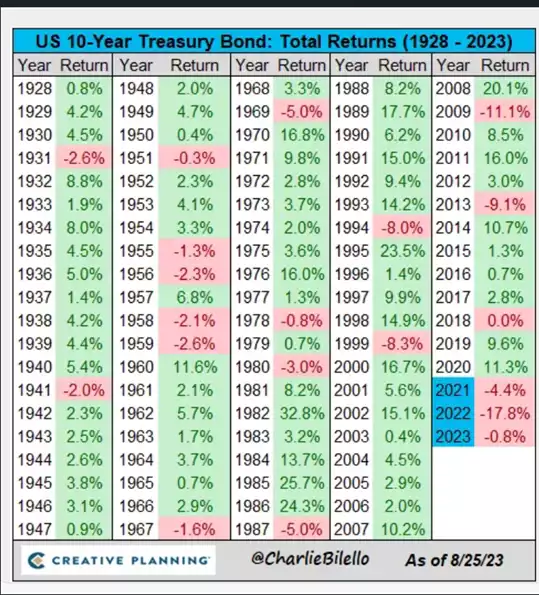

Even though the investment world saw this event coming, the contagion effect of the Evergrande collapse is likely to seep into the world economy, with bonds and junk bonds the likely victim. It’s not just Evergrande sitting on these losses, with current Chinese property bond default estimates of over $1 trillion. As US banks sit on mark-to-market losses in government bonds at similar levels, the world bond market currently looks precarious at best. Current US 10-year Treasury bonds are looking at their 3rd year of negative returns, something never before seen.

Just like in the 2008 GFC, with high interest rates and underpriced debt, investors are likely underpricing bonds (including government) with risk not being fully priced in. If this risk is repriced, this will see bond prices drop even further and interest rate returns lifting higher outside of central bank intervention. If this does happen central banks will in fact be forced to drop rates to accommodate risk premiums. We discussed this last week on Insights and shared the following chart clearly showing the Fed Funds rates sitting above ALL the US bond returns. That is a clear indication of a broken market as bond buyers get no premium for taking on the term risk of those bonds.