China and Russia adding Gold Reserves

News

|

Posted 11/08/2023

|

2153

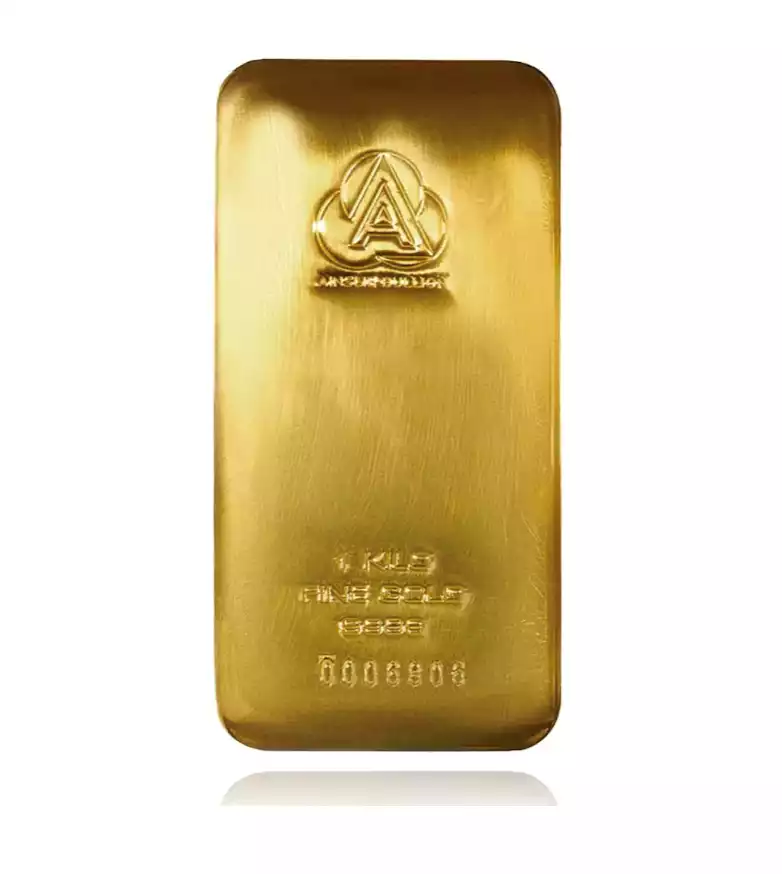

China has added an additional 23 tonnes of gold in July, taking their total official holdings to 2,136 tonnes. July marks the 9th consecutive month of PBOC bullion purchases. Year to date, China has added a whopping 126 tonnes. We often throw around the term “tonne” when talking about Central Bank holdings, but a tonne is made up of 1,000 1kg bars - each one of those 1kg Ainslie Gold Bars will set you back just under AU$96,000. It’s important to note that these are the official published purchases, most commentators expect that the real holdings are dramatically larger.

Russia has also signalled a return to gold purchases and foreign currencies now that the oil price has rebounded. Oil prices that, with natural gas, make up approximately a third of Russia’s foreign income have come up from US$65 a barrel from May to July, back up to $82 a barrel. We spoke to the oil market dynamics earlier this week.

The Finance Ministry has announced 1.8 billion roubles, or US$19.27 million in FX purchases. Gold purchases weren’t specifically declared, but as of the start of 2023, the maximum holding limits in its National Wealth Fund were doubled from 20% to 40% of their entire portfolio. These purchases are the first time since the outbreak of the Ukraine conflict that saw its non-Yuan foreign exchange reserves frozen.

Oil prices moving back up after dropping for all of 2023 so far are cause for concern as those prices get passed on throughout the economy. Bank of England chief economist Huw Pill has warned that the “days of cheap food may be over”. Food inflation is unlikely to abate, Britons will need to get used to paying more for everyday consumables - unfortunately central banks can’t print more oil or food. During a live Q&A session, Pill explained that there would be no wide-spread transformation to save poorer households. Supply contracts, labour shortages and wages (finally) moving up are having the effect of increasing producers' costs, with consumers needing to bear the final burden.

Closer to home, Australian motorists are suffering $2 unleaded petrol prices again as Australian inflation continues unabated. As recently as 2019, international students were told that they would need to have $21,000 of savings to support themselves in Australia (outside of tuition fees). This amount has been updated in 2023 with students being recommended to have an average of $30-34,000 per year. Neither of those numbers sounds particularly realistic, but the price push is as undeniable as it is unsurprising, as any Australian will find when shopping for furniture, servicing their car or buying a “Pint” of beer in every other state of Australia, but incredibly an “Imperial” in South Australia.

With (official) inflation in Australia still pushing 6%, more and more younger and middle aged Australians are coming through our doors in Brisbane and Melbourne to preserve their wealth.