Central banks again a strong source of demand

News

|

Posted 11/07/2024

|

2397

Central banks were big movers in the gold market in 2022 and 2023, snapping up a record 1,082 tonnes in 2022 and another 1,037 tonnes in 2023, which accounted for 29.2% of all mined gold during those years. The World Gold Council (WGC) reports that central banks added another 289.7 tonnes in the first quarter of this year and, although China's recent decision to step back from buying might lower the total for 2024, net purchases are expected to be around 985 tonnes.

Global production slightly up and China may run out before long

The WGC also recently reported mine production figures by country for 2023 and global mine output increased by 0.3% YoY last year. Interestingly, while China remains the world’s largest gold miner, the U.S. Geological Survey reports its gold reserves are well below the largest countries. Australia (12,000t), Russia (11,100t), and South Africa (5,000t) top the list, with China and the United States both estimated to have around 3,000t of below-ground reserves.

At their current pace of extraction, Chinese gold reserves will be exhausted in eight years, unless further discoveries are found. Meanwhile, at current rates of extraction, it will take 34 years for Russia and 40 years for Australia to exhaust their in-ground supply. Being the world’s largest producer, China’s projected exhaustion of gold reserves could have a significant impact on supply side dynamics in future.

An ounce for your thoughts? 2024 WGC Central Bank Survey

It’s not often that we get direct data on a large group of central banks that gives us an idea of their attitude towards their gold reserves, so let’s delve into some of the data gathered by the World Gold Council’s 2024 Central Bank Survey.

We’re going to need a bigger boat

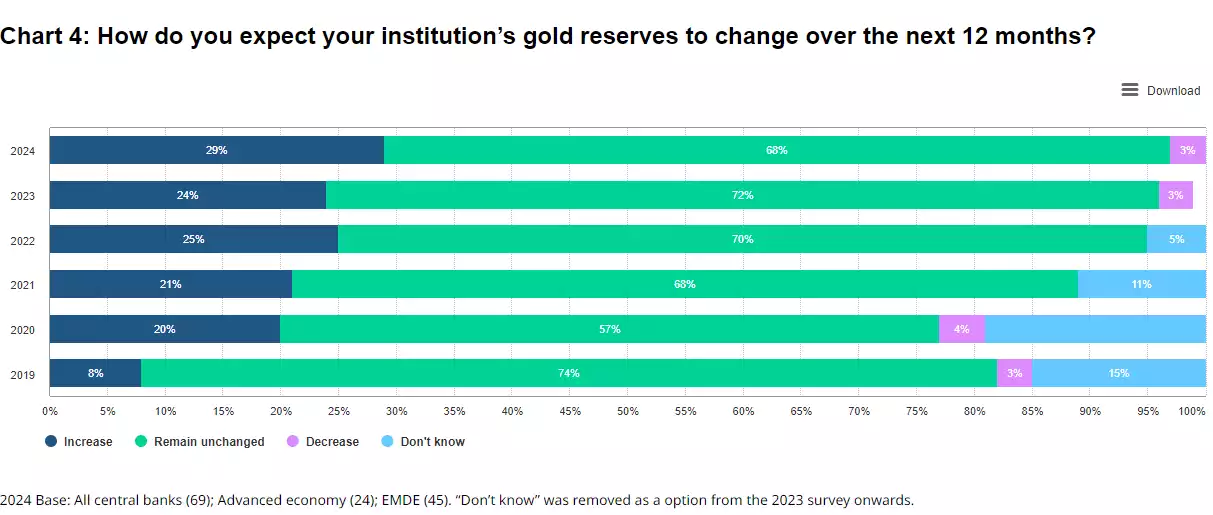

A total of 70 central banks responded to the WGC Survey, which comprised of 24 from advanced economies and 46 from emerging and developing countries. In line with last year, 83% of central banks responding to the survey hold gold in their reserves, with 81% of respondents expecting their gold holdings to increase over the coming year. This represents the highest proportion of respondents since the survey began in 2018, and reflects the higher levels on inflation and geopolitical instability of recent times.

When asked what proportion of total reserves will be denominated in gold in five years, 69% of respondents expected holdings to be higher or significantly higher, while 18% expected holdings to be unchanged, and only 13% of respondents thought that gold holdings would represent a smaller share of reserves.

This information is music to the gold investor’s ears, as it shows that there will likely be increased buying pressure on the gold price from such a significant group of buyers into the medium-term future.

What’s driving reserve management decisions?

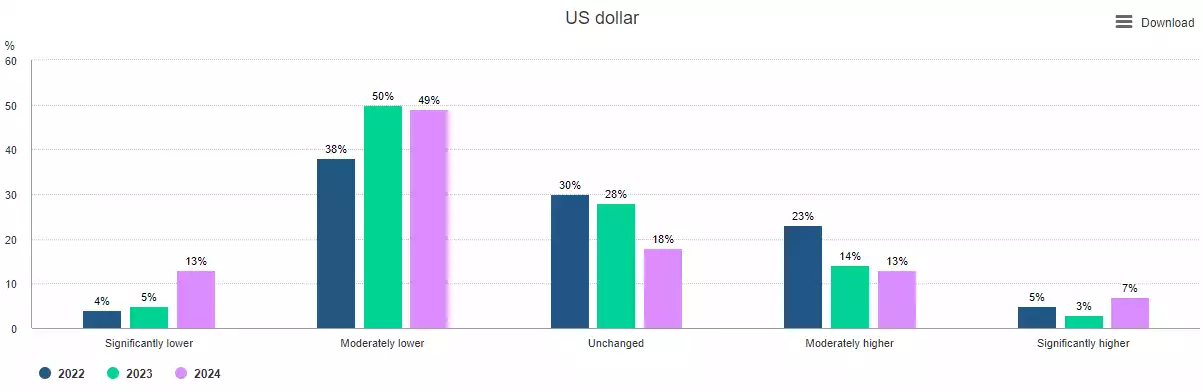

When asked what the most important topics are that determine reserve management decisions, 94% of central banks cited the level of interest rates with inflation concerns (86%), geo-political stability (72%), and ESG issues (45%) cited as other important concerns. While 62% of respondents expected the U.S. dollar to shrink as a share of global reserves, concerns around sanctions and a desire to reduce exposure to the U.S. dollar remain minor drivers, though, this may change given the political uncertainty in the U.S. and in the event of a significant weakening in the relatively strong U.S. dollar.

(Click the image to see the full resolution)

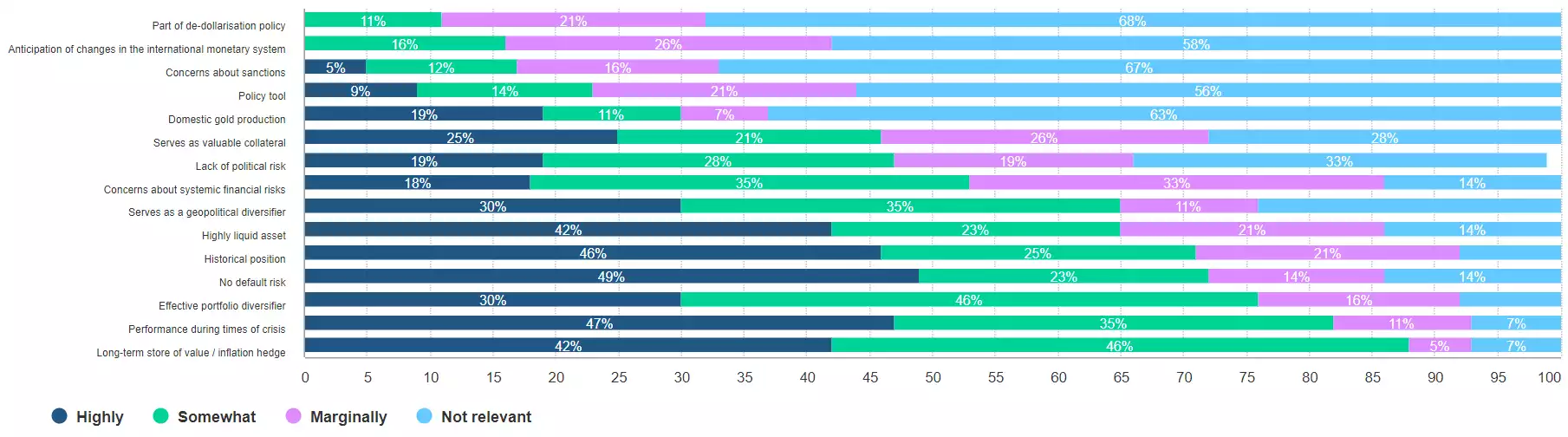

The results of the WGC Survey are clear; central banks view gold as an integral component of their reserve portfolio. The results reinforce the fact that gold is a valuable long-term store of value with the metal offering central banks diversification complementing holdings of debt instruments (such as, T-bills/ bonds) while being largely insulated from political and default risk, with gold a widely accepted form of liquidity and collateral. Many of the features that draw individual investors to gold align to these large institutions. In uncertain times, the value of gold in central bank portfolios look set to rise and this gives us confidence to know that such a larger buyer – 29.2% of all gold mined in 2022 and 2023 – plans to add to their stack.