JOLTs Data Shows US Job Market Starting to Crack

News

|

Posted 30/08/2023

|

1910

In a surprising turn of events, job openings in the United States saw a sharp decline to their lowest level in nearly two and a half years during July. This slump in labour market activity has sparked speculation that the Federal Reserve will opt to maintain interest rates at their current levels next month and not hike, adding to the ‘dovish’ feel ex Jackson Hole.

The latest Job Openings and Labor Turnover Survey (JOLTS) report, released by the Labor Department, unveiled the sobering reality of diminishing job openings. This is coupled with a notable decrease in the number of individuals voluntarily leaving their jobs, a trend reminiscent of early 2021—a clear indication that faith in the labour market is wavering.

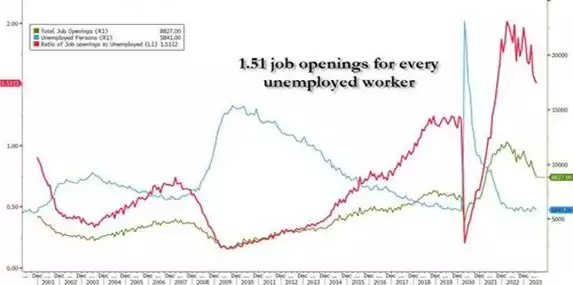

Still, labour market conditions have yet to completely fully loosen their grip, maintaining a ratio of 1.51 job openings for each unemployed individual in July, albeit down from June's 1.54. Although this is the lowest ratio since September 2021, it continues to surpass the 1.0-1.2 range deemed consistent with controlled inflation and historically low lay-off rates.

Conrad DeQuadros, Senior Economic Advisor at Brean Capital in New York, observed, "The labour market is undergoing a shift in dynamics. Firms are scaling back on vacancies rather than resorting to layoffs, signalling a balancing act that is not driving up unemployment."

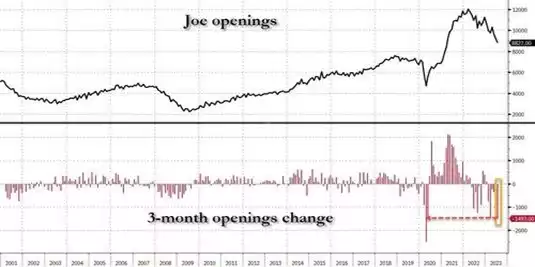

The JOLTS report disclosed that job openings, a pivotal gauge of labour demand, plunged by 338,000 to 8.8 million in July—the lowest tally since March 2021. Notably, economists polled by Reuters had anticipated a far milder decline to 9.5 million job openings.

The faltering job availability was most pronounced in the professional and business services sector, which saw a drop of 198,000 openings. The healthcare and social assistance field was also affected, with 130,000 fewer vacancies, alongside a 67,000 decline in state and local government job openings, excluding education.

The job openings rate overall deteriorated to 5.3 percent, its lowest level since February 2021, down from June's 5.5 percent.

This decline in job availability is expected to be reflected in sluggish job growth during August, as economists foresee a moderation in the increase of non-farm payrolls, following July's second-smallest gain since December 2020.

Addressing the situation, Jerome Powell, Chairman of the Federal Reserve, emphasized a cautious approach, stating, "We will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data."

Considering the evolving landscape, financial markets anticipate the Federal Reserve to maintain its benchmark overnight interest rate in the upcoming policy meeting.

Jeffrey Roach, Chief Economist at LPL Financial in Charlotte, North Carolina, noted, "Reports like this may give the Fed reason to keep rates steady in September."

Despite five interest rate hikes from the Federal Reserve since March 2022, the labour market had shown resilience. This could be attributed in part to employers filling positions that emerged during the COVID-19 pandemic, as well as a reluctance to lay off workers due to labour shortages. July's unemployment rate stood at 3.5 percent, approaching historic lows.

However, this trend may experience a shift in August. The Conference Board's "labour market differential," which gauges respondents' perceptions of job availability, narrowed to 26.2 percent. This is the lowest level since April 2021, down from July's 32.4 percent and indicating a potential increase in the unemployment rate.

Anticipated dampened labour market optimism, coupled with rising petrol prices, could impact consumer confidence in the coming month, potentially erasing the consecutive gains seen in June and July. While the link between confidence and consumer spending isn't robust, many economists are viewing the fading morale as a sign of an economic deceleration.

As the US labour market navigates these intricate shifts, the coming months will be crucial in determining whether the current trends are indicative of a new normal or a transient phase in the country's, and by extension global, economic landscape.