BTFP CRE Commercial Bubble what does it all mean?

News

|

Posted 07/02/2024

|

2008

Going into last Fridays Fed commentary there was an expectation of 6 rate cuts this year, starting in March in the U.S. As Powell poured cold water on this stating in his 60 minutes (yes you heard that correct the Federal Chairman of the US Federal Reserve who is meant to be impartial and not signal the market did a PR interview on 60 minutes in the US) indicating that rates will likely be on hold until at least May to ensure inflation doesn’t take off. This saw regional banks stock collapse – but we thought the banking system was sound?

Timing couldn’t have been worse for Regional Banks

With the domino collapse of several regional banks last year seeing the amalgamation with bigger banks, the Fed introduced the BTFP (Bank Term Funding Program – more on this below) which backstopped banks and stopped the collapses. But with Powells 60 minutes rate signal that there may be fewer and later rate cuts the timing couldn’t be worse for regional banks. Why? The BTFP is due to cease in March 2024, with the backstop removed for regional banks and higher rates than March last year when the Regional Bank Collapse started to occur, mark to market losses are likely to be higher on bond spreads and additional losses on the Commercial Real Estate market which is concentrated in Regional Banks in the US.

This appears to be a perfect storm for Regional Banks, after Powells comments on Sunday night regional bank shares continued to drop on Monday including, NYCB (New York Community Bancorp) dropping 37%, after shock disclosure of an increased loan provision of $552m loss. The drop can be seen in the KRE ETF for Regional Banking – dropping around 12% in the last week, closing on levels seen during the beginning of the March 23 Regional Bank event.

Bank Term Funding Program

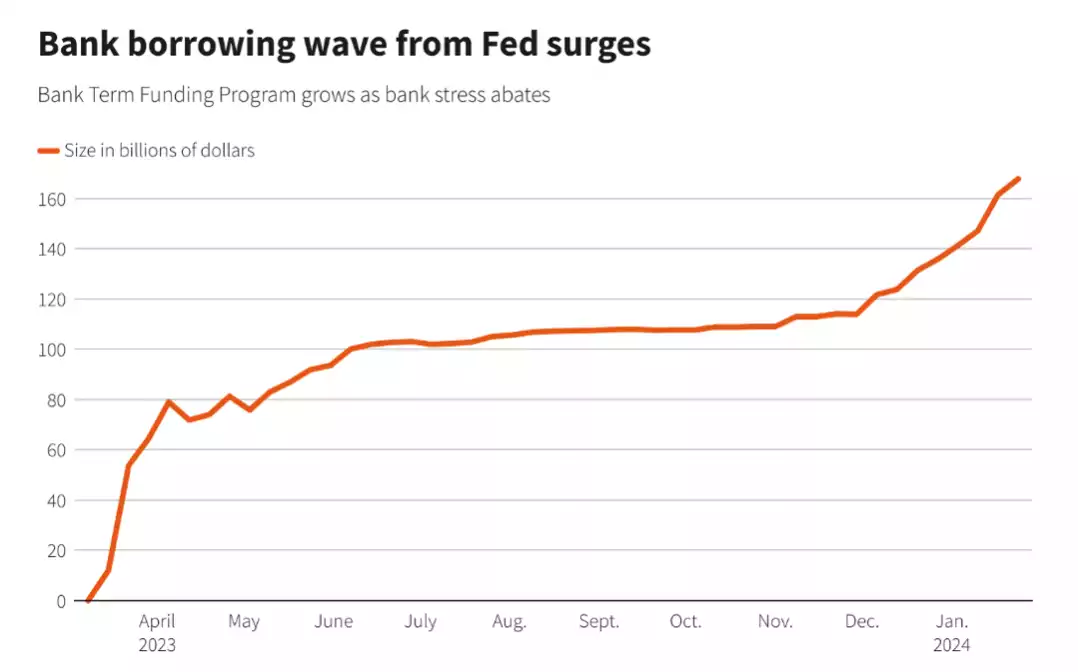

The Bank Term Funding Program was implemented by the Federal Reserve in March 2023 in response to the collapse of several regional banks, including Silicon Valley Bank, the 16th largest bank in the US at the time, and the largest bank collapse since the Global Financial Crisis. The BTFP was designed to backstop regional bank liquidity to give certainty to business and household depositors to ensure liquidity was not drained from struggling banks (another idea would have been to drop or raise interest rates slower to ensure no liquidity shock…. But hey they’re the Fed). The BTFP offers loans for up to 1 year to eligible financial institutions and was used by not only struggling regional banks, but by the bigger institutions and an arbitrage opportunity was created due to the lower rates being charged by the Fed. This saw total loans in the BTFP grow dramatically from the initial March opening, reaching $141 billion by January 24. We wrote about this last week too.

The BTFP will cease in on March 11 2024, coincidentally timed to the previous market expectation of a drop in interest rates – which Powell has now dispelled.

CRE and Regional Banks

So with the BTFP stopping, interest rates 1% higher than the last regional bank crisis and Powell’s 60 minutes comments destroying any hope of a March interest rate drop dramatically lifting bond rates and the US Dollar since last week, the question needs to be asked if enough was done by regional banks over the last year to shore up their capital positions. This we suggest is unlikely as Regional Banks are the largest CRE lenders (Commercial Real Estate) and this bubble appears to have deflated in the meantime. As Powell also disclosed in 60 minutes some smaller banks will ‘have to be closed’ or merged ‘out of existence’ – but why, I thought the US banking system was sound? It was, with the BTFP in place – but this is ending and in the last year a property bubble (not residential this time but Commercial) has collapsed, and the Regional Banks are holding the bag.

CRE – How big is the Bag?

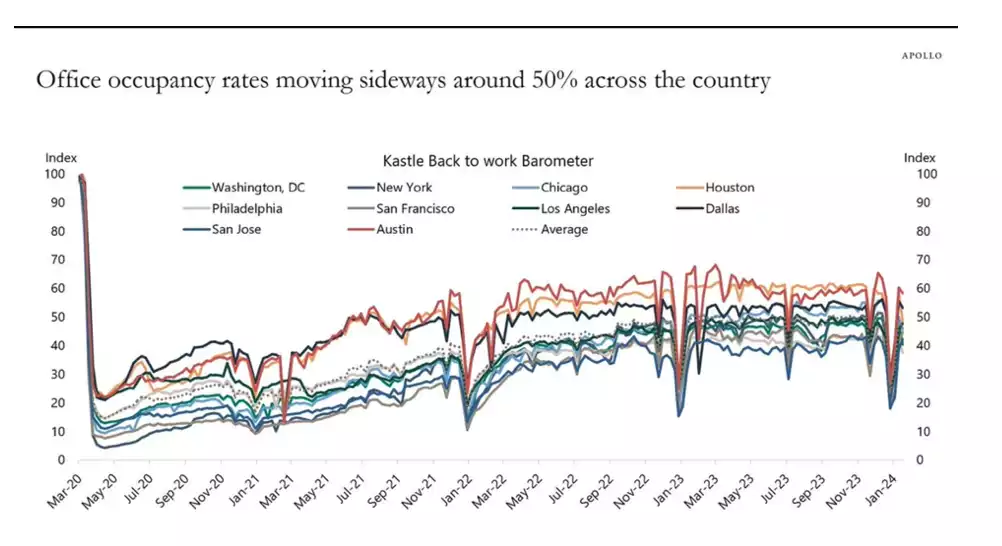

Since Covid there’s been a trend to working at home – this trend has seen office occupancy rates of only around 50%. Due to reduced occupancy the reduced rent has meant lower return, whilst interest rates rise.

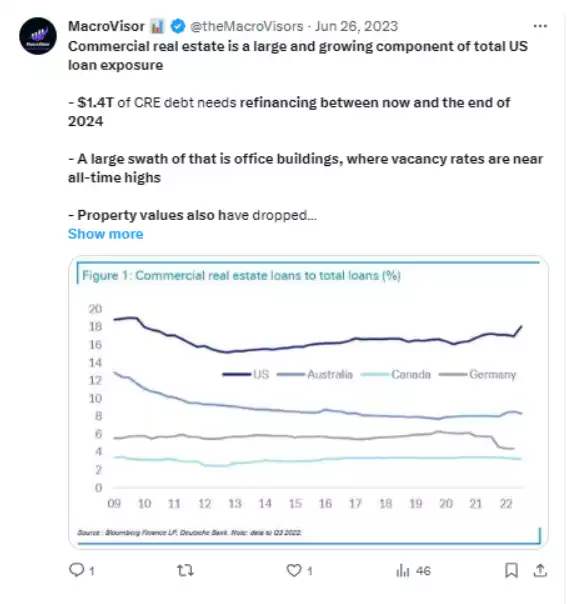

Unlike residential property in the US, where borrowers can fix 30 year mortgages, which has buffered the residential properties, commercial loans usually do not have terms greater than 5 years. In 2024 approximately $1.4 trillion will be needed to be refinanced:

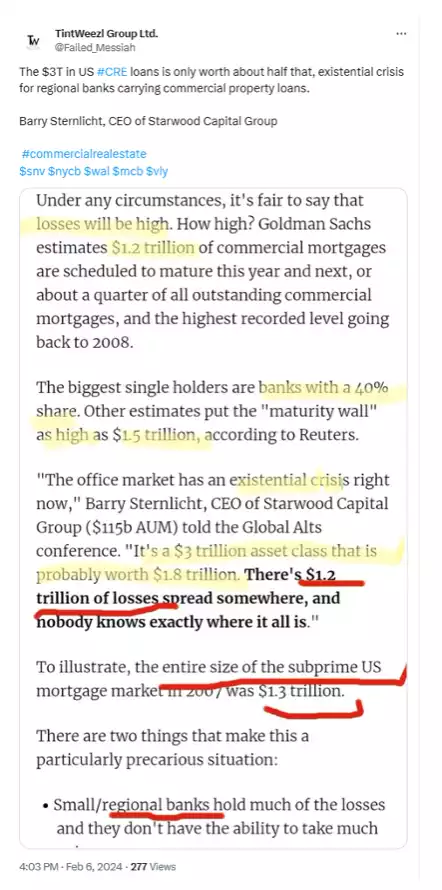

As CEO of Starwood Capital recently stated the Commercial Real Estate Market is a ‘$3 trillion asset class that is probably worth ‘$1.8 trillion’

These losses are therefore somewhere between 30-40% of office real estate values

And in some locations, such as California, with its new onslaught on property taxes for owned properties these losses are over 50%

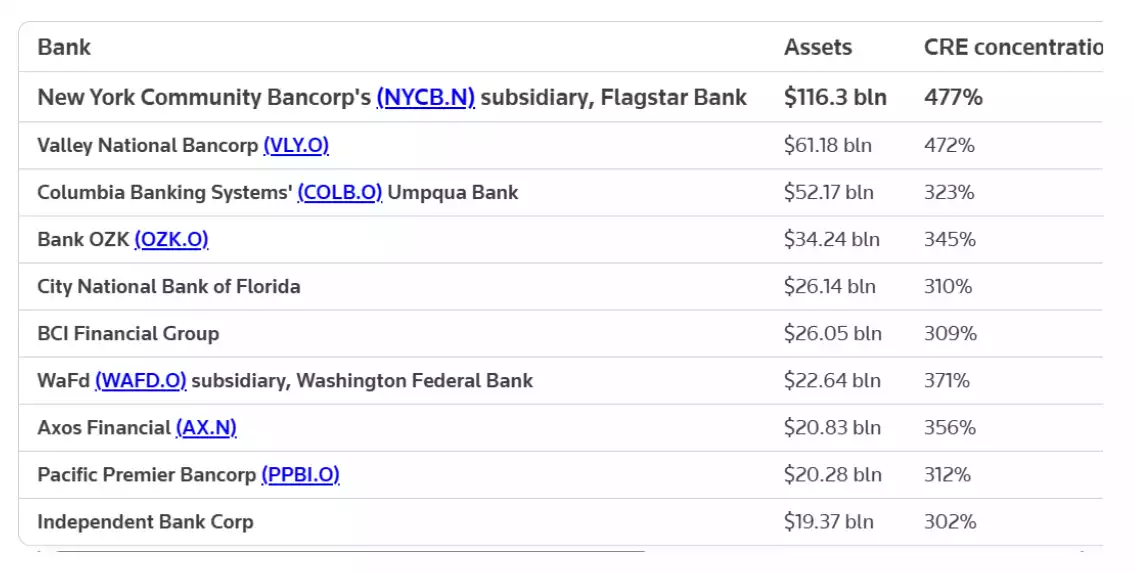

This debt is concentrated to regional banks, but some giants such as Wells Fargo have also been identified. With losses around 40% you can see on the below chart both CRE concentration and the liquidity issue that will arise with 40% asset deflation.

World-wide spillover

Unlike the China real estate bubble, the CRE subprime bubble is not necessarily concentrated to the US, being the reserve currency, many banks overseas are likely to have invested in the CRE market, so there is likely to be spillover. This week in Japan, the Bank of Aozora dropped 20% after disclosure of large losses in the US Commercial Real estate market.

Regional Bank Collapse 2.0

In summary with the BTFP disappearing, interest rates on hold, commercial real estate collapsing and possible international spillover, Powell can only be hoping US banks got their houses in order in the last 12 months. If the CRE bubble bursts, March is the likely month, and this is probably why the market is still not convinced a March cut is off the table, pricing at 20%. So stay tuned for the Fed to 180 again…