The Free Money is Over: Fed Finally Ends BTFP

News

|

Posted 01/02/2024

|

1742

The Fed announced last week that it plans to end its newly implemented Bank Term Funding Program after Banks were found exploiting a financial arbitrage loophole opportunity at the expense of taxpayers.

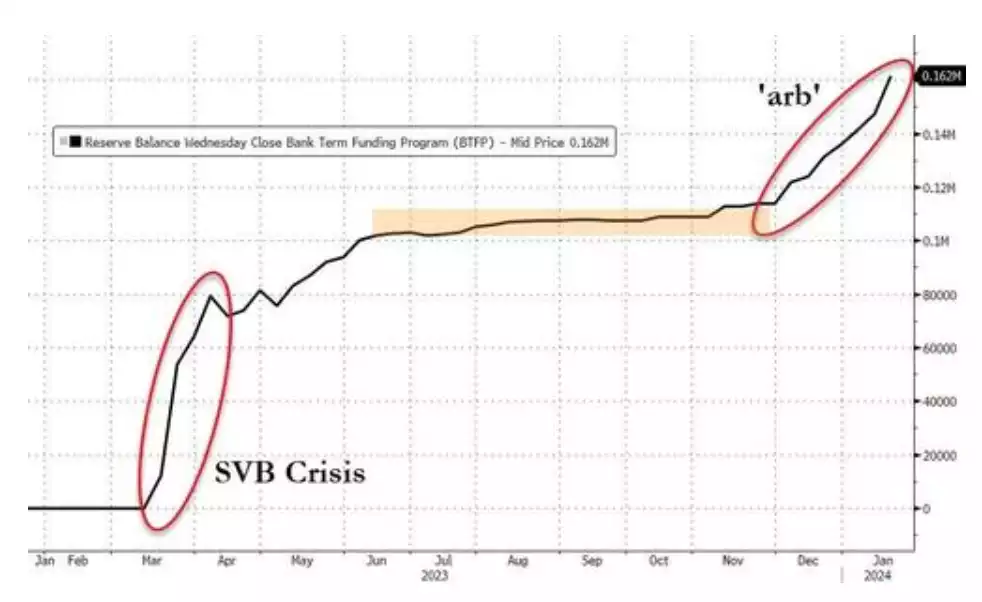

Originally created as a means for struggling banks to have access to capital to pay depositors in the event of a bank run, the BFTP eventually became a money-making scheme for U.S. banks. The program started last March as banks like SVB nearly collapsed as all their bonds were in negative equity territory and the threat of a bank run and contagion loomed large. BTFP was just yet another acronym for printing more money to bail the system out.

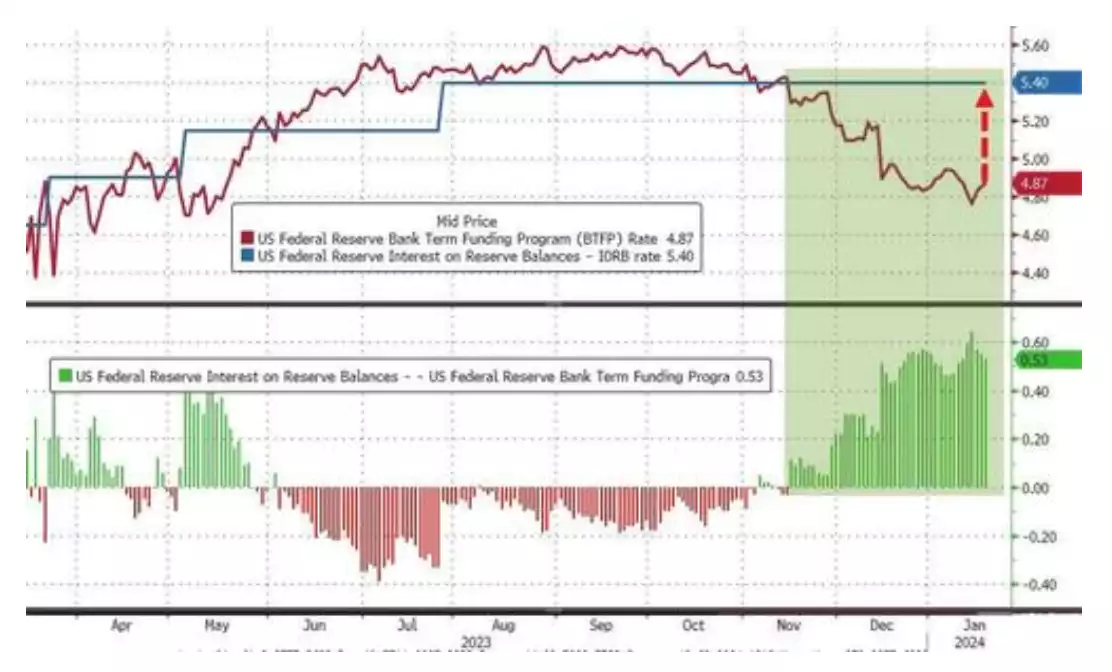

This exploitation began after the Fed's November 1st meeting, where it became clear that interest rates had peaked and the Treasury announced a lower-than-expected refunding plan. This led to expectations of lower rates in the coming year, causing a decline in the one-year overnight index swap rate, which the Fed's Bank Term Funding Program (BTFP) relies on.

This situation created an opportunity for banks to engage in risk-free arbitrage. Banks could deposit collateral with the Fed through the BTFP, receiving cash at par (with a cost of OIS+10bps), and then earn the Fed Funds rate on that cash, effectively making a profit with no risk involved.

At its peak, this arbitrage opportunity amounted to over 60 basis points of free money, funded implicitly by taxpayers for banks, without requiring any meaningful activity on their part. Since December, banks have capitalised on this opportunity, throwing approximately $47.6 billion into this arbitrage.

Originally, we thought this rise in BTFP balances was a display of stress on the banking system, but over time it has become clearer it was merely bankers lining their pockets.

With the program set to expire in March and $162 billion in bailout funds already used, extending the program became challenging for the Fed. This decision was further complicated by the normalising market conditions, making it hard to justify renewing the program.

“In justifying the generous terms of the original program, the Fed cited the ‘unusual and exigent’ market conditions facing the banking industry following last spring’s deposit runs,” Wrightson ICAP economist Lou Crandall wrote in a note to clients.

“It would be difficult to defend a renewal in today’s more normal environment.”

To address this issue, the Fed previously adjusted the terms of the BTFP to eliminate the free-money arbitrage. The interest rate for new BTFP loans would be no lower than the interest rate on reserve balances at the time the loan is made.

Now the Fed has officially announced the cessation of the entire BTFP program on March 11. This decision comes alongside plans to encourage more banks to use the discount window once the BTFP expires.

"The Federal Reserve Board on Wednesday announced that the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11. The program will continue to make loans until that time and is available as an additional source of liquidity for eligible institutions."

Even though the program is being terminated now, $47.6 billion of taxpayer damage cannot be undone. What was meant to stabilise the system, only made it worse. And again, yet another agonising display of Federal Reserve incompetence.

Pointedly too, the life support system for the struggling U.S. banks has been turned off…