Alarm Bells in the CRE Sector for Regional Banks

News

|

Posted 08/02/2024

|

1707

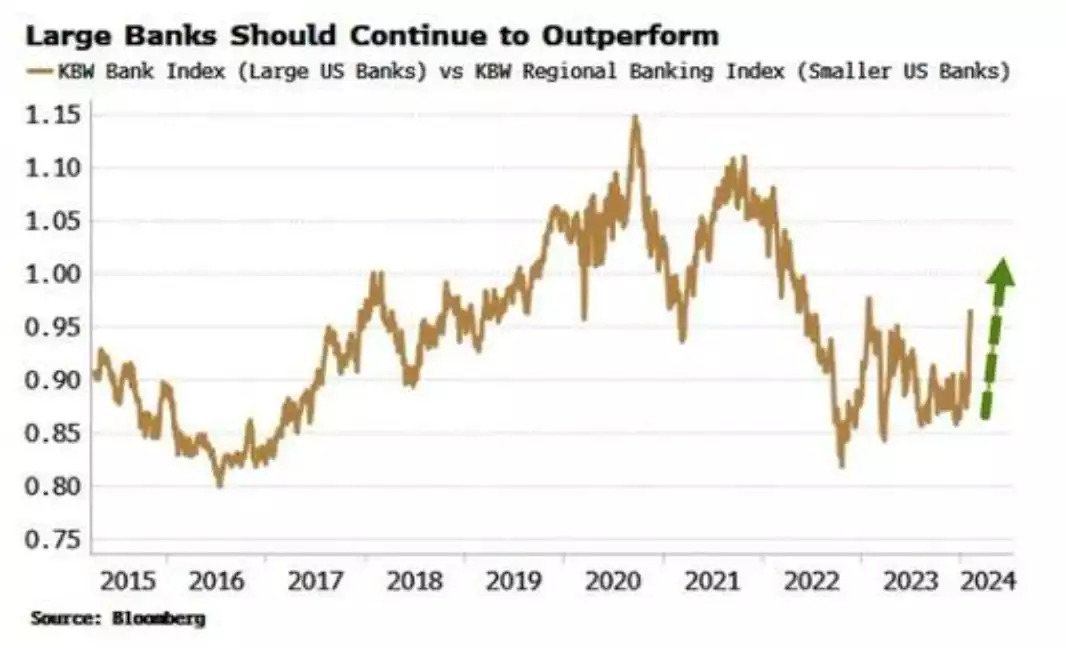

Large banks in the U.S. are set to continue to increase their dominance in the commercial real estate (CRE) sector, but shockingly this is coming at the expense of many smaller regional banks seeing significant financial distress, according to the most recent data performance trends. If you missed our article yesterday it gives you more background to this evolving issue.

According to the International Monetary Fund (IMF), CRE prices have dropped by 11% since the Federal Reserve started raising interest rates in March 2022. This decline is attributed to factors such as higher debt-servicing costs, decreasing property prices, reduced fundraising in private equity, and changes in work and shopping habits.

Smaller banks historically have had more exposure to CRE compared to larger banks, with about 30% of small banks' assets consisting of CRE loans, compared to around 7% for large banks. Additionally, small banks' exposure to CRE has been increasing relative to their overall asset base.

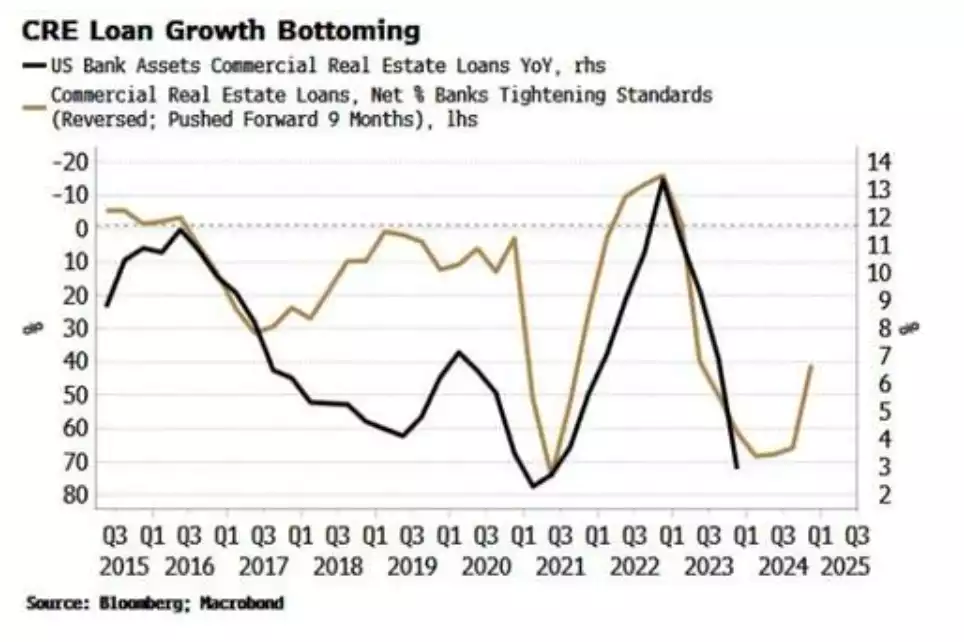

Data from the Federal Reserve's Senior Loan Officer Opinion Survey (SLOOS) suggests that loan standards for CRE are easing, indicating a potential increase in CRE loan growth in the future. Typically, an easing of loan standards precedes a rise in CRE loan growth by about nine months.

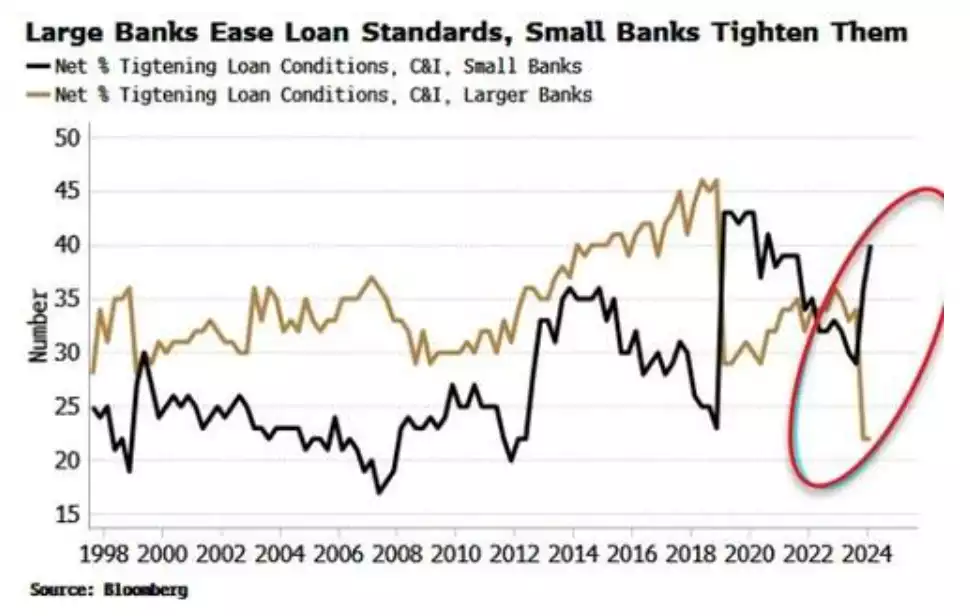

In saying this however, there's been a noticeable gap between large and small banks in terms of loan standards for commercial and industrial (C&I) loans, with large banks relaxing standards while smaller banks tighten them, a strong indicator of regional bank weakness.

Effectively, this implies that larger banks may be the ones loosening lending standards for CRE loans, possibly taking advantage of the distress of small banks and the low valuations in the CRE sector.

This would be yet another example of big banks taking advantage of regional bank financial distress, similar to the arbitrage opportunity we discussed last week here (though nowhere near as profitable).

Jerome Powell during the previous Fed meeting earlier in the week made some alarming comments around the dangers small banks are currently facing within the CRE sector.

“We looked at the larger banks' balance sheets, and it appears to be a manageable problem. There's some smaller and regional banks that have concentrated exposures in these areas that are challenged.”

“I don't think there's much risk of a repeat of 2008. I also think, you know, we need to be careful about making proclamations about the.. future.”

Then he went on to say to some extent he expects a sizable negative outcome from the fallout.

“There will certainly be some banks that have to be closed or merged out of, out of existence because of this. That'll be smaller banks, I suspect, for the most part.”

Overall, the challenges in the CRE sector are likely to favour larger banks, potentially resulting in further consolidation in the banking industry, while smaller banks may face closures or mergers due to losses associated with CRE exposures.