2023 Review & Global Liquidity, Gold and Bitcoin: December 2023 Update – MUST READ

News

|

Posted 22/12/2023

|

4854

Today we bring you our annual Year in Review combined with the latest Monthly Update on Global Liquidity and its impact on Gold and Bitcoin released by our Chief Economist, Chris Tipper. We highlight a few of the key charts he analyses and provide the link to the full presentation which we encourage you to watch. As always, there is a lot of value here for anyone looking to understand specifically how Global Liquidity is driving the Gold and Bitcoin price, combined with actionable trade ideas to take advantage of the opportunity as we look forward into the unfolding landscape for 2024.

This presentation is an ongoing look into the current state of the Global Liquidity picture that is updated each month to keep you informed over the entire cycle as it unfolds. In many ways 2023 was a year that caught many who don’t understand the Global Liquidity Cycle off guard as we didn’t get the widely expected recession, there was no new ‘Lehman moment’, stocks rallied, tech shares boomed and the prices of gold and Bitcoin surged. We have been arguing that this is largely because the Global Liquidity Cycle bottomed in October 2022 and that investors faced a relatively benign “rebound” investment regime that is likely to continue until a peak in late-2025. As always, things never move in a straight line, but we now expect to have the wind behind us for the year ahead and not in front.

The framework provided in the presentation has proven successful for taking optimal advantage of the Global Liquidity Cycle, which is becoming increasingly important. As Chris discusses, Gold and Bitcoin can be considered as “Monetary Inflation Hedges” and could prove to be an absolutely essential component of your portfolio as we move further into a world of exploding debt and the corresponding debasement of fiat currency that is underway.

Some Key Highlights:

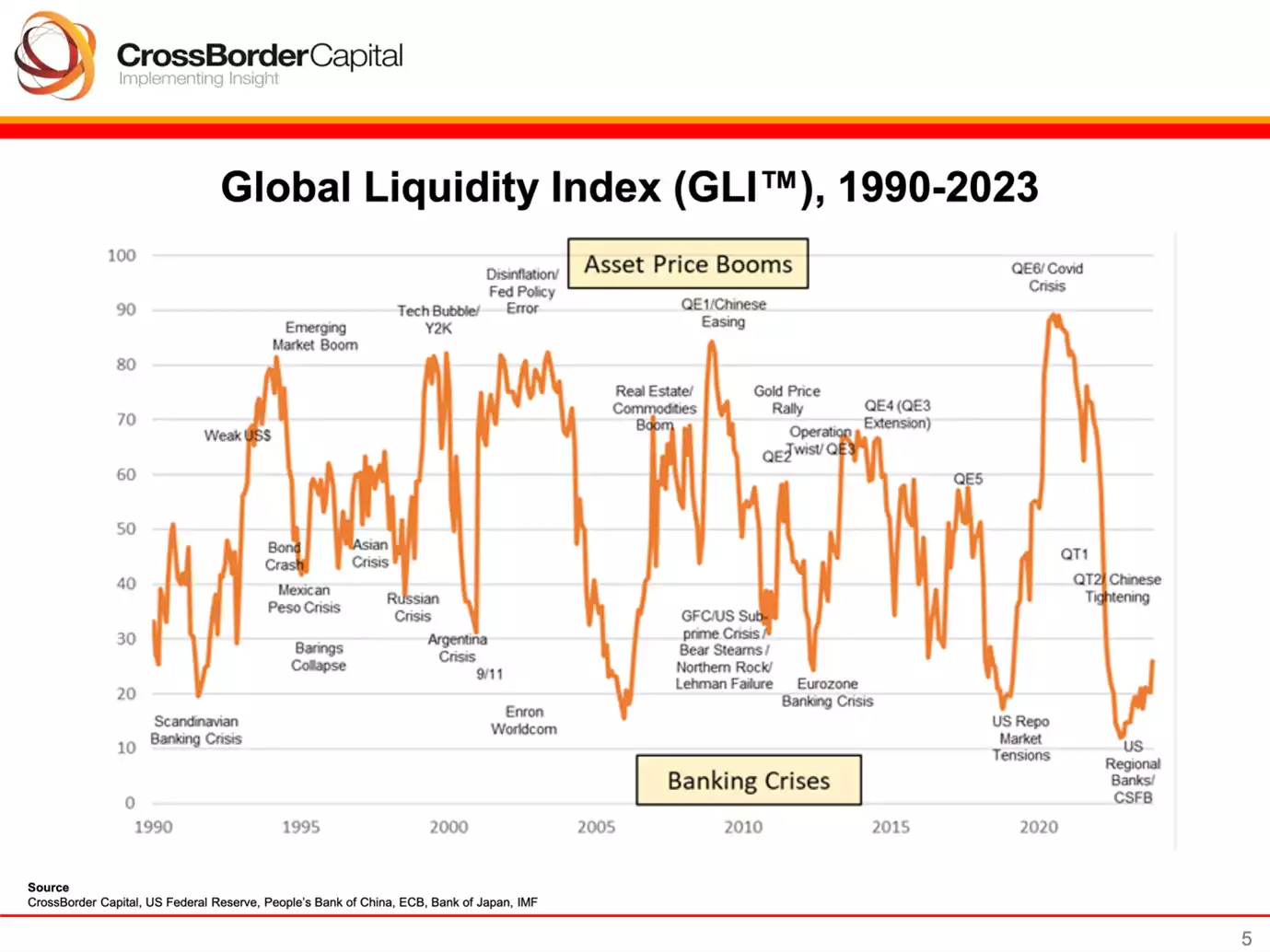

By understanding the Global Liquidity Cycle you can position yourself to take advantage of the predictable “booms” and “busts”

Even though the broader trend for liquidity will always remain increasing over time, there are predictable cycles within the creation of all this new currency that are quite consistent. Governments go through periods of slowing down the production of new liquidity and speeding it up, attempting to smooth out booms and busts in their individual economies. Periods where the liquidity is rapidly reduced create crisis and periods where the liquidity is rapidly expanded create speculative bubbles.

We are currently heading into a new cycle of more Global Liquidity flooding into the system

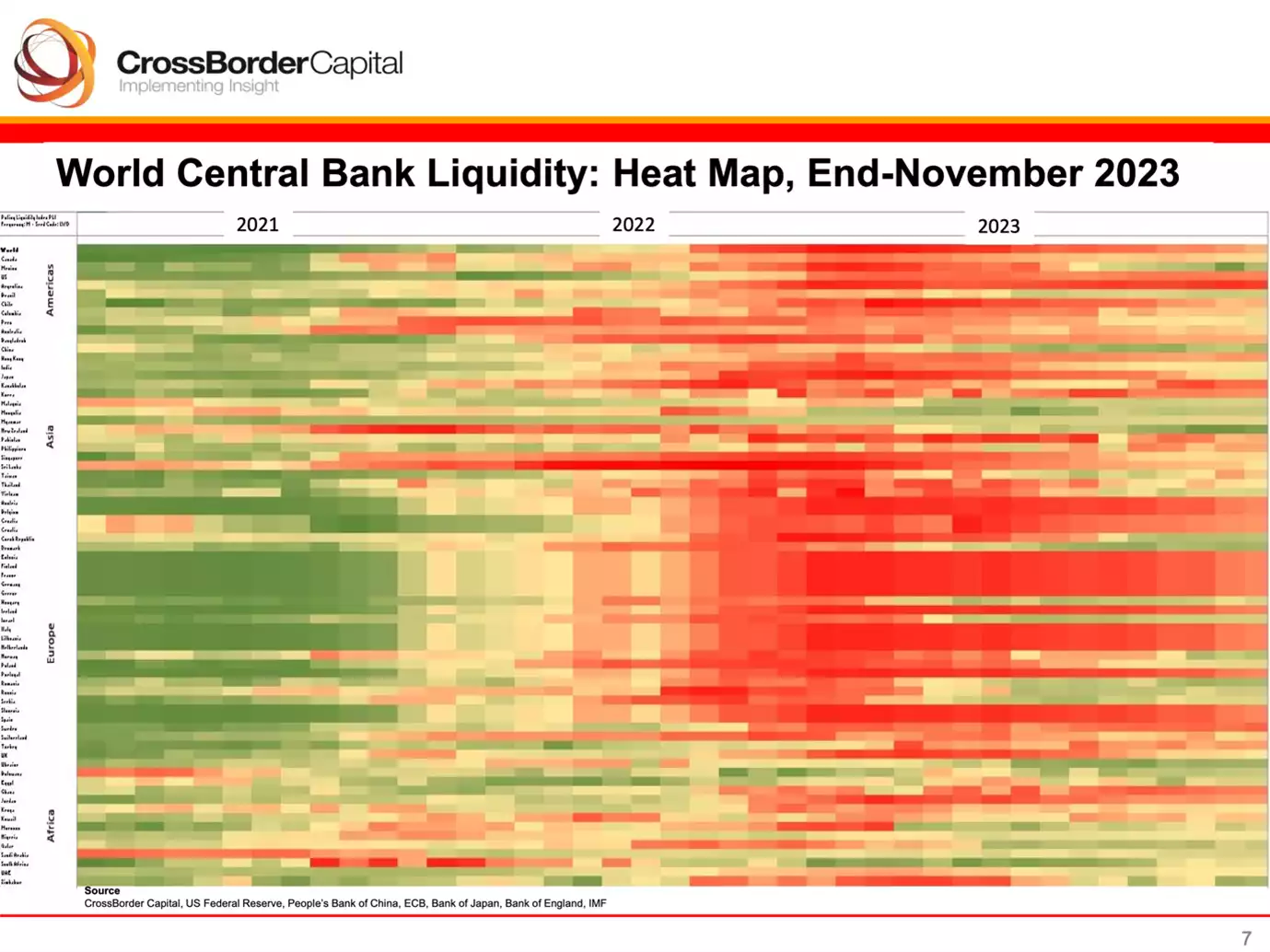

This heat map shows the cycle in motion and what it looks like in reality. The area of green dominance in 2021 shows the period of rapid expansion that was underway on the back of stimulus spending coming out of COVID, while the area of red dominance in 2022 shows the period of rapid contraction as Quantitative Tightening was implemented. We are now progressively moving into a new “green” period of worldwide liquidity expansion.

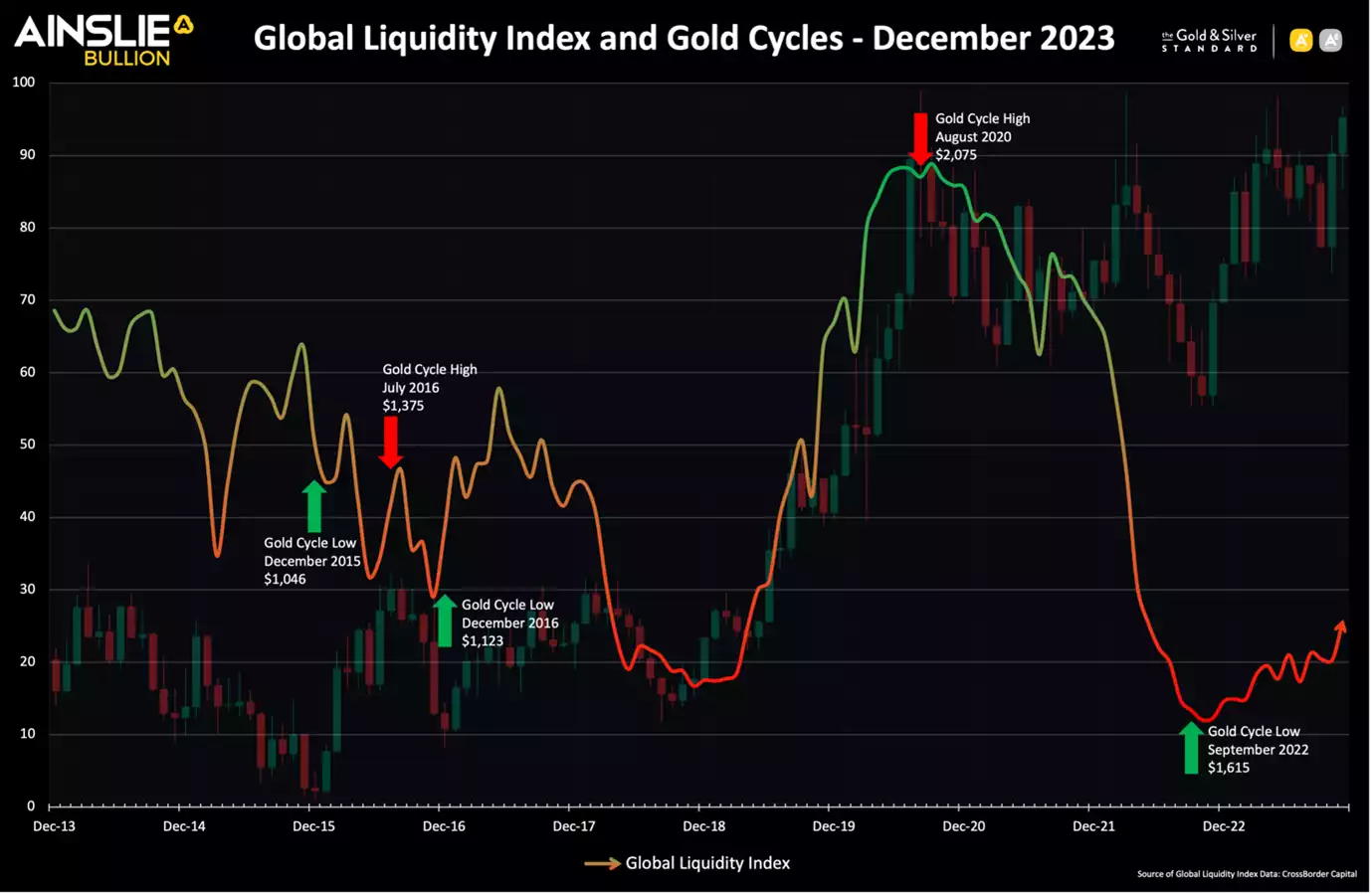

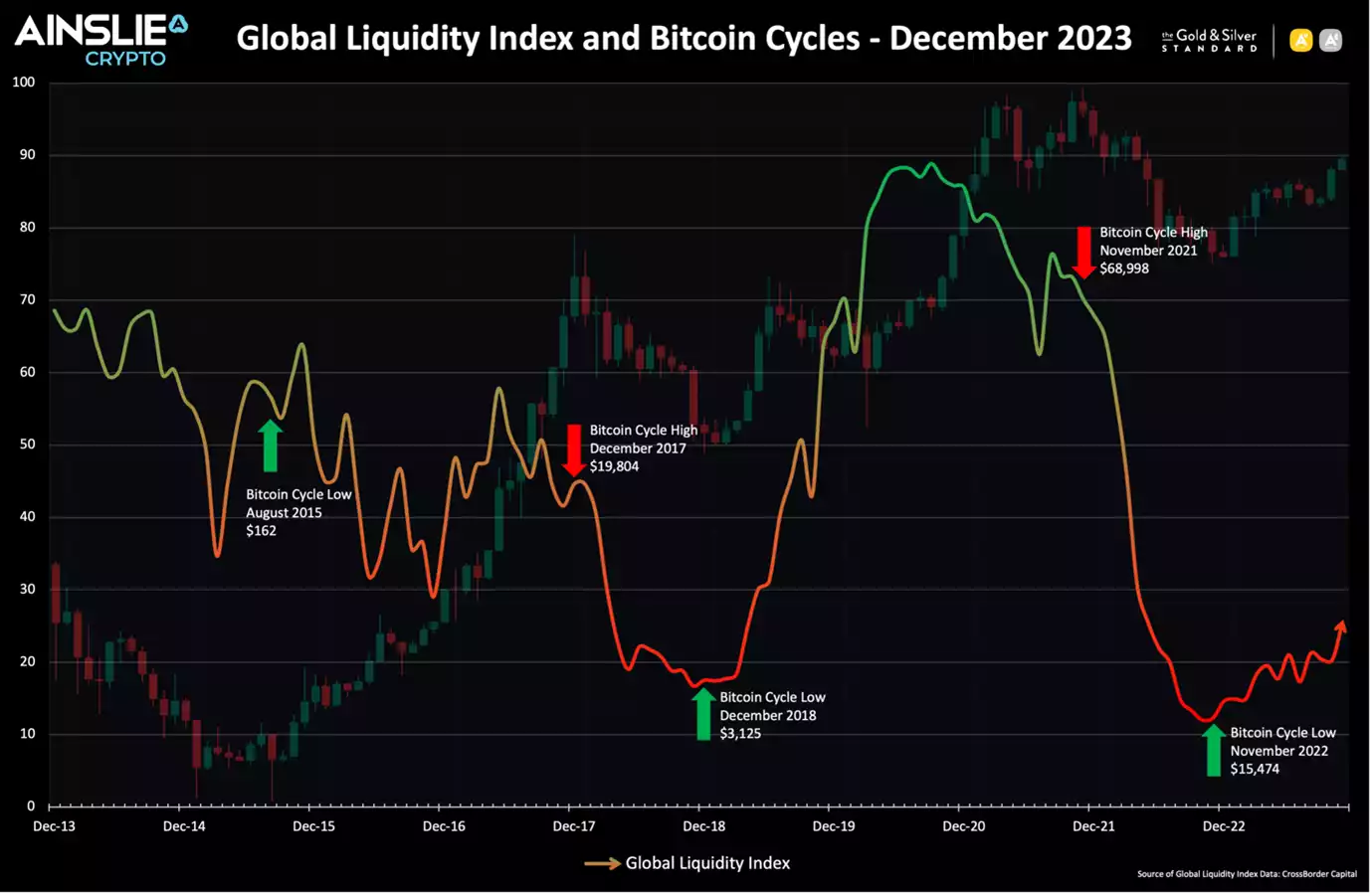

Gold and Bitcoin are the best assets to trade against the Global Liquidity Cycle

Some assets are better than others at more accurately reflecting the Global Liquidity Cycle. Even though most assets go up over time in dollar terms as more total liquidity is added to the system, Gold and Bitcoin act as Monetary Inflation Hedges, which means they are among the best assets to specifically select to trade to take optimal advantage of the cycle. You can see in these charts the longer-term correlation between the price of Gold and Bitcoin (the candle bars in the background) to the overlayed Global Liquidity Cycle Index line. This correlation is increasing in recent years and the cycle is becoming more pronounced and undeniable as global government debt has started to spiral out of control.

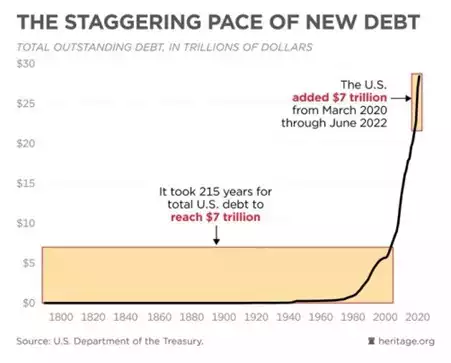

Global debt, highlighted through US Government Debt, continues on its “hockey stick” exponential path, which is making the Global Liquidity Cycle more pronounced but will create significant issues in the future and will be important to watch as we move through 2024

When you look at US Government Debt we are now passed the point of no return where more monetary inflation will come as the interest payments on the debt alone ensure more liquidity must be injected to keep the entire system from collapsing. With no government seriously addressing the underlying issues, and as we head into an election year in the US where the incentives to continue spending are as high as ever, it becomes even more important to pay attention to the role of Monetary Inflation Hedges (specifically Gold and Bitcoin) to have any chance of keeping up with the certainty of further currency debasement ahead.

With the right tools to understand where we are in the cycle, the aim is to not only keep up with monetary inflation, but outpace it with significant profit

January 10, 2023: Buy Bitcoin at $17,179 USD. Current Gain of 148.3% over the past 343 days - as at the open of Tuesday’s candle ($42,661 – 19/12/23), which is 157.8% annualised.

Remember you can buy Bitcoin and most other cryptocurrencies at Ainslie Crypto simply and securely, including AUDD stable coin allowing you to hold AUD outside the ever restrictive banking system. We call it unchaining yourself on-chain! Remember too Gold & Silver Standard has onchain gold (AUS) and silver (AGS) tokens, backed 100% by Ainslie Bullion and also tradeable 24/7 on Australia’s most popular exchange, Coinspot (AUS and AGS).

Watch the full presentation with detailed explanations on our YouTube Channel here: https://youtu.be/SGd88WXpJWY

If we quantify the year that was (as at start 22/12/23), it reflects Chris’s observations well, particularly when you consider ALL the S&P500’s gains were in the Magnificent 7 tech shares and a very large portion of the MSCI World Index too. In other words, value shares globally did very little without the boost of the growth sector enjoying the newly injected liquidity.

ASX200 (Aussie shares) +8%

S&P500 (US shares) +24%

MSCI World Index +20%

BTC (Bitcoin) +164% (read more on 2023 for crypto at Ainslie Crypto)

ETH (Ethereum) +87%

Gold (AUD) +12%

Gold (USD Spot) +12%

Silver (AUD) +2%

Silver (USD Spot) +2%

Platinum (AUD) -11%

Platinum (USD Spot) -11%

As always, the whole team at Ainslie want to thank you for your loyal custom, engagement with our daily content, and the many friendships we’ve developed with so many customers. We take enormous pride in doing things fairly and right, and helping protect the wealth and wellbeing of so many people who are educating themselves and taking action to, as our trademark says, Balance your wealth in an unbalanced world.

Next year is a big year for us (spoiler alert, we turn 50!) in what also promises to be a big year in global finance and markets. Trust will be everything and we have built a reputation of trustworthiness over those 50 years.

Have a wonderful and safe Festive Season and we look forward to seeing you when we return on 2 January. Remember our webshop is open 24/7 throughout the year.