You NEED to understand this – It's ALL about Liquidity

News

|

Posted 27/03/2023

|

12628

Friday night saw more banking dramas amid Euro banks with none other than Deutsche Bank yet again hogging the headlines, down 14% at one point before finishing down 8% in one session. DB also saw its CDS’s surge as investors scrambled into protection (that someone has the other side to don’t forget!). A few weeks ago, before any talk of banking crises, we wrote the possibly prophetic article titled ‘SPLASH’ LANDING – WHY LIQUIDITY IS ALL THAT MATTERS & GREAT FOR GOLD and spoke to it further in the Insights interview that afternoon. In hindsight and as we suggested then, these are critically important concepts to understand as you choose investments to protect and grow your wealth amid the financial chaos hidden from plain view and most people’s understanding.

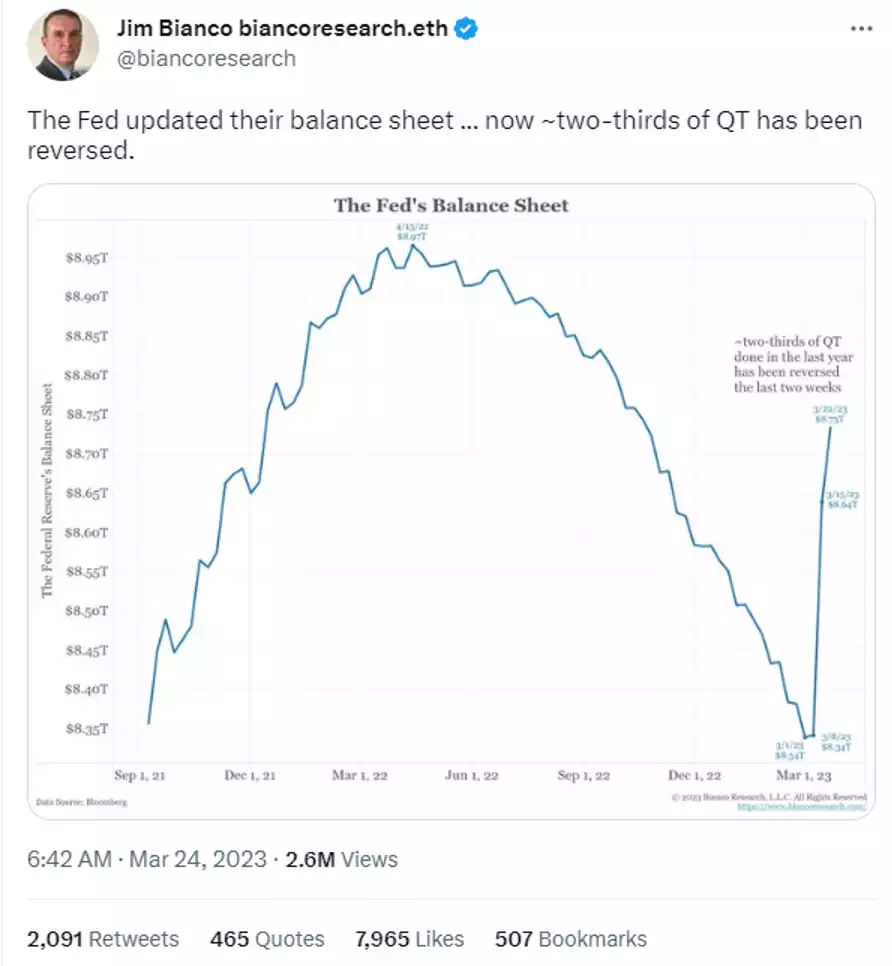

Anyone watching the financial twitter-verse will have seen the following chart that fits well into the above. Amid everyone’s fixation on whether the Fed will or will not raise rates and stop Quantitative Tightening (QT), this happened since SVB was bailed out…

And so debate rages over whether that was QE or not. Frankly it doesn’t matter. What it signifies very very clearly, is the Fed has turned on the liquidity spigots to stabilise the banking situation. Whether its traditional QE (printing money to buy bonds) or, as appears to be the case here where they are ‘lending’ newly created money to banks with their (underwater) bonds provided as collateral (so as not to trigger the mark to market losses should they actually sell them); the end result is a whole lot of new money pouring into the system to buy financial assets given banks can’t give you any interest because the yield curve is inverted. That is not to mention how safe you feel with your cash in one at the moment too… Can kicked down the road again… Nothing to see here….

We referred to Cross Border Capital’s Michael Howell in the abovementioned Ainslie article. He spoke insightfully to all this recently as follows:

“When banks lose deposits it results in a tightening of liquidity conditions. Using the US as the example, the research based assumption has been that the minimum operating level of bank reserves was in the order of $2.5 trillion. Bank reserves have been sitting very close to that minimum number for quite a while now. The events of the past couple of weeks have shown that the level before things break is now likely closer to $3 trillion (which also makes sense that this number rises over time as global debt has also risen over time).

The problem is that once you get a crisis the demand for reserves goes up so in actual fact that $3t number is currently rising and the level of reserves required in the system now is probably closer to $3.5 trillion. So what we’re looking at here is potentially a a significant increase in the size of the FED balance sheet to plug the hole.

We can argue all day whether it is technically QE or not, but whichever way you look at it it's a liquidity easing because the Federal Reserve has no other choice than to backstop the system (which so far they have done very quickly and effectively the moment any real stress is identified).

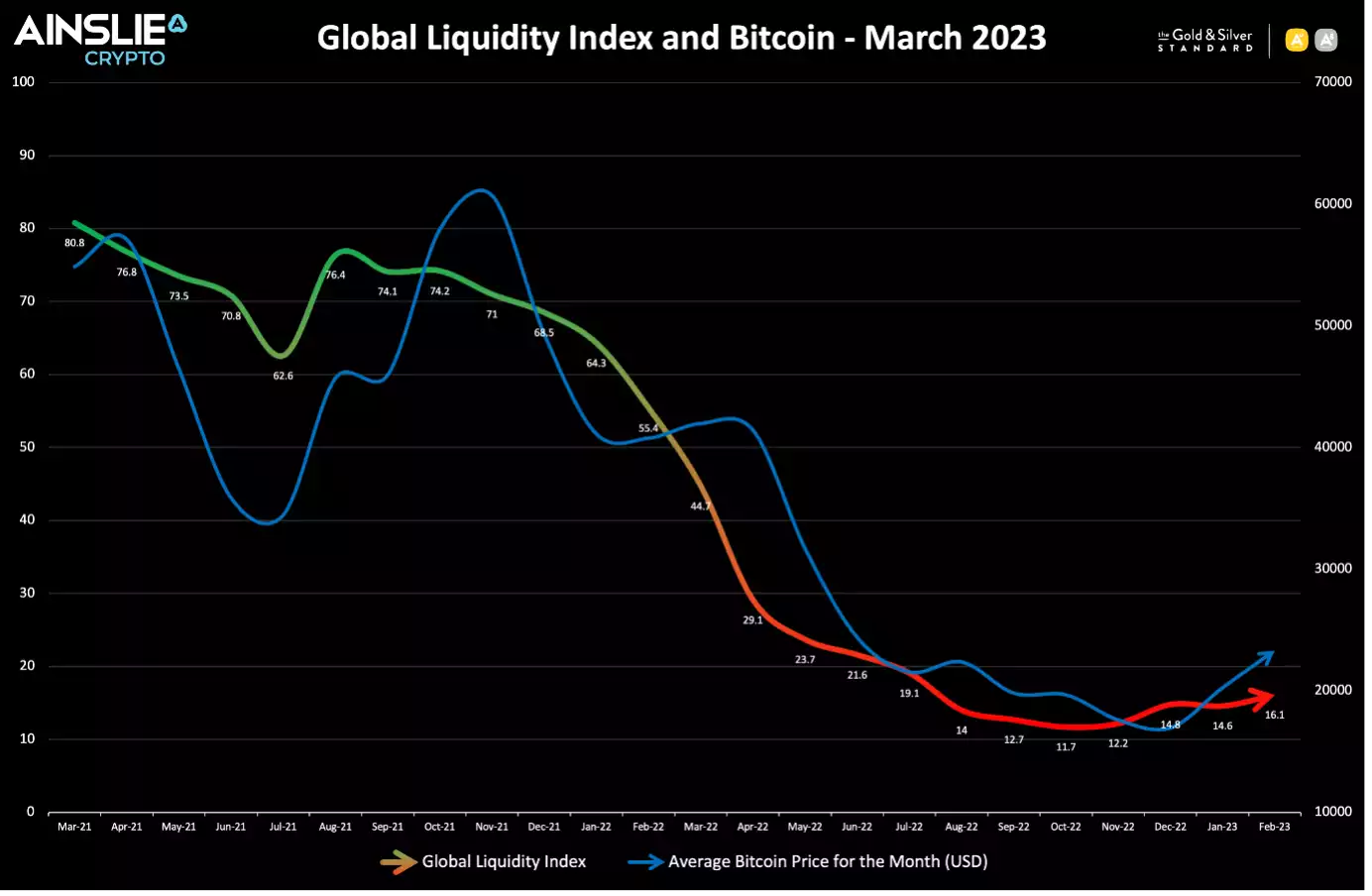

This ultimately results in monetary inflation and the best instrument that hedges against monetary inflation is gold because gold has been long-standing as a monetary inflation hedge. There is a subtle but very important distinction between a monetary inflation hedge and a High Street inflation hedge and gold is not always a great High Street inflation hedge but it's always been a very good monetary inflation hedge. The new version of a monetary inflation hedge is Bitcoin. Gold and Bitcoin are likely to be pretty decent measures of liquidity (they have a very high correlation to liquidity movements and act as a “barometer” of liquidity) so if liquidity goes up you could expect a significant step move higher in Gold and BTC.”

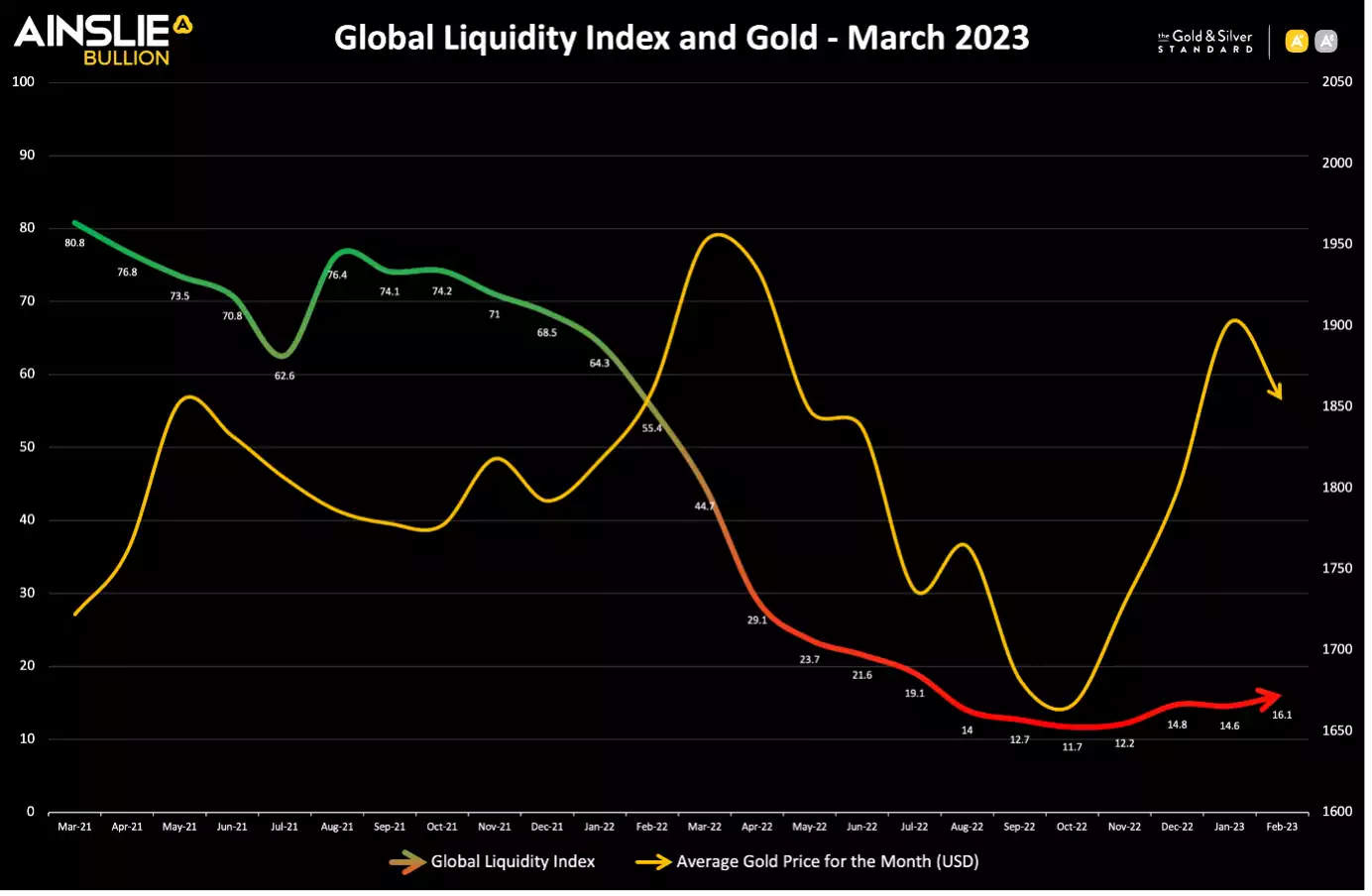

The following charts spell this out very clearly (albeit the gold one hasn’t captured the rally on Friday back up to near $2,000):

You will see above that gold broke that correlation for a while in early 2022 as its other role, that of safe haven asset, was bid during the Ukraine invasion. That invasion never escalated to the point the market feared (yet) and it revisited its trend down in line with liquidity.

As he said too, BTC follows it more closely than any other asset and it never got the Ukraine bid:

The correlation, regardless, is undeniable. The logic behind it, likewise, undeniable. As more and more ‘money’ is created and injected into the system, the more real money (unable to be simply printed or created) is the logical home for it.

The global liquidity cycle is exactly that, a cycle. It somewhat predictably has 3.5 years up, 3.5 years down. Howell says it bottomed last October. Gold and bitcoin agree. If history repeats, as it has done for decades, then we have a 3 year bull market ahead of us.