What will back a new global payments system?

News

|

Posted 27/01/2023

|

11354

Oil, Gold, Bitcoin? What’s going to back a new global payments system? One thing seems certain, there are clear movements away from the dollar hegemon, but what’s coming next? More or less everyone is trying to figure out what the world will look like over the next ten years. While we have no crystal ball, there are certainly a lot of suitors, for the status of the world’s global reserve currency.

Developing a new global currency as a basket of various government issued fiat currencies is likely to lead to in-fighting. Who would decide if the basket is backed with, for example, 32% Russian ruble, or 10% Iranian Rial? After the last five decades of a pure fiat floating system of payments underpinned by the US Dollar, the appetite would be low for nations to jump from the frying pan into the fire.

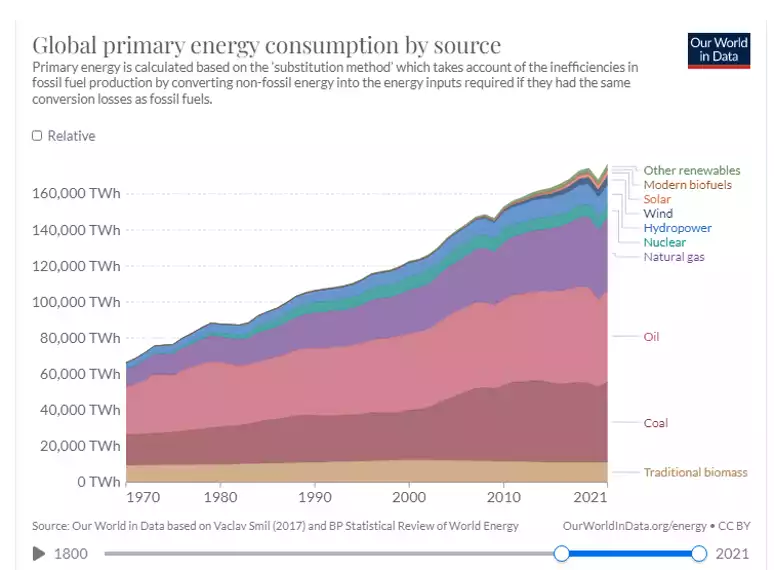

In a similar move, China is pushing for the Yuan to replace the dollar in the oil trade, setting the stage for a “PetroYuan”. Backing international settlements with oil again remains a distinct possibility. Oil is a key part of the global energy mix, however coal, natural gas and other commodities may also be considered. In 1971, Oil made up 40% of the global energy mix, in 2021 it sat at just under 30%. Coal now represents 25%, natural gas 22%, and with the 2011 Fukushima melt-down well and truly in the rear-view mirror, we may well see nuclear reemerge as a major source of energy from it’s current 4%. Details aside, the point is that globally, the dominant energy sources are guaranteed to ebb and flow.

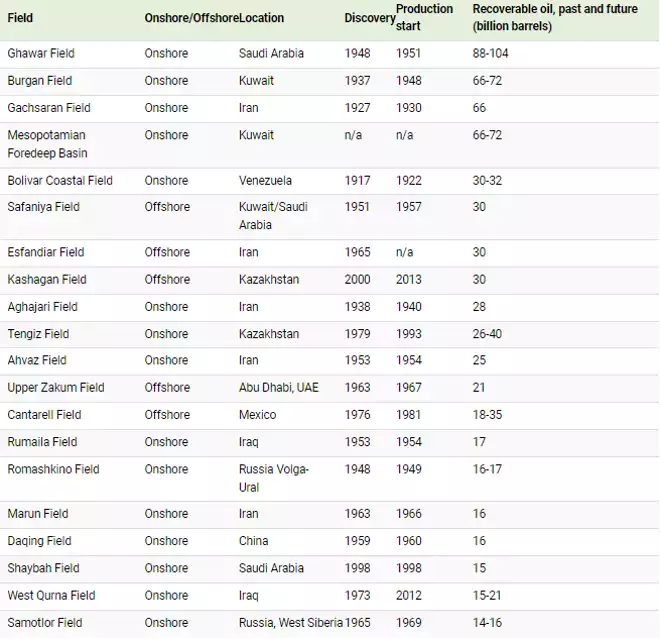

Similarly, the last major oil discovery was way back in the year 2000. A list of the top 20 oil field discoveries are dominated by strikes more than 70 years ago. We saw oil go negative in in April of 2020, before ripping up to over $100 USD per barrel in mid 2022. With fewer large discoveries, the chances of wild price swings in the future for oil remain a major challenge.

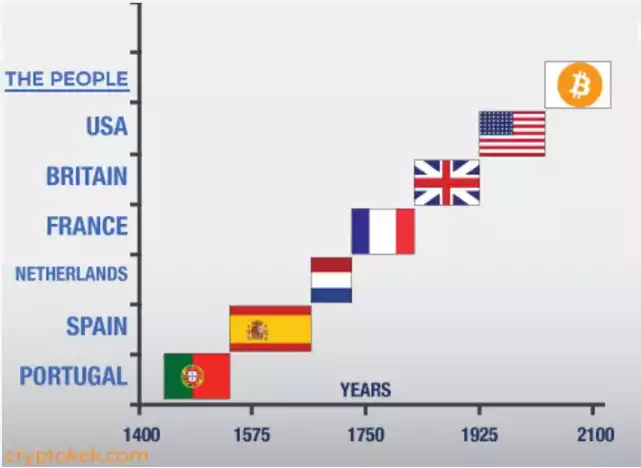

There are lots of reasons why Bitcoin would make a great trade settlement currency and global reserve. It has a limited supply, it is decentralised and nation states can, and do, mine the digital asset. Argentina and Paraguay have used BTC in place of the USD to settle a number of export trades. Venezuela, though not necessarily a success story, are using Bitcoin for both domestic and international trade. Unlike gold, a cross-border transfer is completed with finality and there is no need to audit all of the bars that have been shipped across the seas to fill the order.

While there are some smaller nations adopting Bitcoin as one of their major national currencies, it is also possible for sovereigns to accumulate the token in secret, as the distributed ledger is transparent, but the holders of the wallet addresses are opaque. Bitcoin’s key issue is it is volatile, a 70% VAR asset compared to gold at around 15%.

However it is still in its relative infancy, finding its fair value as adoption and trust/understanding expands, and may eventually find a relatively stable pricing profile like gold.

We covered the Russian and Iranian gold backed token in last Friday’s news. While the devil is in the detail, it does present gold as the one of the main contenders for the new heavy-weight currency of the world.

It is by default the international trade standard, due to its durability, rarity and the relative ease of melting down and recasting from one super-power’s branding or denomination to another when they change hands. As we have often mentioned here at Ainslie’s Daily News, Central Banks and the sovereign nations they, notionally, represent, are buying gold at rates not since the 1960s.

So, the return of gold as the world reserve, or at least a part of the mix, looks very likely. In any case, whatever system is currently prevailing, precious metals maintain purchasing power over long periods of time. Always have, always will.

While we don’t know what the future monetary reality looks like, it pays to balance your wealth in an unbalanced world.