The USD de-dollarisation & Hunt for the new trade system

News

|

Posted 16/01/2023

|

11119

The trend of De-dollarization is growing traction as the hunt for new trading settlement systems continue. Russia and China now conduct more than 50% of trade in Yuan, bypassing International Trade Sanctions, thereby increasing China’s ability to arbitrage the energy market at the same time as improving trade terms for Russia in export pricing.

USD Weaponisation and the De-dollarisation Acceleration

In having the world Reserve Currency the US is able to hurt other countries who do not fall into line with US policy.

The drive to de-dollarisation has been accelerated in 2022 due to the sanctions and exclusions to the SWIFT system imposed on Russia, described by President Macron as a ‘financial nuclear weapon’. This left Russian banks estranged from a system they required for trade and meant the hunt was on for alternatives. Since then China and Russian trade in Ruble-Yuan now accounts for about 50% of Russian trade (previously it was nearly all USD).

By using this policy to sanction Russia, other countries saw the aggressive move as the ability of the US to try to bring other nations in line with US World policy. What would this mean for say Australia with China as a major trading party if the US decided to do the same to China?

2022 USD HEX

The Headline of inflation in 2022 is not new news, and one of its root causes that we have written about is USD strength – the US exporting inflation to the world. The exacerbated pain to all non-US countries this has caused has led to an acceleration in the hunt for new trading alternatives. At the recent Regional Outlook Forum in Asia on January 10th, George Yeo former foreign minister to Singapore stated “The USD is a hex on all of us”. He continued this further stating “I have believed for a very long time that reserve currency diversification is absolutely critical”.

So as Asia is searching for diversification and de-dollarisation, BRICS nations continue to advance their cause and several recent examples have seen them move away from USD trade.

Dedolllarisaition Acceleration

In recent months some of the actions of the BRICS countries to de-dollarise are becoming very clear. In December 2022 India and Russia agreed to drop all use of the USD and Euro in bilateral settlements and concluded their first transaction in Ruble-Rupee transaction via a Vostro account. Smaller nations including Bangladesh and Kazakhstan are stepping up negotiations with China for use of the Yuan as their trading currency and corporates around the world are selling USD portions of their debt concerned with continued losses due to USD strength in 2022.

US will not go down without a fight

The competitive advantage the US has means they will not give it up without a fight – so expect volatility in the next couple of years as the fight for international dominance continues. In the last 2 weeks in response to Egypt joining the BRICS de-dollarisation effort, the US has responded by announcing a $426 million contract to Boeing to produce 12 CH-47F helicopters to the Egyptian Airforce – not a huge coincidence it would seem…

USD use for trade and preceding stock market crashes

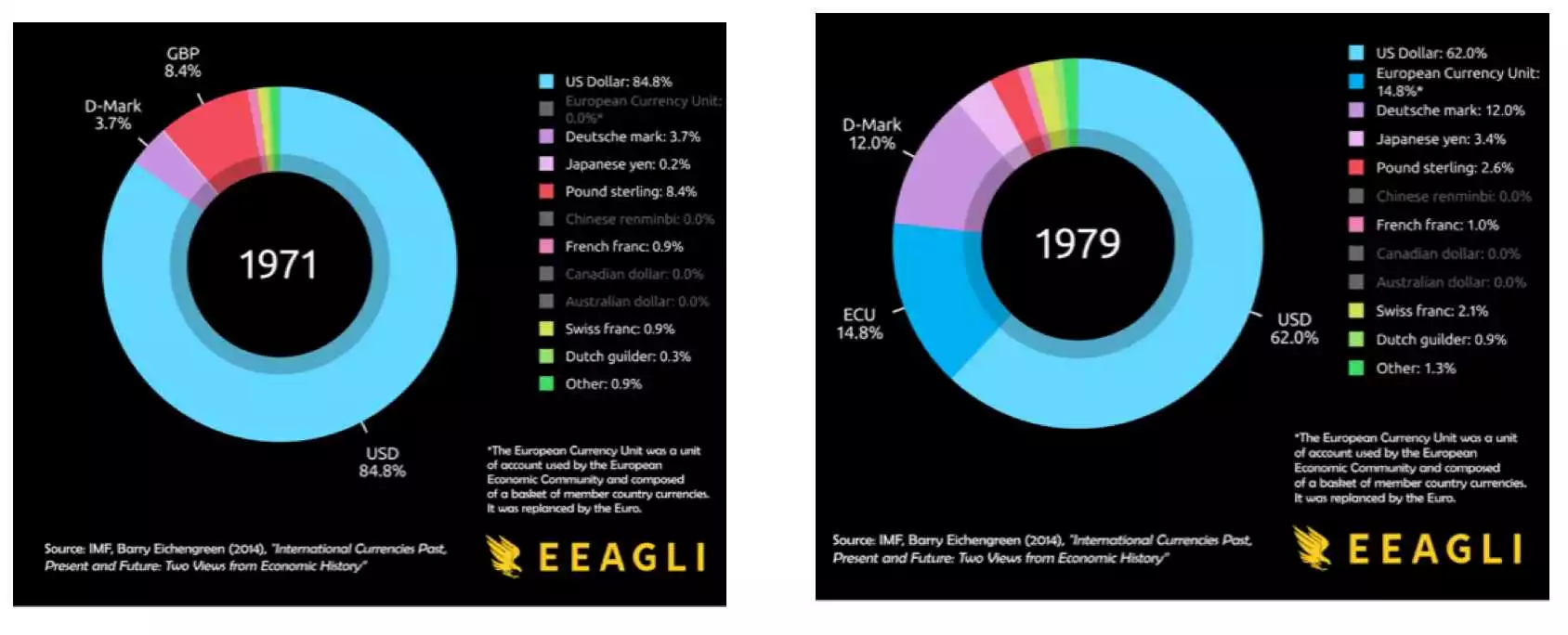

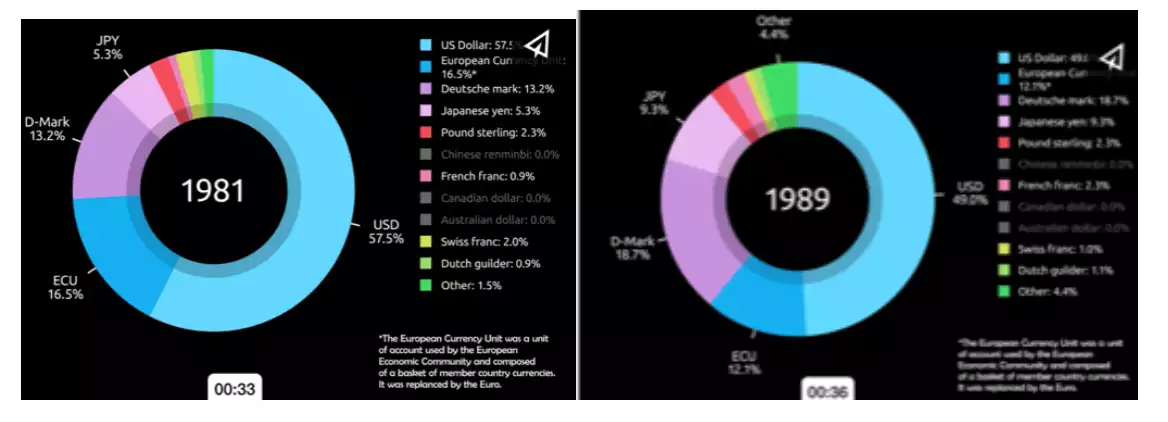

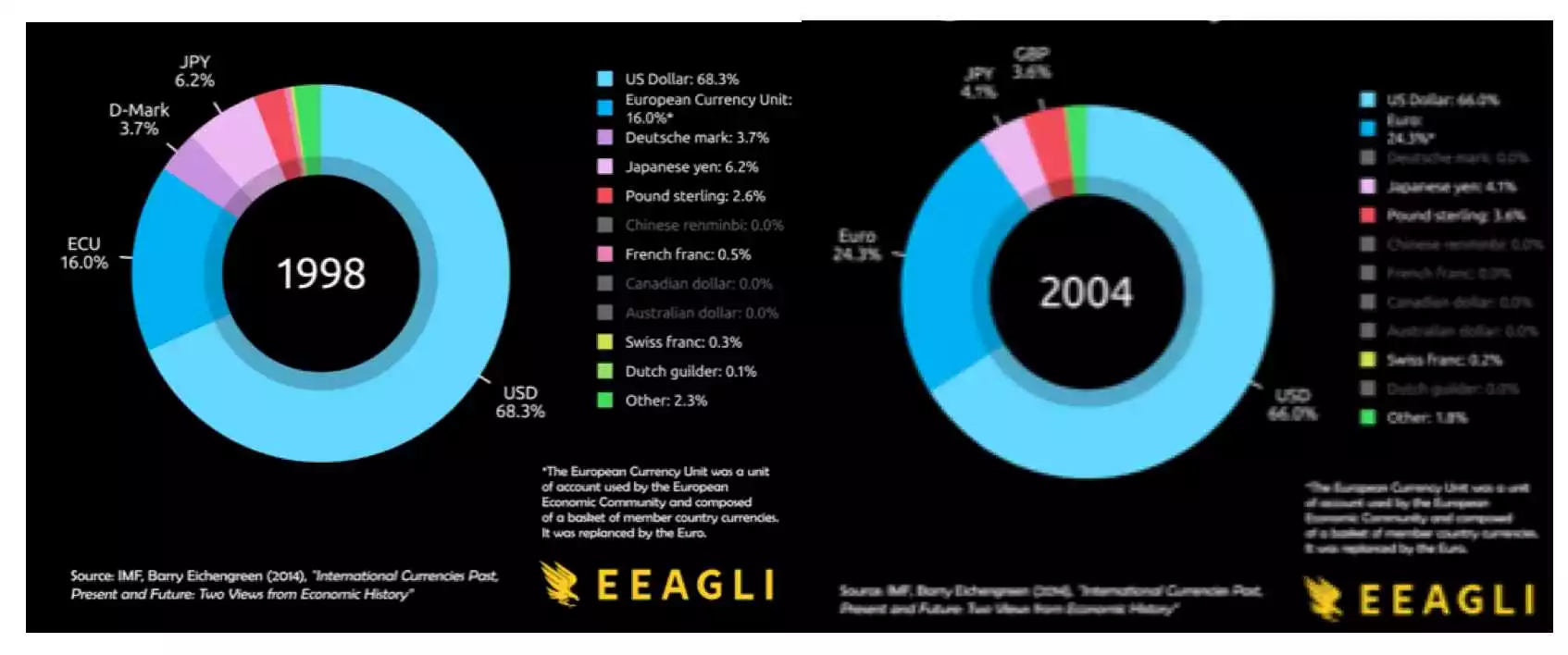

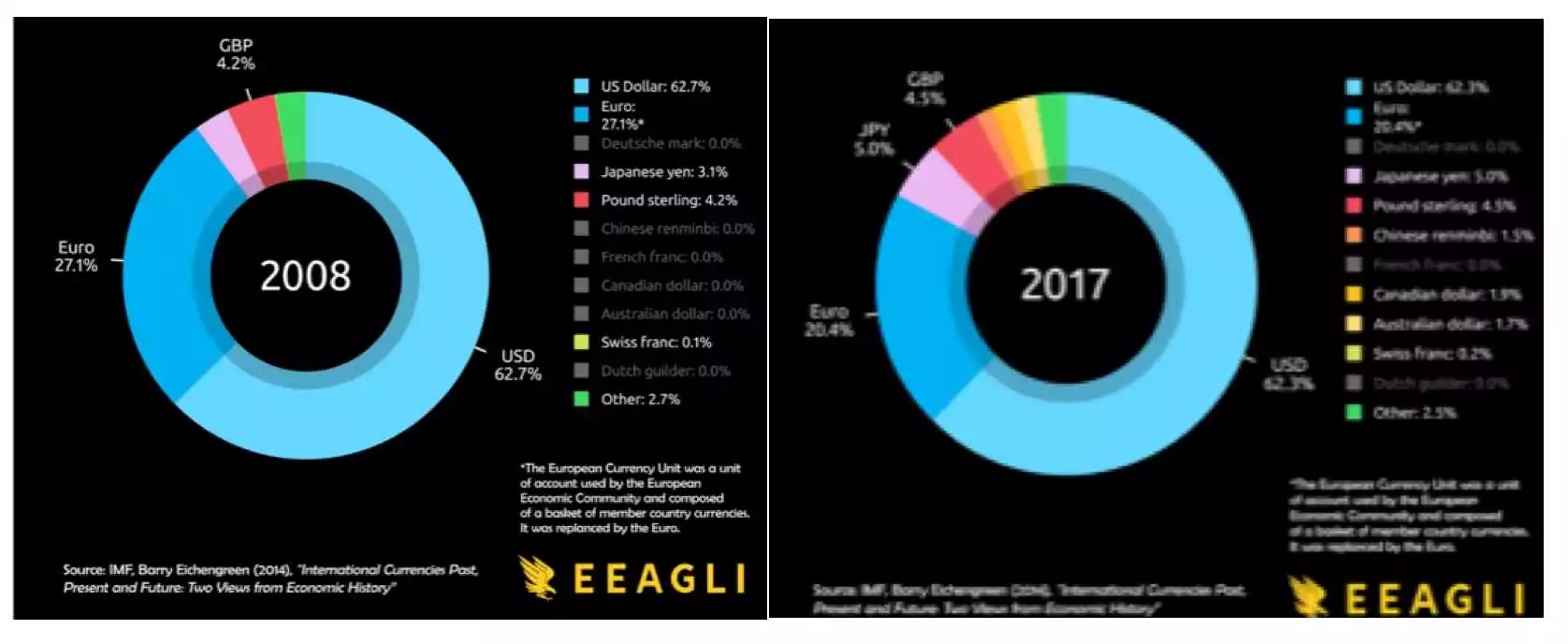

Looking back at the ebbs and flows of the USD over the past 60 years since the introduction of the Petrodollar, one does not need to look far to see that as the ‘flow’ in use of USD as a trading medium increase, stock market crashes appears within a short period of time. These crashes then seem to follow with an Ebb of USD use for trade over the next 5 - 10 years.

In 2007/2008 through to 2020 this Ebb/flow seemed to subside and trade % became more steady – probably explained through the massive money supply propping up the world trade system. However since the more recent stock market covid crash, is the 10 year Ebb of USD trade use now a trend the world will follow? Its certainly something countries are actively looking for. The following charts needs to be looked at carefully and understood as they speak volumes to what is happening.

So we should expect to see a fight for dominance in the next 5-10years that if the US loses, and no more printing of money is there to prop up the world financial system, a recession (or depression) in line with previous boom and bust cycles looks almost certain. History tells us this can be very constructive for gold as an investment.