The SDR and Gold – Where the ‘world is heading’

News

|

Posted 07/02/2019

|

39165

Yesterday we touched on the SDR (Standard Drawing Rights) of the IMF (International Monetary Fund) and have had a number of queries on it. Today we delve deeper into the SDR and where it might end up.

From the IMF themselves:

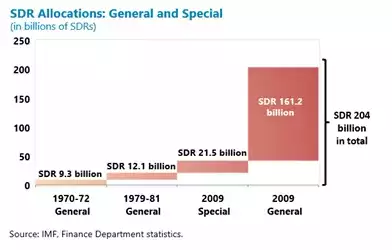

“The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves. So far SDR 204.2 billion (equivalent to about US$291 billion) have been allocated to members, including SDR 182.6 billion allocated in 2009 in the wake of the global financial crisis. The value of the SDR is based on a basket of five currencies—the U.S. dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound sterling.”

“The SDR was initially defined as equivalent to 0.888671 grams of fine gold—which, at the time, was also equivalent to one U.S. dollar. After the collapse of the Bretton Woods system, the SDR was redefined as a basket of currencies.”

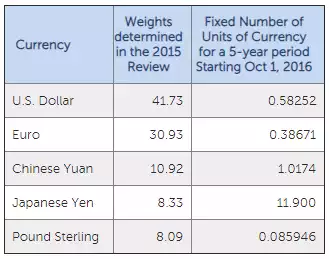

The weighting of each is based on “assigning equal shares to the currency issuer’s exports and a composite financial indicator”, is fixed for 5 years and is currently as follows:

As mentioned above, during the GFC the IMF injected around SDR180billion or $270billion (along of course with the Fed and others) and currently have an agreed lending capacity of around SDR690billion ($950billion) that they call their ‘crisis firewall’. The following chart is typical of the monetary stimulus that occurred to prevent the GFC getting worse.

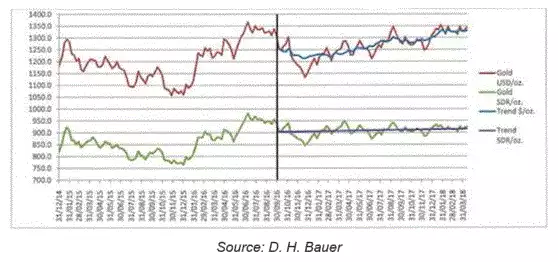

As we mentioned yesterday and regularly readers will know, Jim Rickards is a strong proponent of the theory that we will end up with the SDR as a global reserve currency and that gold will underpin it as gold is inflated to deflate the debt pile. He is predicting $10,000 gold on that basis. Indeed since the Yuan was accepted into the SDR in October 2016, there has been a steady correlation between the SDR and gold price at around SDR900= 1oz gold. Rickards believes the chances of that being coincidence are “infinitesimal”.

As Rickards explains:

“China can also conduct gold purchases and sales for yuan or dollars on the open market in Shanghai and London and separately buy or sell SDRs for dollars or yuan. China can also buy or sell the SDR basket currencies separately as a synthetic SDR to manipulate the price of the actual SDR.

This kind of intervention by China to maintain the SDR/GLD peg might also explain the mysterious “gold slams” we see in Comex gold futures trading with regularity.

Analysts have speculated for years that China was acquiring gold in anticipation of a new gold-backed yuan. I always disputed that idea because China does not have a good rule of law. The yuan lacks the kind of deep liquid bond markets, primary dealers, repo facilities, futures contracts and other legal infrastructure needed to be a major reserve currency with or without gold backing. The yuan is a decade or more from becoming a major reserve currency

But the SDR is an ideal vehicle for a gold-backed currency because it has the support of every major economic power on Earth through the IMF.

The bottom line is that China has now pegged the SDR to gold. This is highly ironic, because when the SDR was created in 1969 it was originally pegged to gold and defined as a weight in gold (SDR1 = 0.88867 grams of gold). That peg was abandoned soon after, even as the dollar peg (USD1 = 1/35th ounce of gold) was also abandoned.

Since this SDR peg to gold is informal, it can be abandoned at any time. It probably will be abandoned because the Chinese sponsors of the peg have ignored the lessons of 1925 when the U.K. returned sterling to the gold standard at the wrong price. The result was catastrophic deflation that presaged the Great Depression.

The Chinese peg of SDR900 is far too cheap to be sustainable given the scarce supply of gold and the growing supply of SDRs. More to the point, the IMF will print trillions of SDRs in the next global financial crisis, which will prove highly inflationary.

Still, this is a historic development, and we’ll be watching it closely in Rickards’ Gold Speculator. Even if the peg is unsustainable in the long run, it’s a clear short-run signal that China is betting on the SDR and gold, not the yuan or the dollar.

My advice under these circumstances is simple. Dump dollars, yuan and SDRs (if you have any) and get gold.

That’s where the whole world is heading.”