The Great London Silver Squeeze

News

|

Posted 17/02/2021

|

12101

The last couple of weeks have been extraordinary for silver, starting with the #silversqueeze movement which saw unprecedented sales of both physical silver and silver ETF shares and the accompanying massive spike of silver being delivered to the vaults backing these shares. It was also the biggest period of sales of our AGS Silver Standard silver backed tokens on CoinSpot ever. If you somehow missed the #silversqueeze action we reported on it here, here and here.

The volumes on the world’s largest ETF, iShares’ SLV, alone are staggering. On 28 January, 152m shares were traded with each share representing 1oz of silver. On 29 January it was 113m, 1 February 280m and so on. Between 29 January and 3 February SLV alone added 109.83m oz of silver or 3,416 tonne. To help visualise that, it was 113,501 good-delivery silver bars each weighing nominally 1000oz or nearly 30kg each.

SLV vaults all their silver through their custodian, none other than JP Morgan, and all of it is stored in LBMA vaults in London. Such extreme demand has seen a tightening already of the relatively small and inelastic market of physical silver with reports of 85% of all good deliverable silver in London having been used by SLV in just those few days. Given this supply squeeze, SLV very quietly added the following to their prospectus on 3 February:

“The demand for silver may temporarily exceed available supply that is acceptable for delivery to the Trust, which may adversely affect an investment in the Shares.

To the extent that demand for silver exceeds the available supply at that time, Authorized Participants may not be able to readily acquire sufficient amounts of silver necessary for the creation of a Basket.

Baskets may be created only by Authorized Participants, and are only issued in exchange for an amount of silver determined by the Trustee that meets the specifications described below under “Description of the Shares and the Trust Agreement— Deposit of Silver; Issuance of Baskets” on each day that NYSE Arca is open for regular trading. Market speculation in silver could result in increased requests for the issuance of Baskets.

It is possible that Authorized Participants may be unable to acquire sufficient silver that is acceptable for delivery to the Trust for the issuance of new Baskets due to a limited then-available supply coupled with a surge in demand for the Shares.

In such circumstances, the Trust may suspend or restrict the issuance of Baskets. Such occurrence may lead to further volatility in Share price and deviations, which may be significant, in the market price of the Shares relative to the NAV.”

And we repeat, this is just one ETF.

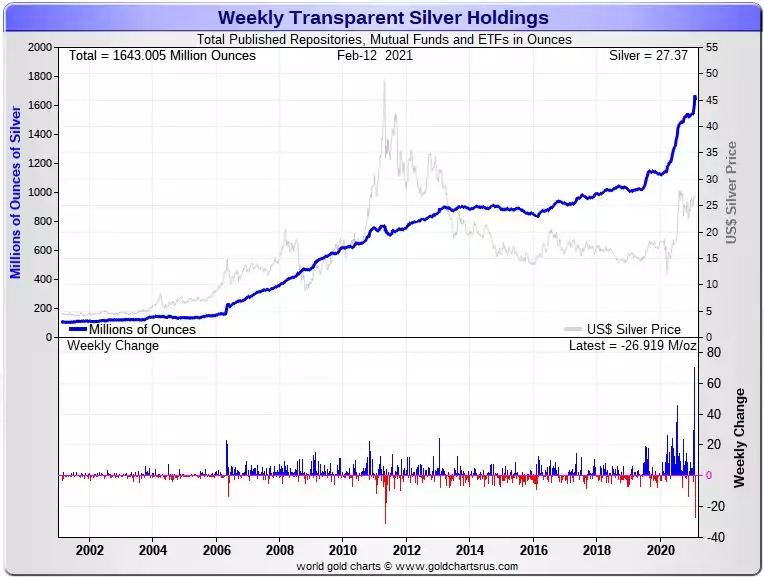

It becomes even more intriguing when we look at the weekly transparent holdings chart. You can see the massive spike up (far right blue bar) that illustrates the inflows talked of above. However, 1 week on and directly to the right is a near record outflow red bar of 26.9m oz in 1 week.

Whilst simplistically you might understandably assume that this reflects the ETF withdrawing the silver as the price corrected and FOMO latecomers panicked and sold. However the data shows that it was not silver being sold but rather silver redemptions for physical metal. What this means is that the select few that are actually allowed to, the so called Authorised Participants, were converting their ETF shares for the physical metal at a great rate.

Authorised Participants are the very big end of town, the so called bullion banks etc. That they are taking delivery of the physical silver must surely be sending a signal to the market and could well be related to that new disclosure in the SLV in their PDS.

The other elephant in the room is whether or not that silver has also been leased out. This practice, called rehypothecation, means there are in effect 2 claims for the same oz of metal. Investopedia defines it thus: “Rehypothecation is a practice whereby banks and brokers use, for their own purposes, assets that have been posted as collateral by their clients. Clients who permit rehypothecation of their collateral may be compensated either through a lower cost of borrowing or a rebate on fees.”

Derivatives, ultimately are a paper promise. An ETF is a derivative. Wall St are conditioned to be comfortable in that space as it is pretty much all they can and do trade. Again, that they are converting their derivatives into physical metal is telling.

Ainslie gives you a number of non derivative options to buy and hold silver and has ample stock in almost all lines with more on the way. You can buy bars and coins and hold them yourself or in your own safe at the independent Reserve Vault. You can have an Ainslie Allocated Storage account where those same bars and coins you order are stored at Reserve Vault but we manage it for you at a charge. Or Silver Standard (AGS) tokens which are fully allocated tokenised silver on the blockchain. Silver Standard (as with Gold Standard) is backed by real bullion, already vaulted, all serial numbers recorded and discoverable for all eternity, verified by global assurance firm PKF, fully insured, and with direct ownership by token holders with Gold Silver Standard Custodian simply that, the custodian of your silver. The legal terms explicitly prohibit any rehypothecation of that metal. The upside is you buy silver at rates only available for the biggest silver bars, free and secure storage without the logistics of all that heavy silver, and 24/7 tradeability through CoinSpot, Australia’s most popular exchange, at the click of a button.