The FTX Collapse, On-Chain

News

|

Posted 15/11/2022

|

12340

In what has been the craziest, most unexpected, and frankly horrendous weeks in crypto, we saw FTX, the second-largest crypto exchange experience all the following:

- A bank run.

- Halted customer withdrawals.

- Entered into failed talks to be acquired by competitor Binance.

- Discovered to be short between $8B to $10B in customer funds.

- Had exchange wallets allegedly hacked – with a loss of up to $500M.

- Filed for Chapter 11 bankruptcy.

- Exposed what appears to be an unethical and potentially criminal relationship by the Alameda / FTX entities.

Such an event is a sad and untimely setback to the industry, leaving millions of customers with trapped funds, damaging many years of constructive industry reputation, and creating new credit contagion risks, many of which likely remain undetected.

The event brings back unfortunate memories of the failure of Mt Gox in 2013, whereby a significant custodian is found to be fractionally reserved – something which goes against every fabric of what Bitcoin, and crypto, originally stood for.

Those who got out of FTX in time were likely tipped off by suspicious on-chain data. So, let’s dive into how this debacle revealed itself in the data.

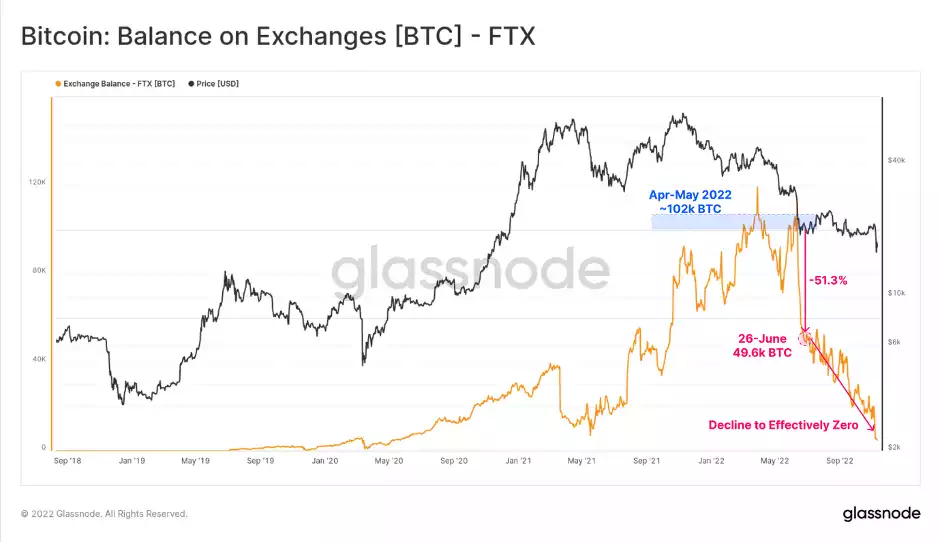

Tracking the exchange reserves for FTX is somewhat of a challenge for many data providers – FTX used a relatively complex peeling system for their reserves, making it harder to track what their real reserves are.

However, from April to May this year, the FTX reserves had been estimated to reach a peak of over 102k BTC. This dramatically declined by 51.3% in late June. From then, reserves persistently declined until reaching effectively zero during last week’s bank run.

As claims of Alameda misappropriating customer deposits come to light, this indicates that the Alameda-FTX entity may have experienced severe balance sheet impairment in May-June following the collapse of LUNA, 3AC, and other lenders.

The supply of ETH held on FTX has also experienced two periods of significant decline:

- In June, where reserves dropped by -576k ETH (-55.2%)

- This week, falling from 611k ETH to just 2.8k (-99.5%)

Much like the Bitcoin balance, this leaves close to no ETH in FTX-owned wallets, with the bank run effectively clearing what was left from the balance sheet.

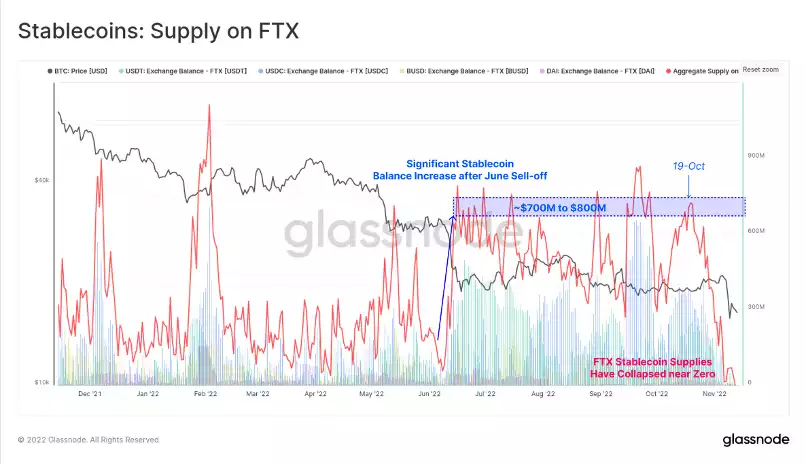

When looking at stablecoin reserves, we can see that aggregate reserves on FTX started to decline significantly from 19-Oct, dropping from $725M, to effectively zero over the following month.

Stablecoin balances spiked significantly to a new sustained height after the June sell-off, at a time when BTC and ETH reserves had dropped swiftly.

Whilst there remains significant uncertainty regarding what happened between FTX and Alameda, there remains a growing pool of on-chain data to suggest cracks had formed as far back as May and June. This would leave recent months as being simply a precursor to what was more than likely an inevitable collapse of the exchange. FTX/Alameda simply was hiding the fact that they lost customer funds and were “hoping” to recover. Unfortunately, with the sheer scale of lost funds, what occurred was inevitable.

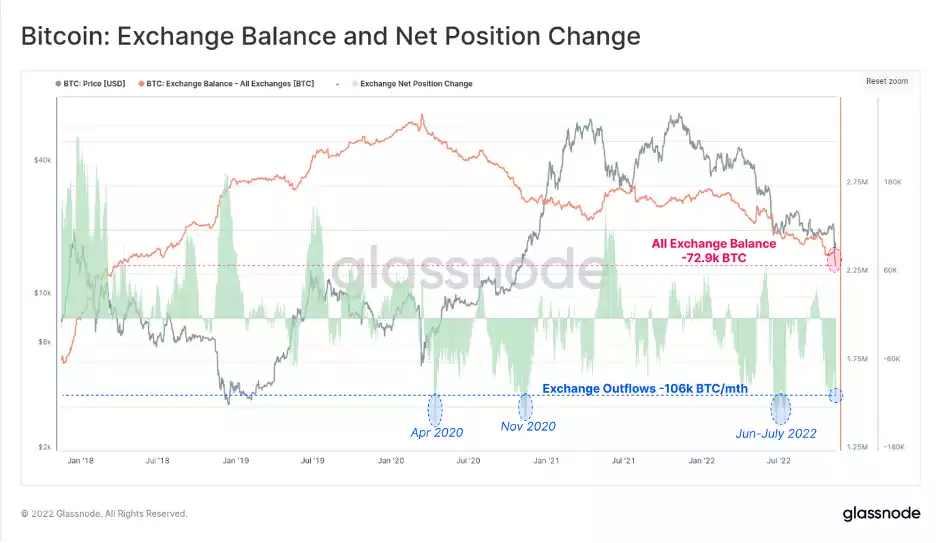

Away from FTX, on an industry-wide scale, we have seen a withdrawal of coins from exchanges at a truly historic rate, as holders seek the safety of self-custody.

Exchanges have seen one of the largest net declines in aggregate BTC balance in history, falling by 72.9k BTC in 7-days. This compares with only three periods in the past; Apr-2020, Nov-2020, and June to July 2022. We are currently experiencing what will become a hallmark moment in the history of Bitcoin and the crypto industry. A moment where centralised trust hit an all-time low.

The collapse of FTX is significant and leaves a massive stain on the industry. It is a truly horrendous event where customers find themselves the victim of a custodian who acted with negligence and carelessness.

We would like to sign off today’s news with the first few sentences of Bitcoin’s whitepaper as a reminder of crypto’s original ideologies. The market will come back from, so long as we remember:

“Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust-based model.”

Minimise your counterpart risk. And always ask yourself how much you trust your custodian, whether that’s traditional financial institutions or crypto exchanges. Bitcoin and DeFi are the big winners here – they are the solution moving forward.

Update: As of 9th December 2022 A research study by CoinGecko and found that FTT, FTX's native token, plunged by 90%, wiping out over $2.6 billion.