Short-Term Pain, Long-Term Gain

News

|

Posted 10/10/2014

|

5149

Summary

- The miners are unable to produce silver profitably at current prices.

- The industrial demand for silver is growing and there is a huge potential in some new high-tech industries.

- Any purchase of physical silver, or ETF (for example SLV or PSLV) holding physical silver, under $20 per troy ounce is a great buying opportunity from the long-term point of view.

The silver price has collapsed under $17 per ounce and it seems that the fall may continue. Most of analysts focus on reasons why silver may continue to decline. On the other hand there are a handful of factors, both on the supply as well as on the demand side of the market that support significantly higher silver prices in the longer run.

1. Production costs

Although cash costs of the biggest silver producers are around $10 per ounce, they are happy to make any profit by the current silver prices. All-in costs are mostly above $20 per ounce. Thence resulting, that at the current silver prices the closures of silver mines are just a question of time. Closures will lead to limited production and limited production will lead to higher silver prices.

2. Limited reserves

According to USGS, the known reserves of unmined silver are around 520,000 tonnes which equals to approximately 16.718 billion troy ounces (toz). The world global production in 2013 was 26,000 tonnes (835.919 million toz). It means that at the current volumes of yearly production, the underground reserves are sufficient for only 20 years. And at current prices, there is only a little motivation to explore new deposits, or to finance development of new mines. We can face a big problem in a couple of years because the typical life cycle of a mining project from exploration to production usually lasts for around 10 years. The later the silver prices recover, the bigger the future silver market deficits will be.

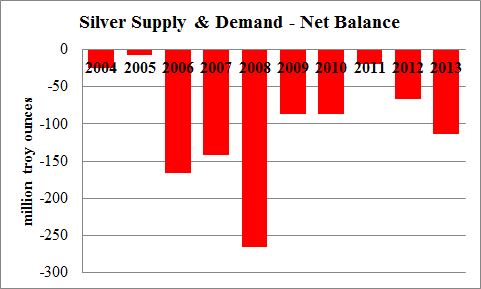

3. Permanent supply deficits

There is not only a serious threat that the current low silver prices may severely damage the supply side of the market in the future. In fact, the supply side hasn't managed to keep up with demand for the last ten years. According to data of the Silver Institute, the global silver demand has outpaced the global silver supply every single year since 2004. Although the volume of the deficit is highly unstable, there has been no one year of silver surplus, regardless the price movements.

Source: Own processing, using data of the Silver Institute

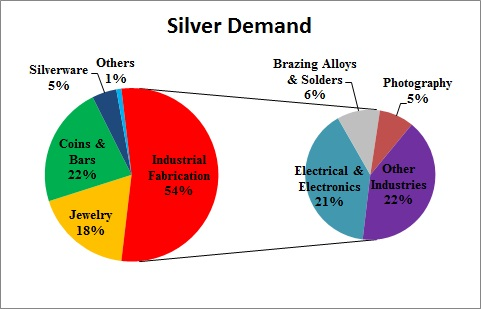

4. Growth of industrial demand

Silver is not only a precious metal, it is an industrial metal as well. In 2013, more than 50% of demand was attributable to industrial fabrication. Thanks to its great thermal and electrical conductivity it is widely used in electronics, including laptops, mobile phones or TV's. It is also used for production of CDs and DVDs. For its antibacterial abilities, it is used in medicine and in water-purification systems. It is also inevitable for ever growing photovoltaic industry. It is highly probable that huge amounts of silver will be consumed by production of high temperature semiconductors and nanotechnologies in the coming years. Because silver is consumed mainly by modern high-tech industries, the industrial demand for silver is poised to keep on growing.

Source: Own processing, using data of the Silver Institute

5. Solar Energy

The photovoltaic industry may become a real silver glutton. According to the International Energy Agency (IEA), solar power could become the world'slargest source of electricity by 2050. The expected capacity is approximately 4,600 gigawatts. It means 29-fold growth from 154 gigawatts in 2014. An average solar panel contains approximately 20 grams of silver. According to the European Photovoltaic Industry Association (EPIA), there were 30 gigawatts of solar capacity installed worldwide during 2012. According to Casey Research, the photovoltaic industry's demand for silver was more than47 million ounces in 2012. A simple math says that 1.5 million ounces of silver was needed to build 1 gigawatt of generating capacity. Conservatively assuming that because of the technological progress the number of ounces needed will on average decrease by 25%, there will be roughly 5 billion troy ounces (1,500,000*0.75*(4600-154)) of silver needed to reach capacity of 4,600 gigawatts. It is more than ¼ of the current unmined silver reserves, or 6 times the current global yearly production. It means huge amounts of silver consumed just by the photovoltaic industry.

Conclusions

Although the silver price may decline further in the short term, the long-term fundamentals must prevail and the silver price will increase again. The current silver price represents a great opportunity to buy physical silver or ETFs that hold physical silver, for example iShares Silver Trust ETF (NYSEARCA:SLV) or Sprott Physical Silver Trust (NYSEARCA:PSLV).

SLV data by YCharts

PSLV data by YCharts

SLV as well as PSLV hold physical silver and they track the price of silver very well. A big advantage of holding physical silver is the fact that investors don't have to worry about losing money when the fund rolls its futures contracts. The current price of SLV is just shy of $16 and price of PSLV is slightly under $7 which seems to be a great buying opportunity. In fact, any purchase of silver under $20 per troy ounce seems to be a great investment from the long-term point of view.

Article from

seekingalpha.com