Platinum Supplies ‘Exhausted’

News

|

Posted 04/02/2021

|

13040

OK, that might be a little click bait-ish… But platinum demand is increasing along with its value and it has seen cases of exhaust system catalytic converter theft booming across the US.

Platinum, like silver has the dual value proposition of precious metal and industrial metal. Like silver those industrial uses are benefitting from environmental initiatives needing its unique properties, one of which is its use in catalytic converters. From WPIC:

“As a commodity, platinum is not widely well understood. Some view it as a precious metal, while others believe it is an industrial metal. Aspects of platinum’s market value can be overlooked if its ability to straddle these two categories simultaneously is not fully appreciated. In reality, platinum is both a precious metal and an industrial metal – over 65 per cent of platinum consumption is expected to come from automotive and other industrial uses this year.

From an investment perspective, platinum is closely correlated to gold, bringing similar diversification benefits to a portfolio, as well as being a hedge against currency and interest rate fluctuations and a store of value. Platinum is also a hard asset, which, like gold and other commodities, has been in great demand amidst the extreme volatility of many equities recently.

Since the start of this year, the platinum price has traded at over US$1,100/oz, up over 80 per cent since the start of the COVID-19 pandemic, which saw the platinum price fall to US$599/oz in March 2020. Yet despite this strong price performance, platinum remains undervalued versus gold. What is more, platinum is also undervalued when compared with other industrial metals, for example palladium and copper.

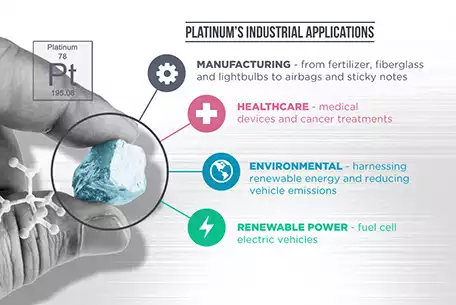

Platinum has a unique combination of physical and chemical properties which is why it is used so extensively in industry and manufacturing, where its high melting point, density, ultra-stability, extreme non-corrosiveness and catalytic effects are highly valued.

In fact, one of platinum’s most important uses is as a catalyst – the presence of even a small molecule can speed up chemical reactions, reducing process energy needs and improving yields. Biocompatible and well tolerated by the body, platinum is also used in numerous established medical treatments and is at the forefront of many new ones.

What is more, platinum is at the forefront of two key technologies that are unlocking the rapidly expanding, zero-emissions hydrogen economy – fuel cells and electrolysers. At the same time, it remains key to the automotive industry, reducing emissions from internal combustion engine vehicles.

Indeed, platinum is currently growing its share of the autocatalyst market as it continues to substitute for significantly more expensive palladium in gasoline engine vehicles on a one-to-one basis.

Investors, familiar with platinum’s strong correlation to gold, are becoming more aware of the significance of platinum’s industrial credentials, which are providing upside as the global economy recovers from the effects of the pandemic.

Coupled with its strong demand growth potential from the automotive and hydrogen sectors, more and more investors are viewing platinum’s current discount to its peers – both precious and industrial – as an investment opportunity.”

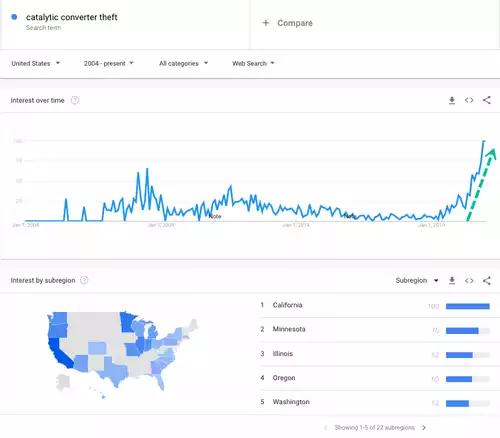

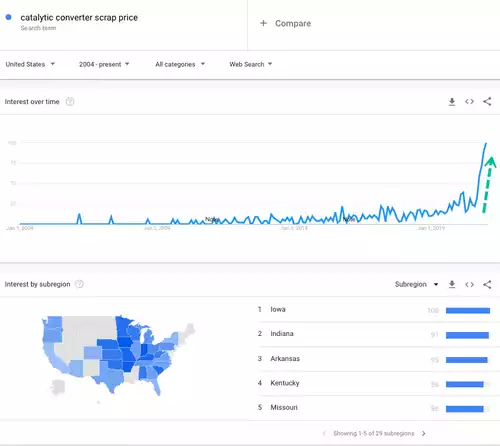

The dual COVID outcomes of millions of people losing their jobs in the US and the boom in precious metals prices has seen thieves literally cutting out catalytic converters from vehicles in industrial parking lots and residential streets to sell for the platinum and palladium scrap. The Google searches tell it all:

And what will I get for it?

Ainslie offer an easier and legal way to get in on the action. Buy platinum online, by phone or in store. No hacksaw necessary…