PART 1 The Petrodollar Bretton Woods and Nixon

News

|

Posted 17/10/2022

|

12329

The Bretton Woods Agreements revolved around fixing foreign currencies to the USD. In the 1960s a USD surplus imperilled the system as the US did not have enough gold to cover the amount of USD leading to an overvaluation of the USD. Does that seem recurrent to the current state of the USD?

Bretton Woods collapsed in the 1970s in part due to The Nixon Shock, a US economic shift in 1971 – whereby Nixon’s ‘New Economic Policy’ was televised and was touted to turn America’s policy’s inward to deal with domestic issues;

- Creating better Jobs

- Stemming inflation and the cost of living

- Protecting the US dollar

Does this sound familiar? Trumps ‘America First’ Policy sought to do the same…

Tax cuts and 90 day holds on prices were used to hold the cost of living down, the suspension of convertibility of USD for gold on the 15th of August 1971 and a 10% import duty on all imports.

The New Economic Policy sent panic to the international exchange rate markets which led to the G10 devaluing the USD in December 1971 due to huge selling pressure on the USD.

Finally in February 1973, amid heavy selling pressure on the USD the G10 called for European members to tied their currencies together and floated them against the USD, ending the Bretton Woods system

Creation of the Petrodollar

The petrodollar came into existence in 1973 with Nixon aligning himself with Saudi Arabia and ensuring all oil transactions were traded in USD in exchange for the continued US support of Saudi Arabia. This agreement meant the USD became the world Reserve Currency with most commodities converted then traded in USD.

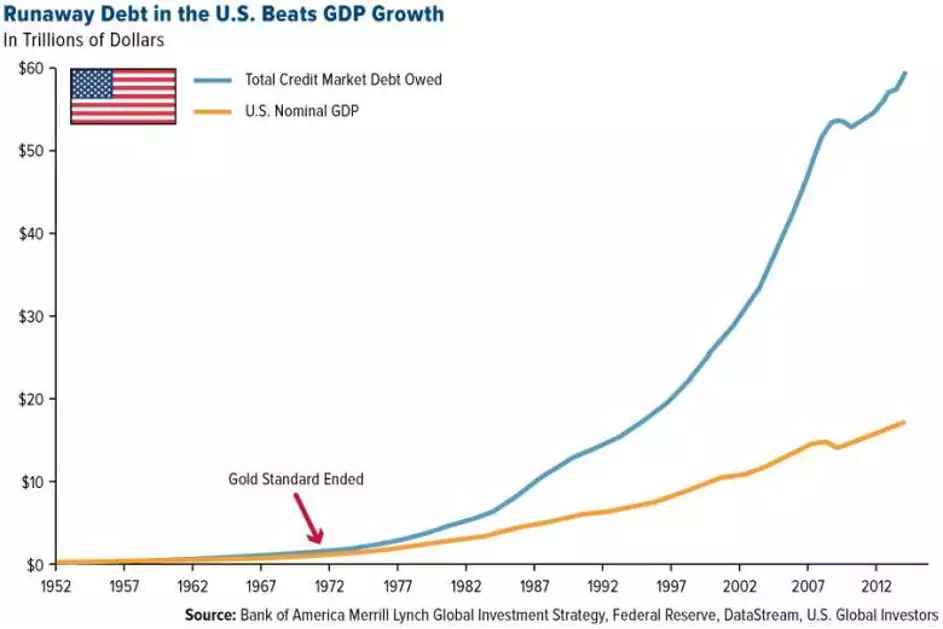

Since the creation of the petrodollar the US began running deficits, which have recently hit $31 trillion or $93,000 for every man woman and child in the US.

*source The world at a turning point – Asia Times

This exponential debt crisis needs to collapse at some point as it cannot continue.

Lessons not Learnt

It appears history repeats itself, and just like the inward policies of the 1970s created stagflation we find the world and particularly the US in the same predicament. Their inward policies began with Trump but continue under Biden and the Federal Reserve pushing inflation onto the world with little external care.

Biden more recently has seemingly forgotten what supports the US Dollar and his attempt at trying to control the Saudi relationship has begun to backfire, with Saudi going against the US request to increase output, seemingly supporting the Russian position, by reducing OPEC output by 2 million barrels a day.

Biden also criticized the UK this week for trying to implement tax cuts and yet his current policies including $400 billion in student loan forgiveness, $2 trillion American Rescue Plan and a personal favourite, "inflation reduction act" with minimal immediate impact so is irrelevant to the current inflation scenario.

With Russia, India and China now pushing to remove the US as Reserve Currency and the Petrodollar partner to the US now touting PetroYuan are we soon to see a repeat of the 1970s….. and what will be the new world currency… and what might back it?

Stay tuned for

PART 2 US Debt Timebomb

PART 3 Liquidity threat of US Debt

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************