Non Farm Payroll and Silver BIG reversal

News

|

Posted 07/11/2022

|

12899

Following the Feds hawkish commentary on interest rate hikes on Thursday, the Non Farm Payrroll showed a mixed and overall lackluster result. With jobs added increasing significantly from 261,000 to 315,000 but the unemployment rate rising to 3.7% from 3.5% the USD had a strong reversal from the Feds commentary the previous night.

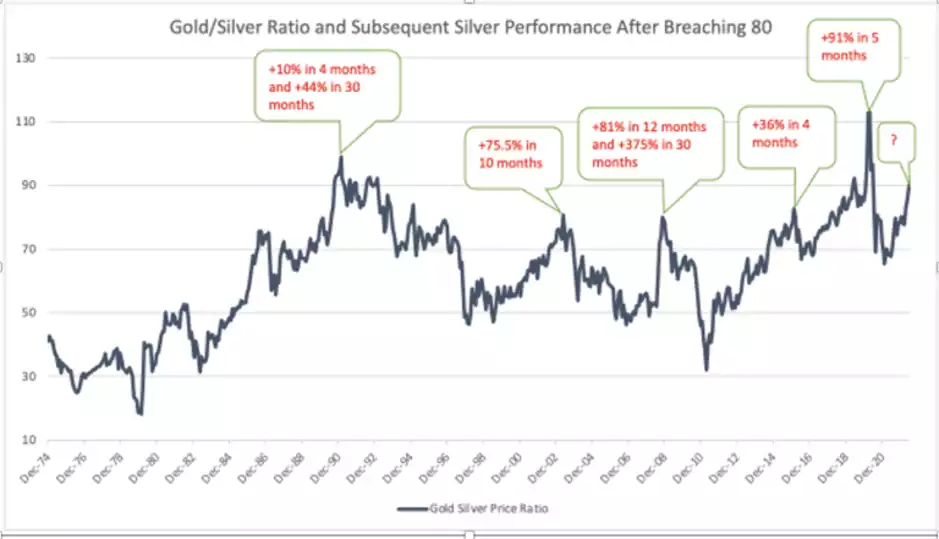

The Aussie dollar jumped on Friday on the back of mixed US Non Farm Payroll results, gaining from a low of around 62.8 to a high of 64.8 (a near 3% swing). This however paled in comparison to both the US gold and US Silver swings of 4.2% and 7%. This saw the Gold/Silver ratio drop from 85 to 80 overnight – these large drops can sometimes be an indication of a trend reversal as silver outperforms gold in precious metal bull markets.

So what has happened in these markets and is this the end of the bear market (at least for silver and gold)

So Much Silver Demand

Silver investment has been increasing dramatically, holdings in LBMA vaults in London have fallen to the lowest level since 2016 with 27,101 tons at the end of September.

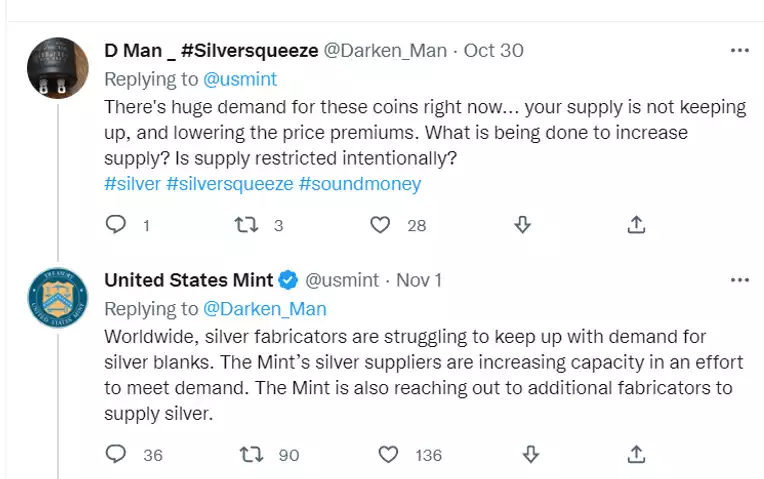

The Perth Mint and US Mint have seen record demand, with the US Mint on Friday responding to a question on Twitter (now $8/month) as to why they were not keeping up with demand, to which the Mint replied ‘Worldwide, silver fabricators are struggling to keep up with demand for silver blanks. The Mint’s silver suppliers are increasing capacity to meet demand.’

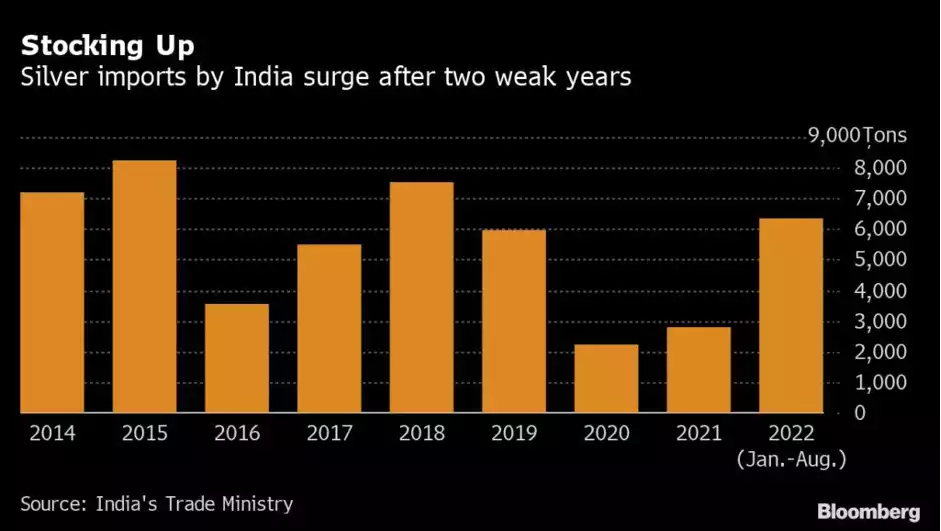

Looking at India, with suppressed sales through 2020 and 2021, this year will see Indian demand outstrip previous years record silver imports as the country gets back to pre covid Diwali.

Source: India’s massive silver demand cutting world’s warehouse stocks - MINING.COM

All this on top of the industrial demand seems to be back on the rise, with newer solar panels out of China needing around 17g of silver per panel. Copper similarly has had estimates that there will not be enough copper mined by 2050 to meet the worldwide carbon reduction goals. On the back of this and 5G surging demand for industrial silver is expected to rise by 5% by the end of the 2022 year.

Peter Schiff interviewed industry stalwart Doug Casey recently and they spoke to the aforementioned historical trait of silver outperforming gold in bull markets:

“If you’re bullish on gold, you should be even more bullish on silver. Silver typically outperforms gold in a gold bull market. And the silver-gold ratio indicates that silver is significantly underpriced when compared to gold. Historically, when the spread gets this wide, silver doesn’t just outperform gold, it goes on a massive run in a short period of time. Since January 2000, this has happened four times. As this chart shows, the snapback is swift and strong.

Casey was asked why silver tends to outperform gold during gold bull runs.

“Although about 80 million ounces of gold are produced every year, new production of gold is really unimportant to its price. That’s because all the gold that’s ever been mined, the 6 billion ounces that I mentioned before, is still above ground. What influences its price is the desire of people to hold it—not the roughly 1.3% added to its inventory every year. Gold is almost unique in this regard.

With silver, however, there’s not a huge relative amount of inventory to deal with. I don’t have that number, but it’s basically about new mine production. Silver inventories are in line with other industrial metals—very different from the days when the US government alone owned two billion ounces, not counting the billions more that used to be in US dimes, quarters, halves, and silver dollars. In relative terms, everything about silver is small, and small markets by their nature tend to be volatile.”

Casey said he is primarily bullish on silver, along with other commodities, because it is virtually the only sector in the financial markets that hasn’t been in a bubble.”