MMT – Why Printing Money Won’t Save the US

News

|

Posted 13/03/2019

|

8394

Often only in hindsight do we see the ‘thing’ that signalled a level of madness that could only have heralded the beginning of a big shift in history. We wrote last week of the growing profile of socialist policies as the world grapples with the social disconnect resulting from monetary stimulus enriching the rich and leaving the rest behind. The likes of Alexandria Ocasio-Cortez and the so called “New Green Deal” which is estimated to generate annual deficits of $6.6 trillion highlight this. So how do you fund that sort of deficit spending? MMT, or Modern Monetary Theory is the solution. Howard Wang of Convoy Investments explains:

“The theory is centred on the idea that a dollar printing press frees the US government from the budgetary constraints facing normal entities. Because America borrows in its own currency, it can always print more dollars to cover its obligations. As a result, the thinking goes, the US can always run sustained budget deficits and rack up an ever-increasing debt burden with the printing press as the ultimate back stop. The Fed can then keep interest rates low to contain the cost of servicing the debt and should there be an inflation problem from too much printed money, simply increase taxes.”

Simple yeah? Much has been written of late about MMT but a recent note to clients by Mr Wang we think summarises the shortcomings very nicely. First let’s remind ourselves of where we sit right now:

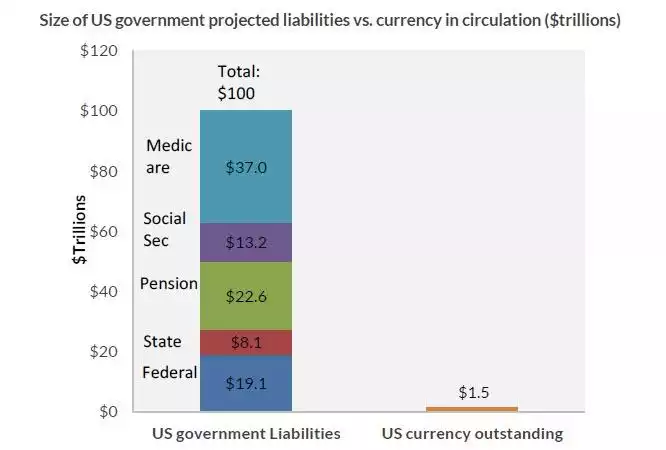

“As of last year, the federal government directly owed about $19 trillion, the state governments owed about $8 trillion, and the pension system had about $23 trillion in entitlements. Social security and Medicare are expected to cost $50 trillion through the next 75 years. We are currently looking at about $100 trillion in projected government liabilities and the deficits are only getting worse and now there is a push for new initiatives that will cost $trillions more.

When faced with ballooning debt we really only have three options short of a direct default:

- Tighten the belt, spend less and tax more.

- Keep borrowing money and increasing the debt.

- Print money.

Our nation has historically pursued some combination of the first two options, keeping an eye on the deficit while increasing the debt ceiling as necessary. However, in the current environment where debt levels are already high, economic growth slow and income inequality wide, the third option seem increasingly attractive to politicians pushing for additional government spending.”

$100 trillion is a staggeringly big number. How does one simply ‘print’ their way out of that? Wang argues you simply can’t:

“In debates about MMT, I’ve heard a lot of analysis around unemployment, inflation, aggregate demand, taxation and other complicated macroeconomic concepts. My biggest problem with MMT is a simple one. The theory boils down to using the printing press as a last resort to fiscal troubles and if we look at how we’d practically go about using the printing press to pay for obligations, we’d find that MMT is completely implausible. This is perhaps why anyone not stuck in economic theory-land, but understands the US monetary system like an actual business with dollars in and dollars out will not accept MMT.

The magical printing press on which MMT relies is far too small in reality compared to the size of our obligations. Below I show to scale the relative size of our projected government liabilities to the size of our currency outstanding.”

“Our currency is not meant to be a rainy day fund but rather a medium of exchange. As a result, it is tiny compared to the size of our economy and our obligations. For every $1 of currency there is almost $70 of liabilities. It would take a massive amount of printing by historical standards to make any kind of a dent in the liabilities. For example, to pay for just 10% of our current liabilities with the MMT approach, we’d have to print so much money that the number of dollars in circulation goes up by 700%.”

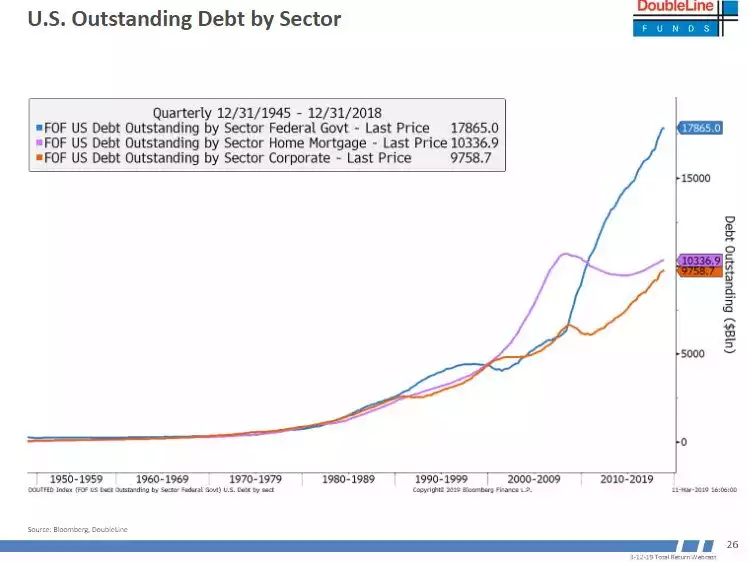

For context too, Jeffery Gundlach, head of hedge funds Double Line presented his latest report to clients last night and put the following chart up. That chart brings in house mortgages and corporate debt on top of the above. (By the way, he too described MMT as “a completely fallacious argument" last night.) Just wrap your head around the explosion in debt this century.

The chart above leads to Wang’s next big issue with MMT, and that is “faith” in the US as the world’s reserve currency.

“To get context around what such a large spike in US dollar would do to the economy, we need to look back at the history of money printing in the US. Today, US is the reserve currency of the world and a huge part of the world economy depends on the stability of the US dollar. For example, 90% of all foreign exchange trades include the dollar as one of the pair, 1/3 of the global GDP comes from countries that are directly pegged to the dollar and a substantial other portion comes from countries that are loosely tied to the dollar. We’ve achieved this privileged status because we’ve earned the trust of the global markets through decades of discipline.”

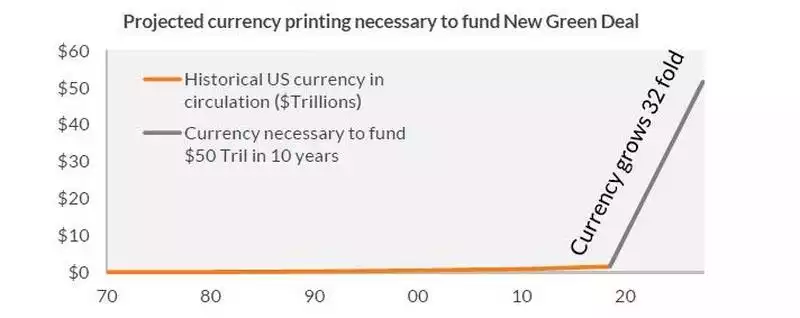

“To print enough money at the scale necessary to fund some of the recently discussed initiatives like the New Green Deal, we’d have to massively depart from history. To give you a sense of how much we’d have to print relative to history, below I show the amount of currency in circulation necessary in order to fund the $50 trillion over the next 10 years (the low end of an estimate from a think tank led by a former Congressional Budget Office director). The number of dollars in circulation would have to go up 3200%.”

“This would undoubtedly lead to massive inflation, spiking interest rates, and crumbling value of the dollar. While MMT directly addresses inflation, I have yet to see proponents discuss the impact on foreign exchange – the US economy doesn’t exist in a vacuum. Recently our former Fed Chairman Alan Greenspan was also asked about MMT, to which he responded, “You’d have to shut down your foreign exchange markets, people will be trying to fly out of your currency.”

If the government then pursues the MMT recommended strategy of increasing taxation in a massively inflationary economy with plummeting currency value, you’d see additional capital flights, further exacerbating inflation and currency problems. It is also interesting that MMT would reverse the roles of the Fed and the Congress, asking the Fed to keep interest rates low to promote government spending while asking the Congress to adjust taxes as necessary to keep inflation in check.”

Whilst that all sounds simply wonderful for gold, you’ve got to ask yourself will the people really buy into what is effectively a Ponzi scheme? Surely not, but unfortunately history is littered with failed attempts at socialism, reckless fiscal policy, and changes in reserve currency.