Is Something Big Brewing In Silver?

News

|

Posted 14/05/2014

|

5838

It's been over three years now since silver topped out at $50 (Comex futures price-basis) and went into a sell-off that appears to have bottomed with an $18.18 low price-tick last June. On the surface it appears as if there is little to say about silver other than it continues to hold above the low closing price of $18.53 (continuous contract basis) it established on June 27, 2013. However, what I have just described is the trading action in the Comex paper silver futures market. While not widely reported or analyzed, over the past several months there has been an enormous amount of buying in the various markets for physical silver - both one-ounce sovereign-minted coins and refined bars. Along with some standard trading signals I'll discuss below, I believe the activity in the market for physical silver is signaling the potential for a large upside move sometime this year.

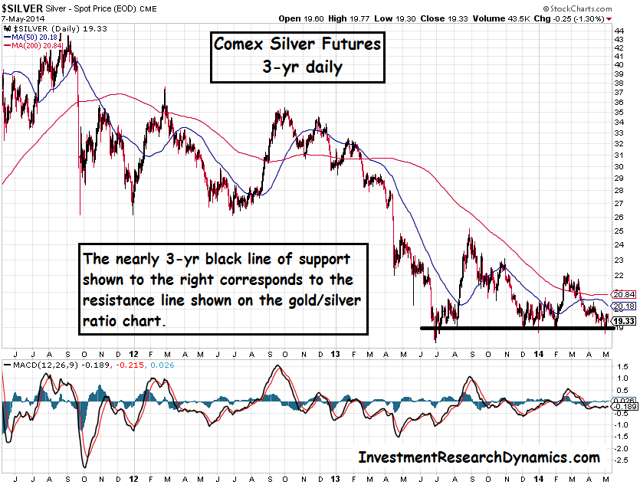

As you can see from this chart below (source: King World News, edit in white is mine), silver is in its most oversold condition since 1976:

While the percentage sell-off in 1980 in silver was greater than the percentage sell-off in silver that started in April 2011, you can see from the MACD momentum indicator on the bottom half of the graph that, technically, silver is more oversold than at any time in the last 28 years. This is significant because it suggests that not only was the 18.56 close on June 27, 2013 most likely the bottom of the big price correction in silver but traders who are short or flat will be looking to cover shorts, start new long positions or add to current long positions on price strength. Thus, from a probability stand-point, silver is more likely to move higher from here than lower.

From a fundamental standpoint, investors are buying physical silver in record amounts. In 2013, the sales of both silver eagles and silver maple leafs hit new record levels. From 2012 to 2013, silver eagle sales increased 26.4% and silver maple leaf sales increased 55.8%. In fact, silver eagle sales of 42 million exceeded the supply of mined silver in 2013 by 2 million ounces. The trend has continued into 2014. Despite a 1-month record sales number in January 2013 of 7.5 million silver eagles (a production shortage in December 2012 pushed December sales into January 2013), sales YTD through April 2014 are higher than for January-April 2013 (18.5mm vs. 18mm). Already in the first 4 business days of May, silver eagle sales are nearly half of the sales for the entire month of May 2013. It seems that as the price of silver continues to drift under $20, silver coin sales continue to increase. At some point the investment demand for physical silver will put a strain on mined supply.

More interesting than the demand from individual silver investors as represented by record silver eagle/silver maple leaf buyers is Indian and Chinese demand for silver bars. In 2013, India imported a record 6,125 tonnes of silver. This up a 189% increase over what India imported in 2012. This was in response to the gold import controls put in place by the Indian Government in July 2013. The 6,125 tonnes represents 21% of the total amount of silver supplied globally from mines, scrap recycling and Government sales. While the official numbers have not been released for 2013, it is likely that 2013 saw a decline from 2012 due to mine closures from the price decline. In the first two months of 2014, India imported 920 tonnes of silver, or 5,520 tonnes annualized. In my opinion, the unanticipated demand from India will eventually be reflected in higher silver prices, as the high volume of demand will likely affect relative supply.

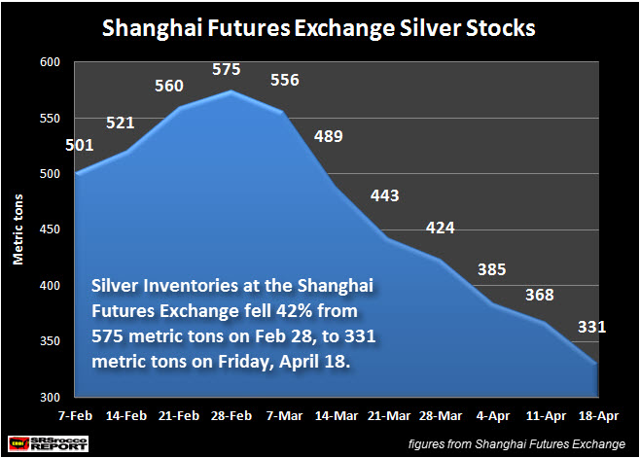

While India has been importing record amounts of silver, recently an extraordinary amount of silver has been withdrawn from both the Comex and the Shanghai Futures Exchange (source: SRSrocco.com):

(click to enlarge)

In the week after the above graph was produced, another 73 tonnes were removed from the SFE. Since the end of February, a total of 317 tonnes of silver have been taken out of the Shanghai Futures Exchange. Because the Chinese Government highly regulates and restricts silver exports (Laws of the Peoples Republic of China), it is highly probable that this silver was either put away in private investment vaults or used in commercial applications inside of China.

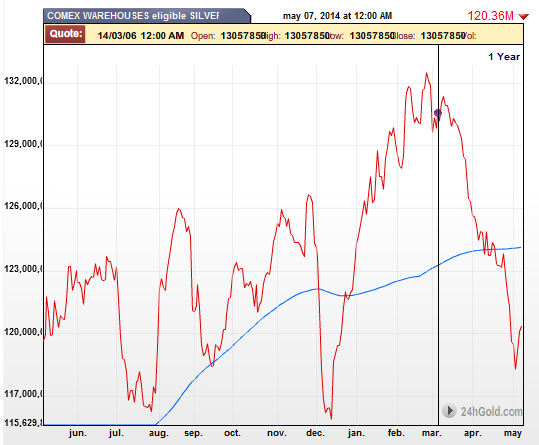

Similarly, since the end of February, 368 tonnes of silver have been removed from the "eligible" Comex vault accounts (source: 24hgold.com)

The "eligible" Comex vault account is the account, which holds silver (or gold) that is being held in Comex vaults for safekeeping. As with China, this silver is either being transferred to private vaults or is being used in industrial applications.

The removal of nearly 700 tonnes of silver from the SFE and the Comex in less than two months, in my opinion, is an indication of an acceleration in demand for silver and an indication that the silver bar market is starting to get tight. This demand is coming from several other sources besides India. For instance, Turkey's silver imports hit a new record in 2013, more than doubling from 2012.

Because of the rapidly growing demand for silver from all over the world, and because it would appear that the supply of silver is starting to get tight, the price of silver is going to have to move a lot higher as a mechanism of creating some kind of equilibrium between supply and demand. While above-ground visible stocks of silver, like the Comex, the SFE and the various physical silver bullion trusts are potential sources of supply in excess of mining output and scrap recycling, as those sources of silver become depleted a shortage will develop unless the price of silver moves higher.

Finally, the current gold/silver ratio is signaling the potential for at least a big short-term move higher for silver:

)

Source: StockCharts.com

As you can see, the gold/silver ratio is back up to the level it hit at the end of July 2013, right before silver spiked up from $19 to $25:

Source: StockCharts.com

Although it may not seem like it, gold has been one of the best performing investments YTD in 2014. In comparison, silver is slightly down for the year. If the gold/silver ratio repeats its "behavior" from last summer, it is highly probable that silver will spike higher from here, at least in the short term.

I believe that we are still in the secular bull market for gold and silver that began in 2001. The first two legs of this bull market topped out in 2006 and 2011. It is my view that we are about to enter the third leg and that this third leg will experience even bigger percentage gains than what occurred in the first two legs. Furthermore, I believe the fundamental shortages of physical gold/silver that can be delivered to the possession of large buyers will drive the price movement. This being the case, I believe that the trading and fundamental factors as I analyzed them are the start of this process.

In the context of my analysis, I believe silver will ultimately experience significantly higher rates of return than gold over the next few years. The safest way to play silver is to buy 1 oz U.S. minted silver eagles and keep them under your own lock and key. If you want to "index" the price of silver for a shorter-term trading play, I recommend buying the iShares Silver ETF (SLV). If you want to leverage SLV you can always buy call options on it. More aggressive traders can get long ProShares Ultra Silver ETF (AGQ), or VelocityShares 3x Long Silver ETN (USLV). I also have some interesting silver mining stock ideas that I will publish in the near future.