How Inflation Could Be Caused in 15 Minutes

News

|

Posted 21/10/2015

|

6871

Jim Rickards Via Strategic Intelligence

One of the conundrums of monetary policy over the past eight years is the Federal Reserve’s failure to cause inflation. This sounds strange to most. People associate inflation with misguided monetary policy by central banks, especially the Fed.

So-called ‘money printing’ is seen as a certain path to inflation.

The Fed has printed almost $4 trillion since 2008. Yet inflation (at least as measured by official statistics) is barely noticeable. With so much money around, where’s the inflation?

Well, the Fed has been printing money, but few are lending it or spending it. The banks don’t want to make loans, and consumers don’t want to borrow.

In fact, the private sector on the whole has been deleveraging — selling off assets and paying off debt — even as public debt expands. The speed at which consumers spend money (technically called velocity) has been sinking like a stone.

This divergence between money creation and money use can be seen clearly in the two charts below.

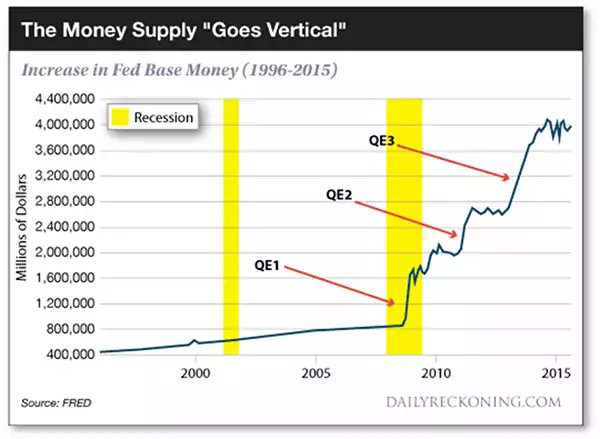

The first chart shows the increase in Federal Reserve base money since 1996.

From 1996–2008, it increased at a steady pace, exactly as Milton Friedman and other monetarists had recommended since the 1970s.

Beginning in 2008, the money supply ‘went vertical’ with three successive quantitative easing (QE) programs of money printing. These are highlighted on the first chart as QE1, QE2 and QE3.

The second chart below shows declining velocity over the same period. In effect, the money printing from 2008 to 2015 was cancelled out by the declining velocity over the same period. The result was practically no inflation.

US base money supply (shown in the first chart) has increased from $800 billion in 2008 to over $4 trillion today. However, the turnover or ‘velocity’ of money (shown in the second chart) has collapsed over the same period.

Increased money supply alone does not cause inflation.

The money must be borrowed and spent. The absence of lending and spending (as shown in declining velocity) is one reason disinflation and deflation have been more prevalent than inflation.

There’s another reason for the absence of inflation.

The world is confronting powerful deflationary head winds, principally demographics and technology. The rate of increase of global population peaked in 1995.

Today populations are in decline in Japan, Russia and Europe. They are also stagnant elsewhere outside of Africa and the Middle East.

Fewer people means less aggregate demand for goods and services. Improved technology and efficiencies from predictive analytics have lowered the cost of everything from inventories to transportation. This combination of less demand and greater efficiency results in lower prices.

The final reason is globalisation. The ability of global corporations to locate factories and obtain resources anywhere in the world has expanded the pool of available labour.

Global supply chains and advanced logistics mean that products like smartphones are created with US technology, German screens, Korean semiconductors and Chinese assembly. The phones are then sold from India to Iceland and beyond. Yet many of the workers are paid little for their value-added in these global supply chains.

These deflationary tendencies create a major policy problem for the Fed.

Governments need to cause inflation in order to reduce the real value of government debt. Inflation also increases nominal (if not real) incomes. These nominal increases can be taxed.

Persistent deflation will increase the value of debt and decrease tax revenues in ways that can cause governments to go bankrupt. Governments are therefore champions of inflation and rely on central banks to cause it.

In the past eight years, the Fed has tried every trick in the book to cause inflation.

They have lowered rates, printed money, engaged in currency wars, used ‘forward guidance’ (promises not to raise rates in the future), implemented ‘Operation Twist’ and used nominal GDP targets.

All of these methods have failed.

The Fed then shot itself in the foot by tapering asset purchases, removing forward guidance and threatening to raise rates from 2013–15. These tightening moves made the dollar stronger and increased deflationary forces even as the Fed claimed it wanted more inflation.

This two-year tightening episode is proof (not that any was needed) that the Fed does not understand the dynamic deflationary forces it is now confronting.

My expectation is that the Fed will soon reverse course and return to some form of easing — probably more forward guidance and a cheaper dollar.

If I’m wrong and the Fed actually does raise rates, deflation will get worse and a global recession will emerge.

A central bank’s worst nightmare is when they want inflation and can’t get it. The Fed’s tricks have all failed. Is there another rabbit in the hat?

Actually, yes.

The Fed can cause massive inflation in 15 minutes.

They can call a board meeting, vote on a new policy, walk outside and announce to the world that effective immediately, the price of gold is US$5,000 per ounce.

The Fed can make that new price stick by using the Treasury’s gold in Fort Knox and the major US bank gold dealers to conduct ‘open market operations’ in gold. They will be a buyer if the price hits US$4,950 per ounce or less and a seller if the price hits US$5,050 per ounce or higher.

They will print money when they buy and reduce the money supply when they sell via the banks. This is exactly what the Fed does today in the bond market when they pursue QE. The Fed would simply substitute gold for bonds in their dealings. The Fed would target the gold price rather than interest rates.

Of course, the point of US$5,000 gold is not to reward gold investors.

The point is to cause a generalised increase in the price level.

A rise in the price of gold from US$1,000 per ounce to US$5,000 per ounce is really an 80% devaluation of the dollar when measured in the quantity of gold that one dollar can buy.

This 80% devaluation of the dollar against gold will cause all other dollar prices to rise also. Oil would be US$400 per barrel, gas would be US$10.00 per gallon at the pump and so on.

There it is — massive inflation in 15 minutes: the time it takes to vote on the new policy.

Don’t think this is possible? It has happened in the US twice in the past 80 years. You may even know some people who lived through both episodes.

The first time was in 1933 when President Franklin Roosevelt ordered an increase in the gold price from US$20.67 per ounce to US$35.00 per ounce, nearly a 75% rise in the dollar price of gold.

He did this to break the deflation of the Great Depression, and it worked. The economy grew strongly from 1934 to 1936.

The second time was in the 1970s when President Richard Nixon ended the conversion of dollars into gold by US trading partners. Nixon did not want inflation, but he got it.

Gold went from US$35 per ounce to US$800 per ounce in less than nine years, a 2,200% increase. US dollar inflation was over 50% from 1977 to 1981. The value of the dollar was cut in half in those five years.

History shows that raising the dollar price of gold is the quickest way to cause general inflation.

If the markets don’t do it, the government can. It works every time.

History also shows that gold not only goes up in inflation (the 1970s), but it also goes up in deflation (the 1930s). When deflation runs out of control, as it did in the 1930s, the government will raise the price of gold to break the back of deflation.

They have to — otherwise, deflation will bankrupt the country.

Do I expect deflation to run out of control soon? Actually, no. Deflation is a strong force now, but I expect that eventually the Fed will get the inflation they want — probably through forward guidance, currency wars and negative interest rates.

When that happens, gold will go up.

Still, if deflation does get the upper hand, gold will also go up if the Fed raises the price of gold to devalue the dollar when all else fails.

This makes gold the ultimate ‘all weather’ asset class. Gold goes up in extreme inflation and extreme deflation. Very few asset classes work well in both states of the world.

Since both inflation and deflation are possibilities today, gold belongs in every portfolio as protection against these extremes.