How ‘Guaranteed’ is YOUR Bank Deposit?

News

|

Posted 19/05/2023

|

12357

The recent banking crisis in the US has sharpened people’s focus on the make up of the US banking system and the FDIC’s deposit guarantee that sits behind them. It’s also prompted Australians to look a little closer at the Aussie set up too.

For newcomers, the FDIC is the Federal Deposit Insurance Corporation and “is an independent agency created by the Congress to maintain stability and public confidence in the nation’s financial system. The FDIC insures deposits; examines and supervises financial institutions for safety, soundness, and consumer protection; makes large and complex financial institutions resolvable; and manages receiverships.” [their website]

The equivalent in Australia is APRA who manage our own Financial Claims Scheme (FCS) which “is an Australian Government scheme that provides protection to deposit-holders with Australian incorporated banks, building societies and credit unions (known as authorised deposit-taking institutions or ADIs), and general insurance policyholders and claimants, in the unlikely event that one of these financial institutions fails.

The FCS is a government-backed safety net for deposits of up to $250,000 per account holder per ADI. It also covers most general insurance policies for claims up to $5,000, with claims above $5,000 eligible if they fulfil certain criteria.

Once activated by the Australian Government, the FCS is administered by the Australian Prudential Regulation Authority (APRA).” [their website]

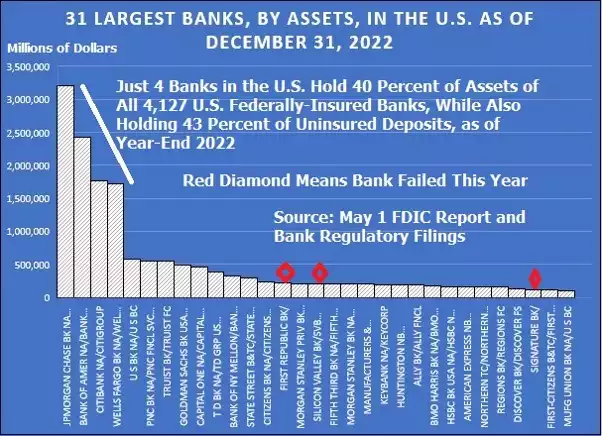

Part of the sharpened focus is looking under the hood of these US banks. Like Australia, the US is very heavily weighted into just a few banks. However, unlike Australia, the US has literally thousands of smaller banks, all covered by the FDIC; 4127, sorry 4124 of them to be exact (moving target…).

The following chart may be considered a cause for concern, particularly in light of it predating the smaller bank run crisis...

As alarming as is it for just 4 banks to be holding that much (over $9 trillion) of the US’s wealth, what is more alarming is how much of it is not insured. The total of deposits in all US banks above the $250K guarantee limit was a staggering $7.7 trillion as at 31 December 2022. Of that, $3.286 trillion uninsured deposits, 43% of the total, are in just those 4 banks. Again, that is at a date well before the crisis that saw a run of withdrawals (many above $250K) from small banks to larger ones.

Now consider this statement from the FDIC:

“Following the 2008-2013 banking crisis, the reliance by the U.S. banking system on uninsured deposits grew dramatically, both in dollar volume and as a proportion of overall deposit funding. From year-end 2009 through year-end 2022, uninsured domestic deposits at FDIC-institutions increased at an annualized rate of 9.8 percent, from $2.3 trillion to $7.7 trillion.”

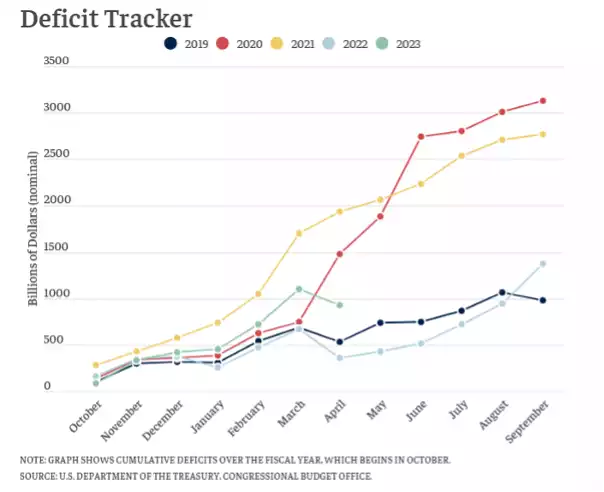

Let’s pause and put that $7.7 trillion into perspective. It is nearly one third of all USD GDP, the total of all its outputs. It is more than the already ludicrous deficits of the US Government for the past 3 years combined. Digressing a little, but you can’t unsee the chart below as an insight into the bigger problem here…

Bank runs, as we saw just weeks ago, get a momentum of their own regardless of guarantees and other measures. The US has allowed the uninsured bank deposits to more than triple since the last banking crisis, the GFC. The offset of this banking risk for depositors (who are unsecured creditors to the bank) was interest payments. With the inverted yield curve, the banks can’t pay a decent interest rate and so the depositors are leaving to seek higher yields in bonds and capital growth in gold, the latter with no risk whatsoever. OR they are leaving small banks for large banks in the belief they are somehow safer despite the above clearly spelt out uninsured deposit concentration risk.

In Australia we have a triple threat of not only the same $250,000 limit per ADI, but additionally ‘banks’ being part of the same ADI (eg Westpac and St George and Bank of Melbourne and Bank SA are all the same ADI, so only $250K in total!) and ALSO a cap of $20b per ADI. Australia’s own Financial Stability Board revealed the following bombshell:

“The limit of AU$20 billion per ADI would not be sufficient to cover the protected deposits of any of the four major banks, even though their assets would ultimately be sold to fund any depositor reimbursements if the FCS was used in the resolution process. In any event, there could be circumstances in which these banks would be deemed too big to undergo payout and liquidation.”

Many do not realise how close the majors came to the brink in the GFC. Kevin Rudd in his book “The PM Years” recounted:

"We were particularly worried about three Australian banks - two second tier, one first tier - as we developed a range of contingency plans to prevent the collapse."

Indeed, it was the US Fed itself that came to the rescue with USD4.5b loaned to NAB and USD1.09b to Westpac just in that 2008-09 period.

Since then, we have had our Parliament quietly bring into law the so called Bail In provisions as we have shared here repeatedly, the original now with nearly 300k reads. Again if you haven’t read these, the latest, interestingly written in the depths of COVID is a great place to start.

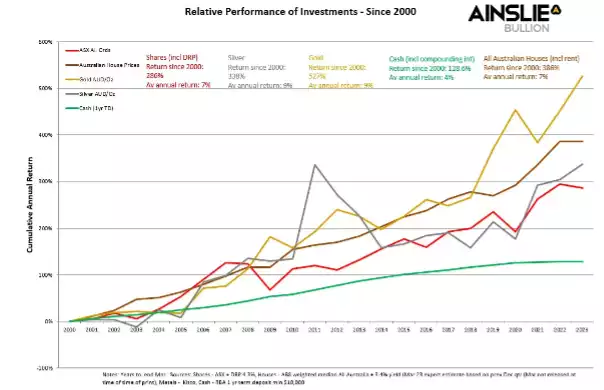

These are all, in theory, low probability events. But as with our article just Monday on the US Debt Ceiling debacle (and again refer that earlier deficit chart to see how they got there), even at a 4% probability, the impact of that low probability event is so absolutely catastrophic it begs why you wouldn’t insure against it. And again, as we showed in Monday's article and reposted below, the performance of your ‘boring’ ‘insurance’ of gold has been the best performing asset this century.

Balance your wealth in an unbalanced world and consider the 5000 year old, no counterparty risk, hard asset that has seen all of this come and go before. Gold.