Highest Ever Negative Yielding Bonds - ECB Capitulates

News

|

Posted 19/06/2019

|

8606

Another record was set last night. The amount of negative yielding global sovereign bonds has never been higher. There is now $12 trillion in negative yielding sovereign debt. So bad is the global economy, so nervous is big money, that it is prepared to PAY for the privilege of owning government issued debt. You only pay someone you are lending money to if you think that ‘investment’ is going to return a better negative outcome than putting your money elsewhere for a worse negative outcome.

This latest extension of negative yielding debt is courtesy of the latest central bank capitulation, this time from the European Central Bank. Just 2 years from when the ECB president, Mario Draghi, laid out how they were going to commence tightening their record breaking Quantitative Easing program and negative rates because the Eurozone was experiencing a "strengthening and broadening recovery", last night Draghi conceded defeat stating that unless their struggling economy and lagging inflation doesn’t improve that "additional stimulus will be required" such as rate drops and more QE.

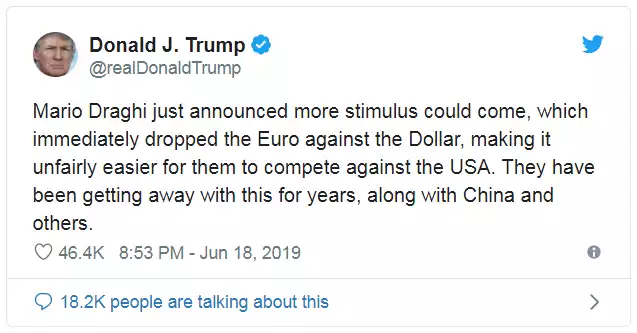

Needless to say that saw the Euro plummet, USD rise and gold initially fall before the market thought ‘wait a minute’…. that does not bode well for the chances of an imminent recession… and gold rebounded to still finish the session mildly higher despite the stronger USD. The devaluation of the EUR against the USD certainly caught one person’s eye:

Ironic much? Trump has been hammering the US Fed equivalent Jerome Powell about easing rates and stimulating the US economy (conveniently forgetting to mention a consequent lower USD). As we reported on Monday, tomorrow the US Fed has its monthly meeting. Whilst the market is only giving a 20% chance of a rate cut this month, events last night raise the question of a ‘pre-emptive’ move by the Fed. When Draghi made those comments off the back of how bad their economy was… Euro shares rallied! Bad news is good news is back with a vengeance. “Not fair!” pouts Trump..

Trump will be desperate for a rate cut tomorrow. Even though the 10 year US Treasury yield crashed to just 2.01% last night (its lowest since his election for an added bit of irony), that is still a handsome premium over say the 10 year German Bund which now has an all time record low yield of MINUS 0.32%. That means money will seek US Treasuries and drive up the USD. Not what Trump wants in this new global currency war where the lower your currency the more competitive your exports.

At home yesterday the AUD fell further off the latest ABS housing data confirming house prices fell in every Australian capital city in the first quarter of this year, down 3% for the quarter and 7.4% for the year with another $170 billion sliced from the total value of Aussie’s homes.

Tomorrow we will outline the results of one of the biggest surveys of US Fund Managers prompting the author to state:

“FMS investors have not been this bearish since the Global Financial Crisis, with pessimism driven by trade war and recession concerns”

Amid such pessimism by the biggest investors in town, is it any wonder so many are prepared to pay for government debt and gold continues to strengthen.