Debt v Gold

News

|

Posted 13/11/2014

|

5975

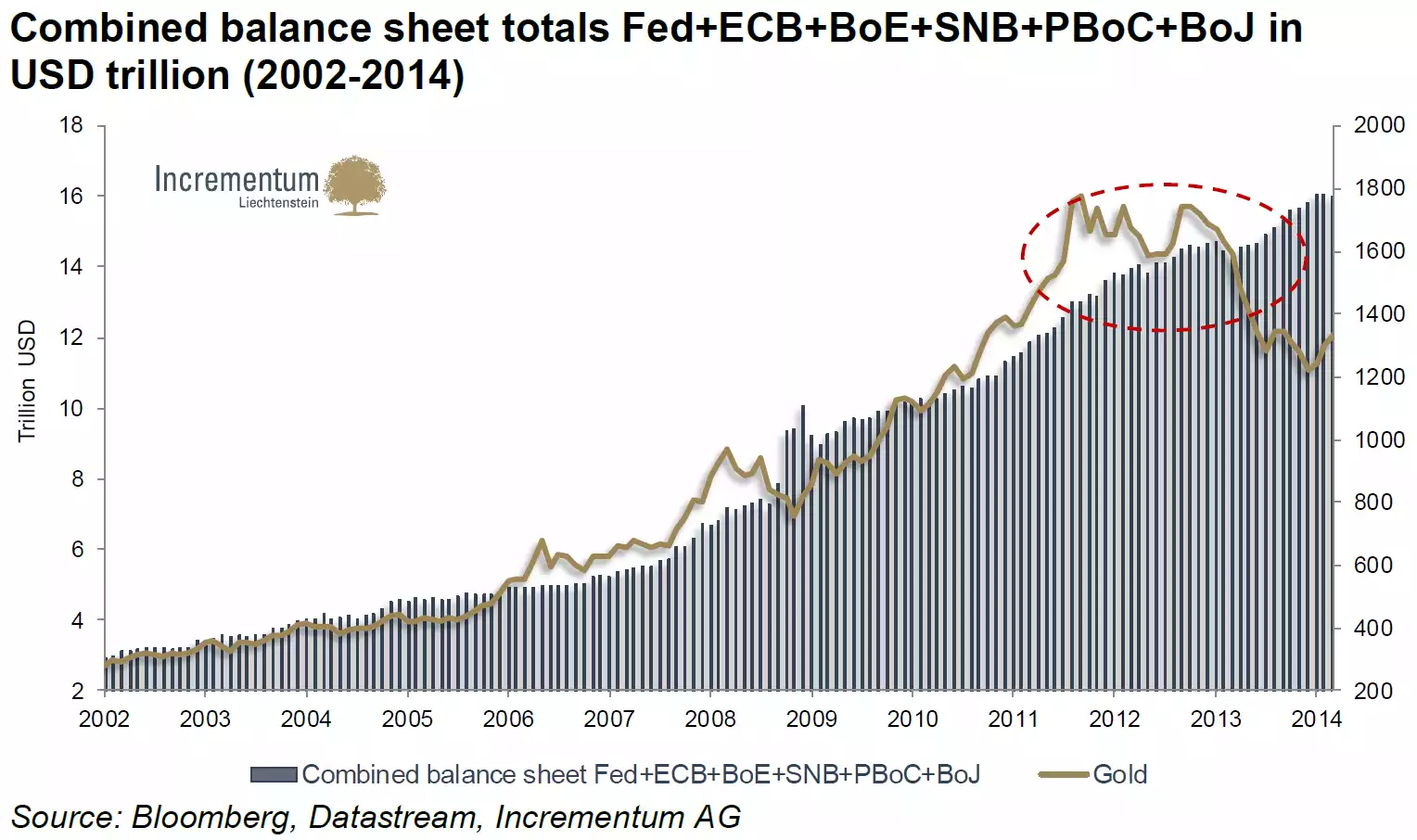

The accumulation of unsustainable government debt is one of the key reasons people buy gold and silver. The chart below clearly illustrates just how insane this has become as governments print money (accumulating debt on central bank balance sheets) to run continual deficits to remain elected and keep markets artificially buoyant and depress their respective currencies against the other to globally compete (which becomes a death spiral when everyone does it….). Last year we saw the gold price deviate from its historic trend of protecting wealth against this debt binge. Many believe this was brought about by orchestrated shorting of paper derivatives and defies global (particularly Eastern) demand. That East and West dynamic has seen 2 distinctly different approaches. China has played the debt game too but has bought things of intrinsic value like gold (at the low prices) in epic amounts and built infrastructure (even derided for its ‘ghost cities’). The US has (simplistically) bought shares at very high PE’s and which have repeatedly shown can lose 50-80% in value over night… The disconnect depicted below looks set to reverse. As a reminder $16t is $16,000,000,000,000….