6 Forces to “Propel” Gold & Silver

News

|

Posted 28/09/2020

|

9357

News is filtering through that the Fed may have stepped back from the plate and markets got very jittery last week. Today we share the latest excellent insights from Crescat, whose investment insight just saw them get make the top of Bloomberg News’ hedge fund monthly performance table for the third straight month and the fourth month this year. i.e. they are worth listing too. They believe we are still in the early days of a secular bull market in gold and silver and this correction is an ideal dip buying opportunity.

“The Reckoning Is Upon Us

Decades of fiscal profligacy are culminating in an explosion of government debt that is poised to bring simmering monetary debasement to a boiling point. Central bank interventions have aided and abetted reckless government spending that has obfuscated poor underlying organic growth fundamentals. Instead of laying the groundwork for future real economic growth, monetary authorities have fostered a euphoric investment environment with delusional asset valuations. Paradoxically, we are past the point of no return where the stimulative policies that have created this frenzy are the death knell for the economy. The world is suffering from a debt overdose. It now must face the inevitability of collapsing financial asset prices and synchronized fiat currency devaluation.

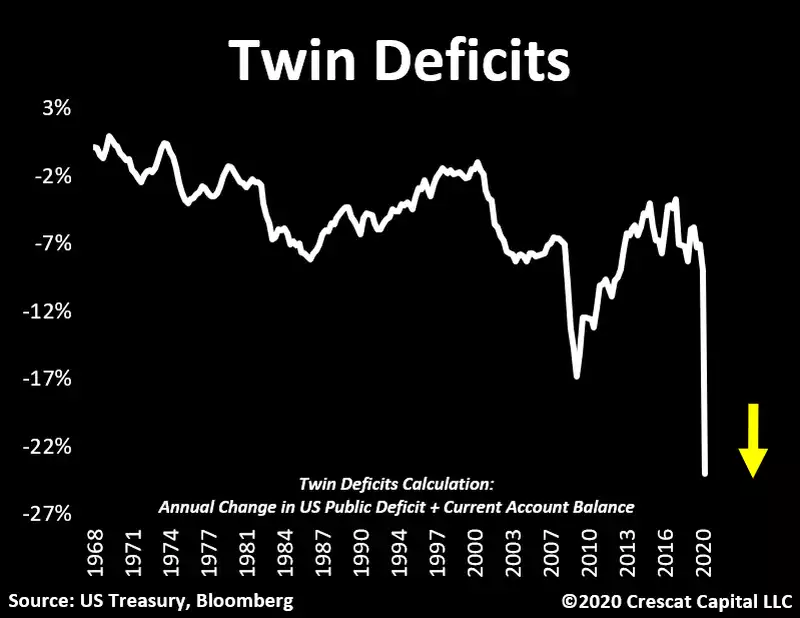

In the US, we have recently seen a precipitous increase in government deficits to World War II levels, which are now accompanied by a significant decline in the trade balance. The recent shrinkage in net exports strongly suggests that a deep new slump in the current account is underway. Based on Crescat’s estimates, the US twin deficit is on track to reach over 25% of nominal GDP which should soon be the worst level ever reported.

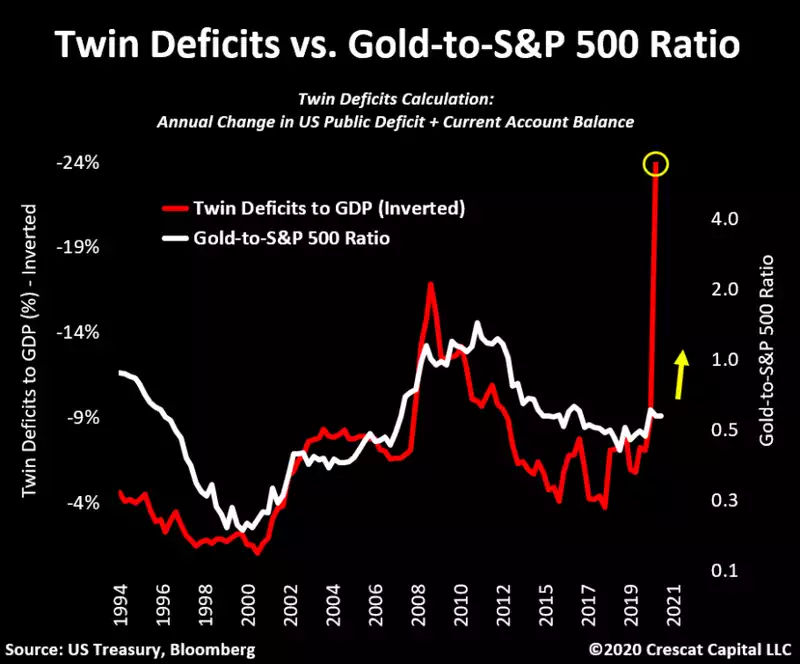

Fortunately, the severity of these long-standing macro imbalances helps set the stage for an incredibly optimistic outlook for precious metals, especially relative to equity markets. In the chart below, we can see a clear relationship between twin deficits (inverted) and the gold-to-S&P 500 ratio. During times of fiscal disorder, monetary metal tends to outperform overall stocks which suggests that a significant move in this ratio is still ahead of us. Let us not forget that this time around policy makers are also fighting “deflation” tooth and nail. The necessary expansion of the monetary base to suppress interest rates and thereby create a negative and declining real interest environment should serve as a major tailwind for the gold-to-S&P 500 ratio to continue to rise.

A Forthcoming of a Key Macro Event

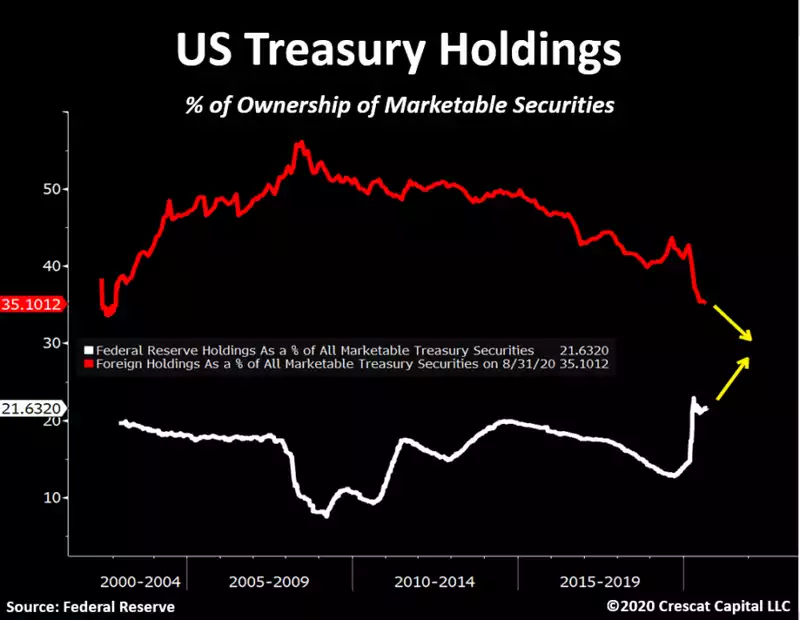

By the end of 2021, $8.5 trillion of US Treasuries will be maturing and, at the current macro conditions, the US government will have no option but to roll over its debt obligations. Consequentially, this will likely cause a shift in the role of monetary policy. Allow us to elaborate. Foreign investors now own the lowest percentage of outstanding US government securities in 20 years. Historically, they funded over 50% of all marketable Treasury securities. Today, that number has dropped to 35%. The Federal Reserve, meanwhile, has increasingly become the buyer of last resort. It now owns a record 22% of all marketable Treasuries. This convergence of ownership is particularly dangerous and appears irreversible. Given the current record government debt to GDP, high unemployment, and large budget deficit, we expect the Fed to monetize the government’s debt burdens at the highest rate ever, from now through 2021. To reiterate our views from prior letters, over-indebtedness and the need for further monetary expansion is a global phenomenon that we believe will lead to the value destruction of all fiat currencies relative to gold, not just the US dollar.

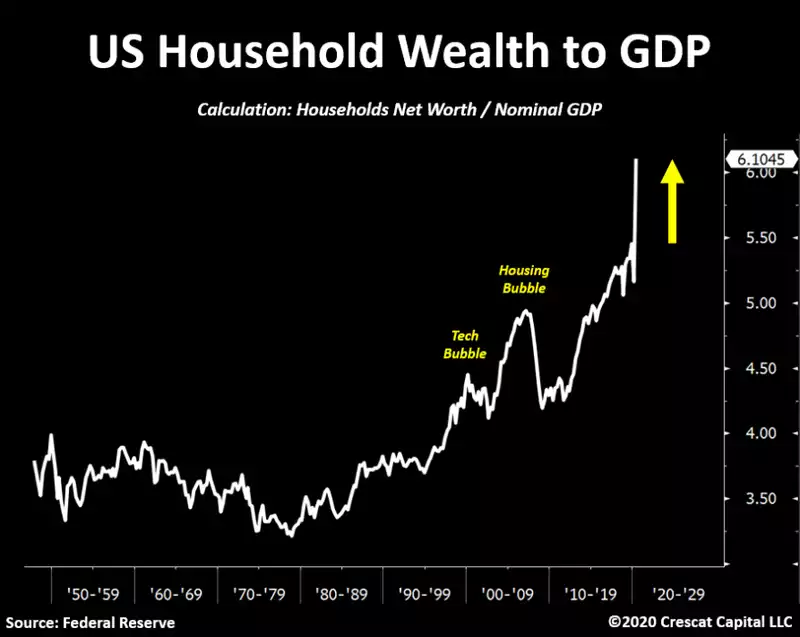

Policy makers are indeed hamstrung. The dependency on extreme monetary policies to maintain the stability of financial markets has become a key part of every central bank mandate. What is puzzling however, is the fact that asset prices have never been so detached from underlying fundamentals. US households are now worth over 6x today’s GDP, a number far higher than any other Fed-induced asset bubble, including both the dotcom mania in 2000 and the housing bubble that preceded the 2008 global financial crisis. Today’s excesses are anything but business cycle low behavior. It is quite the opposite. We are still at a major asset bubble peak. Meanwhile, the economy is already in a recession, one that is pre-destined to linger based on our macro analysis. As we have seen throughout history, the unwinding process from absurd asset valuations leads to real damage in the overall economy. Asset bubbles always burst. There is a business cycle and it is intertwined with security prices. Today, the two have diverged in the short term in a perverse and unsustainable way based on massive raw speculation. There will be a reckoning.

There Is Only One Way Out: Monetary Debasement

The overarching message from central banks remains consistent; none of them can sustainably afford having a strong currency. The set-up of artificially low rates combined with ballooning fiscal deficits, extreme monetary dilution, and inflated risky assets creates, in our view, a veritable utopia for gold and silver. We are in a debt trap globally. Monetary debasement is unavoidable.

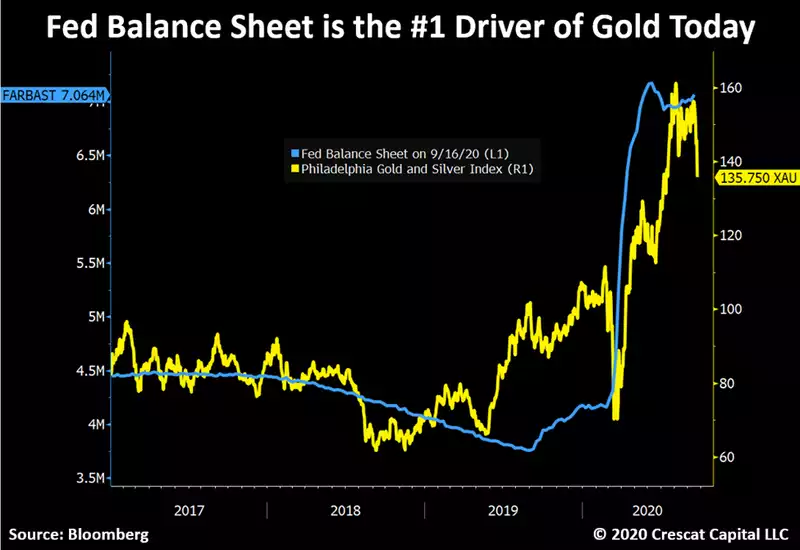

Fed Balance Sheet Expansion Set to Resume to New Record Levels

In the past several days, it seems the combination of gold bulls, stock market bulls, and dollar bears are getting nervous that the Fed balance sheet expansion has stalled since its peak in early June. In our analysis, Fed liquidity injections have been the number-one driver for gold since the Fed’s quantitative tightening experiment in 2018 and the repo crisis which pivoted it back to quantitative easing in late 2019 as shown in the chart below.

We believe there are at least six structural forces that will pressure the Fed to further expand its balance sheet at new record levels and propel undervalued gold and silver prices much higher in the near term:

- The stock market bubble bursts and the Fed must intervene

- The Treasury needs the money and the Fed must intervene ($8.5 trillion in Treasuries coming due by year end 2021 and a record budget deficit that must be funded)

- Left to their own devices, interest rates start rising and the Fed must intervene

- Unemployment remains too high and the Fed must intervene

- Inflation remains to too low and the Fed must intervene

- The dollar keeps strengthening versus other fiat currencies and the Fed must intervene

In our strong view, this is a much-needed correction in gold to shake out the weak hands. We strongly believe it is an excellent buying opportunity in what is still the very early stages of a new secular bull market for precious metals.”