5 Long Term Cycles – Are we at ‘the top’?

News

|

Posted 18/05/2022

|

12735

At a time of monumental change in our global economic and geopolitical setup, financial commentator and author Charles Hugh Smith yesterday looked back at his calls on what he sees as the 5 ‘long-wave cycles’ that he first posited in 2007. Its worth sharing in full as it maps a similar mental journey many of us have been on since the GFC and reminds us of how tectonic the shifts happening right now could be.

“The decline phase of S-Curves can be gradual or a cliff-dive.

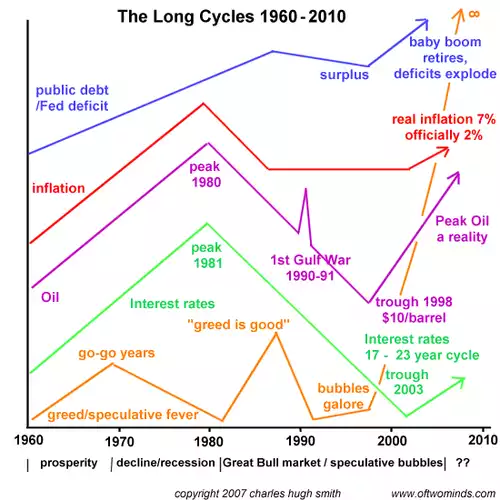

Way back in 2007 I charted five long-wave cycles that I reckoned consequential:

- Public debt (accumulating federal deficits)

- Inflation

- Oil (energy)

- Interest rates

- Speculative fever

Fifteen years ago, my chart look-ahead was about three years, to 2010, with the basic idea being that these long-term cycles had already turned or were about to turn. Looking back, I should have added a few other long cycles: demographics, for example.

I have two takeaways looking at this chart 15 years later. You probably have similar takeaways.

1. I underestimated the status quo's ability to kick the can down the road for a decade. The motivation to kick the can down the road was never in doubt; what was in doubt was the system's ability to respond to doing more of what's failed spectacularly and keep on keeping on more or less unfazed.

2. After 15 years of frantic can-kicking, the cycles have indeed turned. I would say the predicted turns were correct but frantic can-kicking extended the existing cycle of hyper-financialization / hyper-globalization an extra decade.

Various dynamics extended the hyper-financialization / hyper-globalization bubble phase. Fracking in the U.S.--funded by the massive expansion of cheap credit--extended the global energy abundance as the resulting losses were swept away in a tsunami of cheap credit. Zombie frackers were fed as many billions in new loans as were needed to keep the cheap oil flowing.

The whole shebang was at risk of unraveling in 2011, but China's gargantuan credit expansion saved the day, and did so again in 2016. But China's credit expansion has now reached systemic limits, and so those relying on China to save the global economy yet again from the banquet of consequences are about to be severely disappointed.

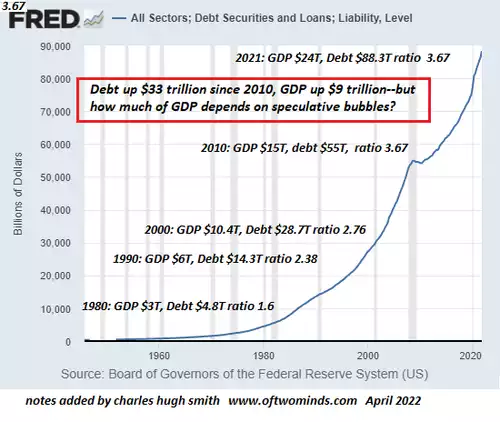

The Federal Reserve's ten-fold expansion of its balance sheet artificially suppressed interest and mortgage rates while various gaming-how-we-measure-what-we-measure tricks understated real-world inflation while hyper-globalization continued deflating costs by shifting production to the lowest-cost regions.

The success of frantic can-kicking to extend hyper-financialization / hyper-globalization pushed speculation into hyper-speculation. The monumental bubbles in stocks and housing 1999-2008 now look modest compared to today's Everything Bubble. The past 20 years have "proven" the profitability of buying the dip which is essentially a bet that there are no limits on frantic can-kicking.

Alas, it is now clear that at long last there are limits on frantic can-kicking, and the cycles have turned. The 40-year decline in interest rates has turned, the four-decade quiescence of inflation has turned, the era of low-cost extraction of abundant hydrocarbons has turned, the cycle of being able to "borrow our way out of trouble" has turned and the era of rewarding hyper-speculation has turned.

How gradual or dramatic the new cycle will be is unknown. If we imagine all these dynamics as a pendulum, the pendulum has been pushed by frantic can-kicking to systemic extremes that will reverse to extremes at the other end of the spectrum (minus a bit of friction).

The decline phase of S-Curves can be gradual or a cliff-dive. While we don't know the decay / unraveling trajectory yet, we can anticipate all these long cycle turns reinforcing each other. It's all one system, after all, and the decay / unraveling of each subsystem will accelerate the decay / unraveling of the other subsystems.

As a general rule, it's a good idea not to stand in the way of the pendulum. Put another way, it's considerably safer to be in the stands watching the great beasts slouching towards Bethlehem than being on the blood-soaked sand of the Coliseum, clutching a wooden sword and a shredded net.”