3 Charts Every Investor Should Heed

News

|

Posted 09/11/2020

|

10141

Markets were steady at the close on Friday and gold, silver and bitcoin all up. Investors are grappling with what looks like a Biden presidency, Democrat house and Republican senate. How will the Republican’s behave in terms of approving stimulus measures in the senate? How will the market fair with no possibility of stimulus until February, winter and an already ballooning 2nd wave of COVD? Will the Fed have to step up further to take up any slack in fiscal stimulus? How effective will or can that be?

Société Générale’s equity strategist undertook a detailed analysis to determine where fair value in the market would be now without Quantitative Easing (QE). Since the GFC we have regularly shared charts showing the correlation between the Fed’s money printing QE program and the US sharemarket. The fact that each time they stopped so did the market, is most simply evidenced in the various program’s naming of QE1, QE2 etc to the ‘clandestine’ “notQE” to the now widely adopted, QEInfinity. It should be no surprise then that SocGen’s analysis shows a widely different result without it. As you can see from the charts below, without QE the S&P500 would be around 1800 (a 48% drop from the current 3500) and the NASDAQ around 5000 (a 58% drop from the current 11895).

The Felder Report also have taken a recent look at this sharemarket and explains their approach thus:

“I like to think of markets and securities in terms of three separate but interrelated dynamics: fundamentals, sentiment and technicals. Fundamentals include things like earnings, net asset value, how those things are trending and valuation relative to them. Sentiment is simply how investors are feeling toward something and technicals are really just a way to analyse the price trend.”

The following are excerpts from this report that applies this simple and intuitive assessment of where we are at at this historic juncture.

Fundamentals

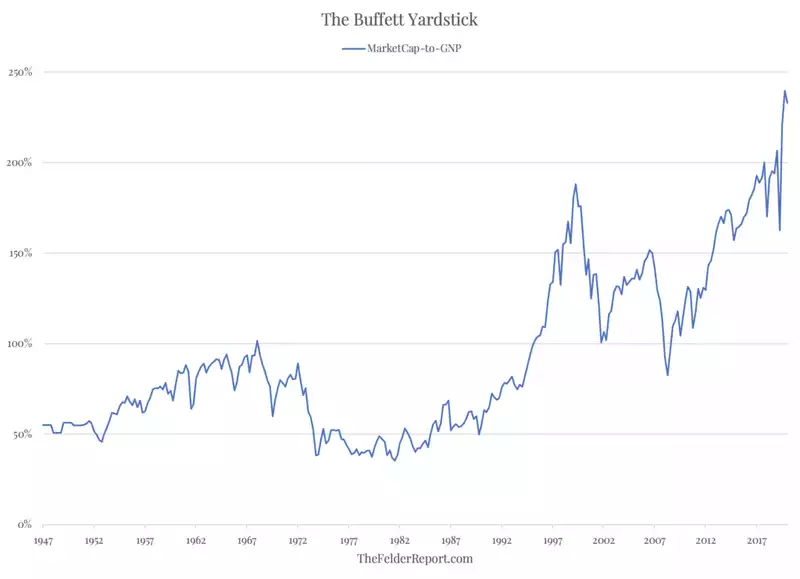

“The chart shows the market value of all publicly traded securities as a percentage of the country’s business–that is, as a percentage of GNP. The ratio has certain limitations in telling you what you need to know. Still, it is probably the best single measure of where valuations stand at any given moment.” –Warren Buffett, December 10, 2001

“The single best measure of valuations, according to Warren Buffett, currently sits just off its highest reading in history. In other words, the stock market has never been as expensive as it is today, largely the product of soaring valuations amid deteriorating fundamentals. Not only does this mean that forward returns will likely be exceptionally poor, it means that downside risk has also never been greater than it is today.”

Sentiment

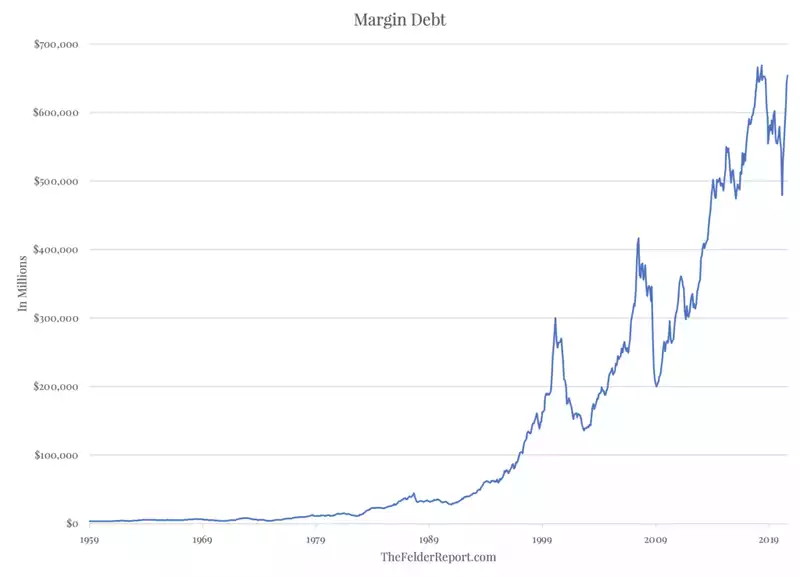

“Even the most circumspect friend of the market would concede that the volume of brokers’ loans—of loans collateraled by the securities purchased on margin—is a good index of the volume of speculation.” -John Kenneth Galbraith, The Great Crash 1929

If the level of margin debt is indicative of the “volume of speculation” then we might infer that, just as we are witnessing unprecedented valuations, those extreme prices have been driven by extreme greed, the likes of which we haven’t seen in generations, if ever before.”

Technicals

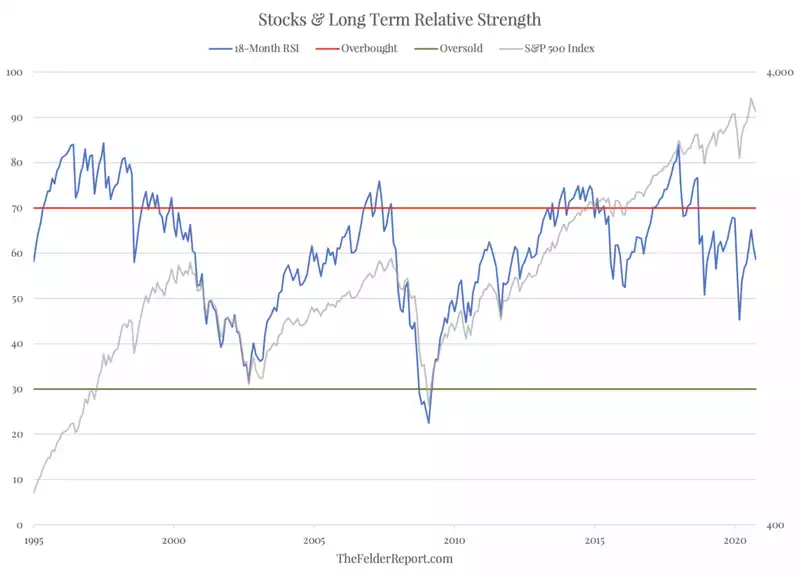

“For me, technical analysis is like a thermometer. Fundamentalists who say they are not going to pay any attention to the charts are like a doctor who says he’s not going to take a patient’s temperature. But, of course, that would be sheer folly. If you are a responsible participant in the market, you always want to know where the market is—whether it is hot and excitable, or cold and stagnant. You want to know everything you can about the market to give you an edge.” -Bruce Kovner, Market Wizards

In analysing the strength of the trend we can use a very simply metric like RSI. In the case of 18-month RSI, oversold readings have proven to be good long-term entry points; Overbought, readings, however, have merely indicated a strong uptrend that may last several more years. By this measure, the strength of the current uptrend peaked nearly 3 years ago and has only been weakening since, putting in a clear pattern of lower highs.”

“Together, these three indicators paint a picture of an extremely overvalued stock market, driven by a speculative euphoria even while the price trend is running out of steam. It is the textbook definition of “late cycle” in the stock market and suggests investors ought to exercise a great deal of caution towards equities as an asset class.”

And so, whilst some may be thinking things will miraculously ‘get better’ now that it looks like Biden is in charge, the reality is anything but. Nothing has actually changed. The US is still a deeply divided state with an election ‘result’ potentially some time off, tackling a massive second wave of the virus, carrying an historically unprecedented debt burden with (currently) next to no inflation to diminish it, and a sharemarket more overvalued than any before it and already showing structural warning signs of unwinding. It would be folly to dismiss this as a “US thing”. We are too interconnected to do that. Hard assets get you outside this house of cards or at the very least, a portion of which in your portfolio, provide a solid foundation. Without that foundation a ‘sink hole’ scenario for your wealth is a real prospect.