“Biggest insolvency crisis of all history” – Coming Soon

News

|

Posted 16/04/2020

|

31559

Last night saw a rush to USD again on the back of a host of awful economic data. Wall Street fell around 2% and in USD terms gold declined 0.6% ($10) to $1717 and as low as $1705, but importantly holding above $1700. However the AUD fell to 63.4c which saw gold in AUD terms rally $33 or 1.2%.

These sharemarket gyrations are a classic human cognitive dissonance as ‘its’ gut knows it makes zero sense to be investing in shares ahead of possibly the worst recession or depression in a century but, as Rabobank's Michael Every put so accurately:

“markets are ecstatic because there is no need to actually do any thinking at the moment. The Fed has made clear that there are to be no losers – or at least that one does not have to bother trying to pick the winners……As in the infamous scene in the movie ‘When Harry Met Sally’, all that markets need to do to make money is to say “I will have what the Fed is having.””

Every is not alone. Global giant BlackRock's Rick Reider stated a similar ‘investment’ philosophy "we will follow the Fed and other DM central banks by purchasing what they’re purchasing, and assets that rhyme with those."

That of course relies on the not so small premise that the Fed’s omnipotence prevails and even if so, the effect of pumping that much money into the system will somehow have no consequences, a topic we have discussed at length over the last week or so.

So let’s quickly look at some of that data from last night that had the sleep walkers second guessing the ‘don’t fight the Fed’ bias:

The US Macro Surprise index (ex Bloomberg) just had the biggest 4 week about-face ever reinforcing everyone was underestimating the effects of COVID-19 and likely still are…

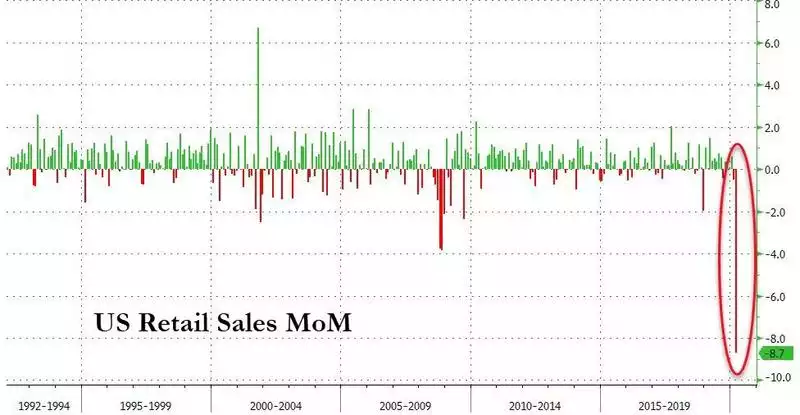

Consumer spending is the largest contributor to GDP and US retails sales just printed the worst monthly drop ever in March:

Note too that March only saw part of the lockdowns and included the biggest monthly surge in food and beverage sales ever….so April promises worse still.

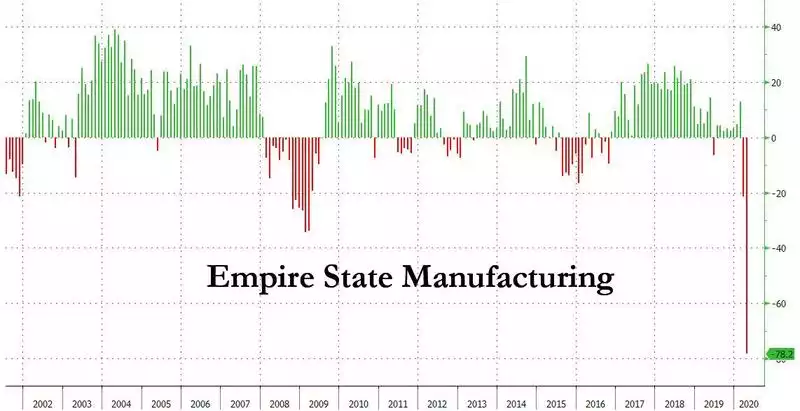

Surely not surprising but against expectations of a -35 print for the New York Fed’s ‘Empire State Manufacturing’ Index we last night saw a -78 print, the worst on record in terms of the size of the miss, the size of the drop and the size of the negative print itself:

As too few people are acknowledging, New York is not the US. New York is just the beginning as this virus inevitably spreads to other major US cities. Below are each of the Fed’s same indices. Only the oil market carnage (which revisited a new low last night) on oil centric Dallas compares SO FAR:

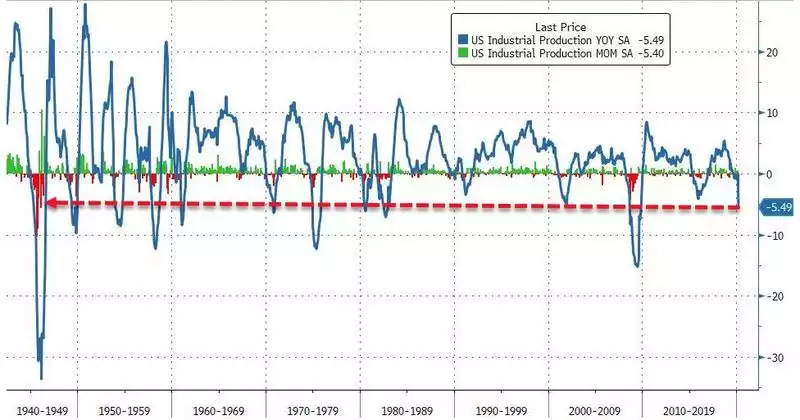

US Industrial Production fell 5.4% in March against expectations of 4% and the worst month on month drop since 1946 and worst year on year drop since the GFC:

Again, putting shareprice and fundamentals into perspective, below shows the bouncing in the Dow Jones industrial Average against the measure of US Industrial Production. Again given March arguably didn’t see the worst (wait for April onwards) how does that bounce look now?

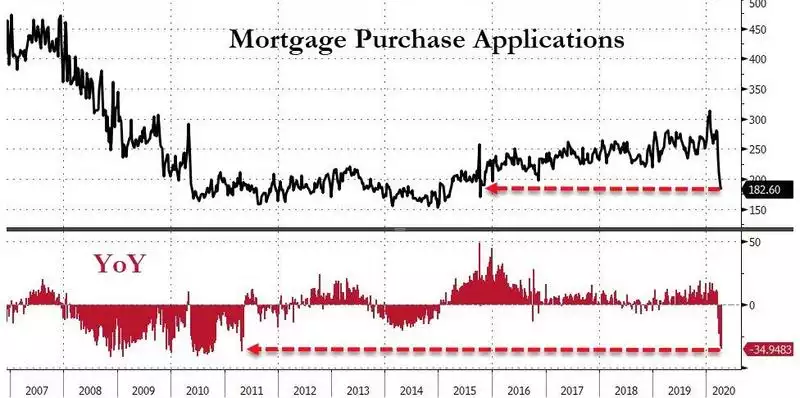

The all important housing market is also plunging. Mortgage Purchase Applications just printed the lowest figure in 5 years and the biggest year on year plunge since 2011.

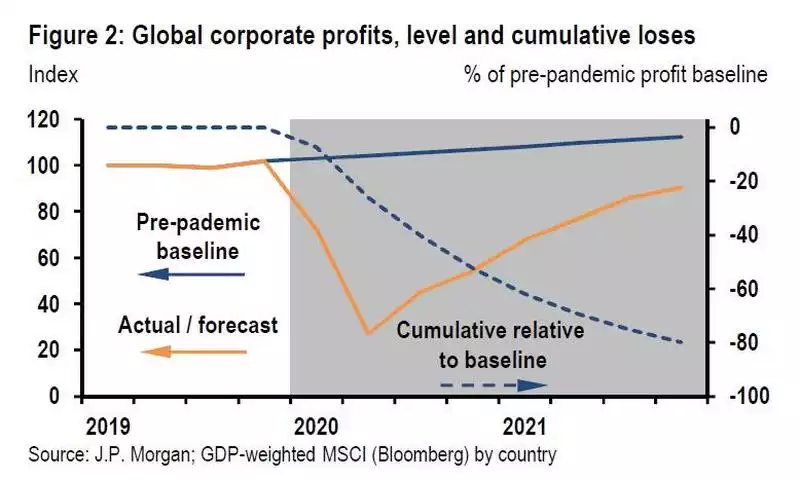

JP Morgan came out with the dire forecast last night that "global corporate profits look set to crater 72% in the year through 2Q20." And debunking the V shaped recovery thesis their chart below shows that even by 2023 those profits will still be 20% below pre-COVID trend because "with corporate debt set to balloon and a significant rise in bankruptcies increasingly likely, the overall deterioration of corporate sector balance sheets will likely be an ongoing legacy of the COVID-19 shock."

Whilst JP Morgan went further than you’d expect a self interested bank to go in such a view it fundamentally still relies on a relatively quick rebound in economic growth, albeit dragging us out of a deep hole. Those subscribed to Real Vision would have already watched or read Raoul Pal’s “The Unfolding” which he described as “one of the more important piece of research I've ever written”. The synopsis states “He lays out his case that COVID-19 may be the catalyst for a multiphase unfolding of the entire global economic system and argues that we are still in the first phase of panic and liquidity. The second and third phases of correction and insolvency are possibly still to come and would take years to complete. Although Raoul describes a truly catastrophic potential scenario, he closes on the hopeful note that this unfolding would be a much-needed reset, and that there is plenty of room to hide in asset classes like U.S. Treasuries, dollars, gold, and bitcoin.”

If you can and haven’t yet watched or read this piece we think you should. Out of respect to subscribers we can’t share it but in the context of what we have laid out above consider the following excerpt:

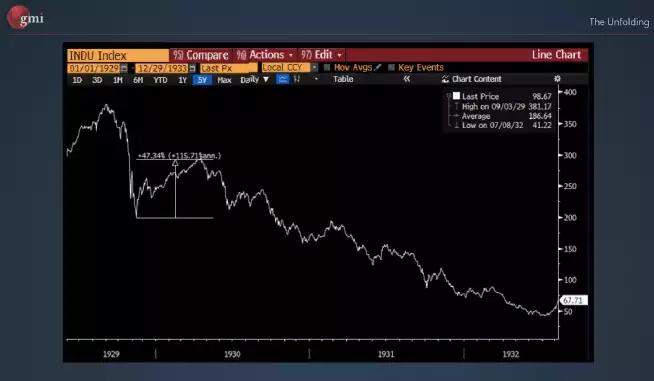

“What I'm thinking is that in a world where negative GDP quarter on quarter continues and continues, well, when nobody has any cash, and everybody's in debt, the answer will be insolvency. I think we're about to face the biggest insolvency crisis of all history, and that we can bring back the chart of the Dow in the 1930s. That was the next phase after the bounce. That was the insolvency event. I think that is really important to note.”

For AUD gold holders the confluence of a rising USD and rising USD Gold price, as we got another example of last night, could see a turbo charged AUD gold price as the AUD falls.