$20,000 Gold v Monetary Base

News

|

Posted 01/06/2015

|

6670

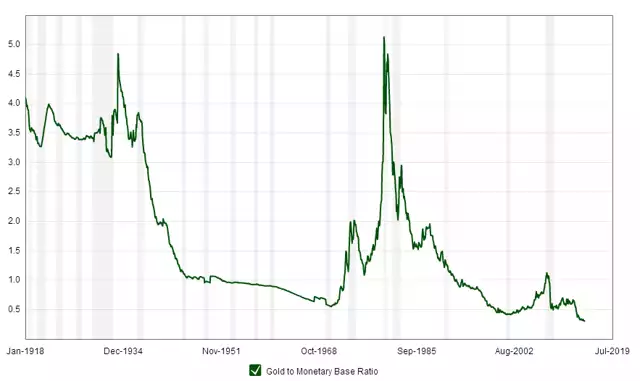

Gold is an alternative currency, it is money in its most fundamental form and has been for thousands of years. So one factor many analysts watch is it’s price against the supply of fiat currency, particularly the world’s (current) reserve currency the US dollar. So for some, one of the most bullish setups for gold is its ratio against the US monetary base. Consider the 3 graphs below… Firstly we all know, through Quantitative Easing (QE), the US has injected an unprecedented amount of ‘money’ into the system, indeed about as much each and every year since the GFC as it created since the Fed was formed nearly a century prior. The first graph shows this clearly..

But much of that money is just sitting in commercial banks (on their balance sheets) and shares and ironically bonds. The graph below clearly shows the former…

And over that period of unprecedented fiat currency creation, real money in the form of gold has actually formed a century long low as a ratio against all that money per the graph below. In this regard analyst Ben Kramer-Miller had this to say:

“Consider that in the 1970's bull market the value of the U. S. gold hoard peaked at 5X the monetary base, or nearly 20X the current ratio, meaning that if gold were to hit the same peak we could easily see $20,000/oz. gold or higher.”