Dalio & The Fall of the US Empire

News

|

Posted 06/05/2020

|

43428

Ray Dalio, head of the world’s largest hedge fund, is famously a ‘big thinker’ macro guy who has both the ability and resources at hand to analyse trends others don’t see, get to properly analyse, or more often, don’t because they just think this time is different. At a time when we are seeing the effects of decades of credit expansion and now the inevitable sabre rattling commence between super powers under internal economic duress, Dalio’s latest book looks at the history of empires holding the mantle of world reserve currency over time, where we may be right now, and where we may be heading.

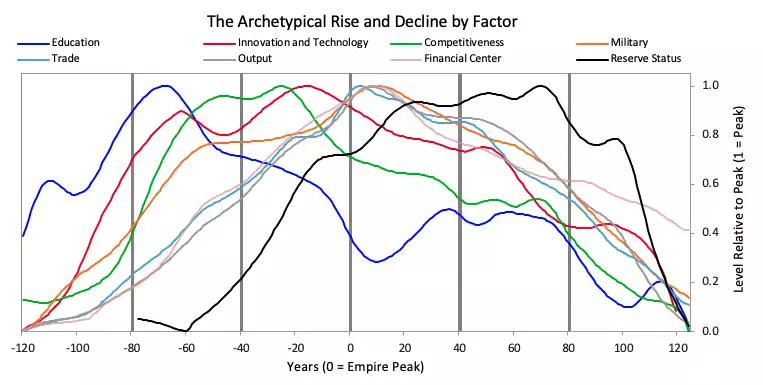

Dalio measures the wealth and power of an empire through 8 factors of roughly equal average weighting: “1) education, 2) competitiveness, 3) technology, 4) economic output, 5) share of world trade, 6) military strength, 7) financial center strength, and 8) reserve currency.”

He then maps the average of each of these measures of strength, with most of the weight on the most recent three reserve countries (i.e., the US, the UK, and the Dutch).

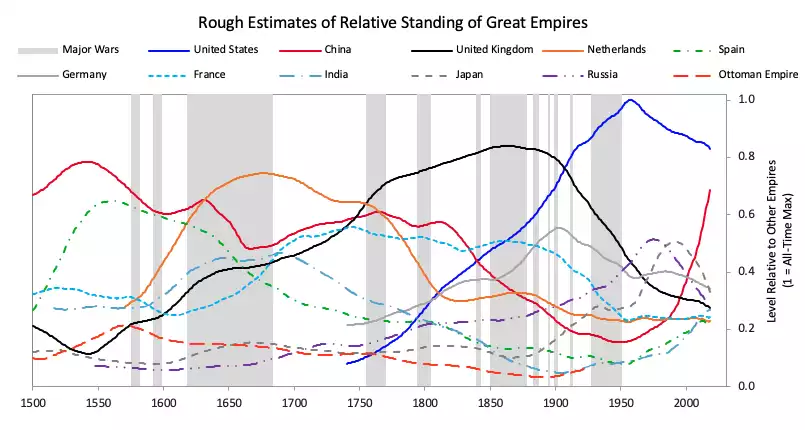

He then maps the collective of these measures as one index of wealth and power for each empire and looks at the cycles of the last 500 years.

“As you can see, nearly all of these empires saw periods of ascendancy followed by periods of decline. The thicker lines represent the four most important empires: the Dutch, British, American, and Chinese. These empires held the last three reserve currencies—the US now, the British before it, and the Dutch before that. China is included because it has risen to be the second-most powerful empire/country and because it was so consistently powerful in most years prior to around 1850. To very briefly summarize what the chart shows:

- China was dominant for centuries (consistently outcompeting Europe in goods trade), though it entered a steep decline starting in the 1800s.

- The Netherlands, a relatively small country, became one of the world’s great empires in the 1600s.

- The UK followed a very similar path, peaking in the 1800s.

- Finally, the US rose to become the world’s superpower over the last 150 years, though particularly during and after WWII, and is now in relative decline while China is catching up once again.”

Zooming back further to the year 600 you get an even clearer picture over 1400 years of the rise and fall of empires and in particular the historic dominance of China.

He goes on in much greater detail what drives each part of these cycles but summarises as follows:

“To summarize, around the upward trend of productivity gains that produce rising wealth and better living standards, there are cycles that produce 1) prosperous periods of building, in which the country is fundamentally strong because there are a) relatively low levels of indebtedness, b) relatively small wealth, values, and political gaps, c) people working effectively together to produce prosperity, d) good education and infrastructure, e) strong and capable leadership, and f) a peaceful world order that is guided by one or more dominant world powers. These are the prosperous and enjoyable periods. When they are taken to excess, which they always are, the excesses lead to 2) depressing periods of destruction and restructuring, in which the country’s fundamental weaknesses of a) high levels of indebtedness, b) large wealth, values, and political gaps, c) different factions of people unable to work well together, d) poor education and poor infrastructure, and e) the struggle to maintain an overextended empire under the challenge of emerging powerful rivals lead to a painful period of fighting, destruction, and then a restructuring that establishes a new order, setting the stage for a new period of building.”

Under the heading of “Where are we now”, Dalio writes:

“As previously explained, the last major period of destroying and restructuring happened in 1930-45, which led to the new period of building and the new world order that began in 1945 with the creation a new global monetary system (built in 1944 in Bretton Woods, New Hampshire) and a new American-dominated system of world governance (located the United Nations in New York and the World Bank and the International Monetary Fund in Washington, DC). The new American world order was the natural consequence of the US being the richest country (it then had 80% of the world’s gold stock and gold was then money), the dominant economic power (it then accounted for about half of world production), and the strongest military power (it then had a monopoly on nuclear weapons and the strongest conventional forces).

It is now 75 years later, and we are classically near the end of a long-term debt cycle when there are large debts and classic monetary policies don’t work well for the world’s reserve currency central banks. This is happening as we are simultaneously in a deep economic and debt contraction that is producing income and balance sheet holes for people, companies, nonprofit organizations, and governments, while politically fragmented central governments are trying to fill in these holes by giving out a lot of money that they are borrowing. Central banks are helping them do that by monetizing government debt. All this is happening at the same time that there are big wealth and values gaps and there is a rising world power that is competing with the leading world power in trade, technology development, capital markets, and geopolitics. And on top of all this, we have a pandemic to contend with.”

This of course was all written before Trump became very vocally critical of China’s role in this pandemic and threatening repercussions. China is retaliating with some uncharacteristic sabre rattling of its own. Those Chinese tensions are of course being felt and even replicated in part here in Australia as well. We are and will remain stuck in a very awkward position of military and economic dependence with each party.

There are a number of levels on which you could view all this. At the most extreme history tells us, as most recently as Dalio’s above reference to WW2, wars often mark the turning point in these cycles. More simplistically, Trump wants to get re-elected in November and a convincing bit of sabre rattling with China wouldn’t hurt his chances at all with an increasingly nationalistic voter base looking for a culprit. Biden is reportedly pro-China further helping his cause. The election aside, Trump, more than any other president, seems to understand the Chinese agenda and hence his taking them to task on trade, South China Sea, and the Huawei 5G allegations for example. History paints a very clear picture over 1400 years and one not to be ignored. The Chinese / American story goes well beyond the US elections in November.

Dalio has set the scene and tomorrow we look at where to from here. Not a huge spoiler alert to say that gold plays a big role, just like it has for 5000 years….